Get the free Lettes of Credit

Show details

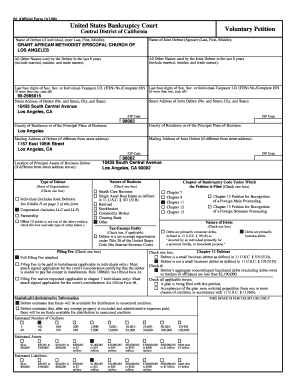

Letter of Credit International Trade Finance By Victor Tan Course Outline How these terms can critically affect your business 1. Overview of Methods of Payment and Trade Facilities in international

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lettes of credit

Edit your lettes of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lettes of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lettes of credit online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lettes of credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lettes of credit

How to fill out letters of credit:

01

Obtain the necessary forms: Start by obtaining the official forms required for letters of credit. These can usually be obtained from your bank or financial institution.

02

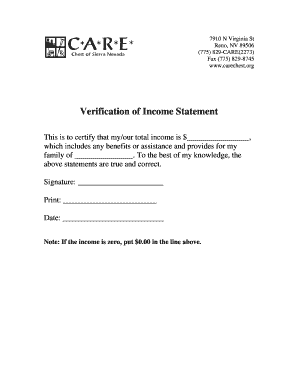

Fill in the application details: The letter of credit application will typically require you to provide details such as the name and address of the beneficiary (the party receiving payment), the amount of credit required, the shipping terms, and any necessary documents required for the transaction.

03

Verify the accuracy of information: Double-check all the information you have provided to ensure its accuracy. Errors or omissions could cause delays or complications in the letter of credit process.

04

Include supporting documents: Attach any necessary supporting documents to the application. These may include invoices, bills of lading, insurance policies, or other relevant paperwork to support the transaction.

05

Submit the application: Once all the necessary information has been filled out and supporting documents are attached, submit the completed application to the issuing bank. The bank will review the application and initiate the letter of credit process.

Who needs letters of credit:

01

International traders: Letters of credit are commonly used by importers and exporters engaged in international trade. They provide a secure method of ensuring payment and guaranteeing that goods are delivered as per the agreed-upon terms.

02

Small business owners: Small business owners often use letters of credit to establish trust and credibility with suppliers or clients. By using letters of credit, they can assure suppliers of their ability to make payment or provide guarantees to clients regarding the delivery of goods or services.

03

Construction companies: Contractors in the construction industry often utilize letters of credit for projects that require advance payment or performance guarantees. This helps protect both parties involved in the construction contract.

04

Banks and financial institutions: Banks themselves also often require letters of credit for various purposes. They may use it to facilitate trade finance, provide credit guarantees for their clients, or ensure proper payment processing in international transactions.

Overall, letters of credit are needed by individuals, businesses, and financial institutions involved in international trade or transactions that require financial security, payment guarantees, or performance assurances. They play a crucial role in facilitating smooth and secure transactions across borders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit lettes of credit from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your lettes of credit into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find lettes of credit?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific lettes of credit and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in lettes of credit?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your lettes of credit to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is lettes of credit?

Letters of credit are financial instruments that guarantee payment from a buyer to a seller.

Who is required to file lettes of credit?

Letters of credit are typically required to be filed by banks or financial institutions.

How to fill out lettes of credit?

To fill out a letter of credit, you will need to provide specific information about the transaction, including details about the buyer, seller, payment terms, and amount.

What is the purpose of lettes of credit?

The purpose of letters of credit is to provide assurance that payment will be made to the seller once the terms of the agreement are met.

What information must be reported on lettes of credit?

Information such as the names and addresses of the buyer and seller, the payment terms, and the amount of the transaction must be reported on a letter of credit.

Fill out your lettes of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lettes Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.