Get the free MORTGAGE EampOIMPAIRMENT INSURANCE APPLICATION FDIC No - ABAIS

Show details

MORTGAGE E&O/IMPAIRMENT INSURANCE APPLICATION FDIC No. Applicant Address City P.O. Box City Telephone Fax Representative authorized to receive notices on behalf of all persons and entities: Name Title

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage eampoimpairment insurance application

Edit your mortgage eampoimpairment insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage eampoimpairment insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage eampoimpairment insurance application online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage eampoimpairment insurance application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage eampoimpairment insurance application

How to fill out a mortgage impairment insurance application:

01

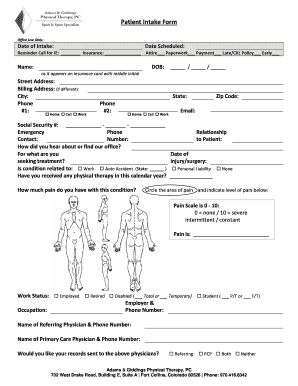

Start by gathering all the necessary documents and information. This may include your personal identification details, property information, loan details, and any relevant financial documentation.

02

Read through the application form carefully and ensure that you understand each section. Pay close attention to any instructions or requirements provided by the insurance company.

03

Begin by filling out the applicant's information section. This typically includes your name, address, contact information, and social security number.

04

Proceed to provide the details of the property for which you are seeking mortgage impairment insurance. This may include the property address, its current market value, and any specific features or characteristics that may be relevant.

05

Fill in the loan details section, including the name of the lender, the loan amount, the interest rate, and the loan term.

06

Next, provide information about any existing insurance policies related to the property. This could include homeowner's insurance, flood insurance, or any other relevant coverage.

07

If required, specify any additional coverage or endorsements you may need for your mortgage impairment insurance policy. This could include additional liability coverage or specialized coverage for specific risks.

08

Review your application form thoroughly before submitting it. Check for any errors or missing information and make the necessary corrections.

09

Sign the application form and date it as required.

Who needs mortgage impairment insurance application?

01

Property Owners: Mortgage impairment insurance is typically needed by property owners who have an existing mortgage on their property. This insurance helps protect the lender's interest in the property in case of any covered perils or hazards.

02

Lenders: Lenders may also require borrowers to obtain mortgage impairment insurance as a condition for granting the loan. This helps safeguard their investment and ensures that they will be covered in case of any damage or loss to the property.

03

Property Investors: Individuals or companies who invest in real estate and own multiple properties may need mortgage impairment insurance to protect their portfolio of properties and mitigate potential financial risks.

04

Property Managers: Property management companies or individuals responsible for managing properties on behalf of owners may also require mortgage impairment insurance. This helps protect their liability and ensures that the properties they manage are adequately covered.

05

Financial Institutions: Banks, credit unions, and other financial institutions that provide mortgage loans may require mortgage impairment insurance to protect their interests and minimize their exposure to potential losses.

In summary, mortgage impairment insurance application should be filled out by property owners, lenders, property investors, property managers, and financial institutions with a vested interest in the property and its mortgage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage eampoimpairment insurance application in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your mortgage eampoimpairment insurance application and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit mortgage eampoimpairment insurance application from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like mortgage eampoimpairment insurance application, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out mortgage eampoimpairment insurance application on an Android device?

Complete your mortgage eampoimpairment insurance application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your mortgage eampoimpairment insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Eampoimpairment Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.