Get the free STATEMENT OF CASH RECEIPTS AND DISBURSEMENTS - aapld

Show details

ALGONQUIN AREA PUBLIC LIBRARY DISTRICT STATEMENT OF CASH RECEIPTS AND DISBURSEMENTS July 1, 2014, through June 30, 2015, Fund Balance Beginning Revenues Property Taxes Replacement Taxes Fines and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of cash receipts

Edit your statement of cash receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of cash receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing statement of cash receipts online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit statement of cash receipts. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

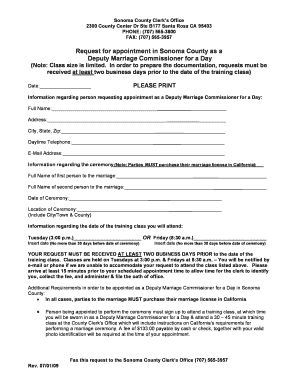

How to fill out statement of cash receipts

How to fill out a statement of cash receipts:

01

Begin by gathering all relevant documents related to cash receipts, such as copies of invoices, sales receipts, and any other supporting documentation.

02

Organize these documents chronologically or by category to make it easier to match them with the appropriate line items on the statement.

03

Open the statement of cash receipts form or template on your computer or get a physical copy if you prefer to fill it out by hand.

04

Start by entering the date of the statement and your company's name or identification at the top of the form.

05

Proceed to list each cash receipt separately, starting with the earliest transaction and working your way towards the most recent.

06

For each cash receipt, record the date of the receipt, a brief description of the transaction or purpose, and the amount of cash received.

07

Ensure that all amounts are accurate and properly accounted for. Double-check that the total amount of cash received matches the sum of the individual receipts.

08

If applicable, include any relevant tax or other deductions related to the cash receipts. This information may vary depending on your specific situation or jurisdiction.

09

Sign and date the completed statement of cash receipts, indicating that the information provided is accurate to the best of your knowledge.

10

Save a digital copy of the statement for your records and distribute the physical or digital copy to any relevant parties, such as your accountant, bookkeeper, or internal department that requires this information.

Who needs a statement of cash receipts?

01

Small business owners: A statement of cash receipts is essential for small business owners who need to accurately track and analyze their incoming cash flow. It provides a clear picture of how much cash is being generated over a given period, which is vital for making informed financial decisions.

02

Accountants: Accountants use statements of cash receipts to reconcile cash inflows and outflows, prepare financial statements, and ensure accurate bookkeeping. This document helps them identify any discrepancies and maintain proper records for tax purposes.

03

Auditors: During audits, financial statements, including the statement of cash receipts, are thoroughly reviewed to verify the accuracy and completeness of the reported cash transactions. Auditors rely on this document to assess a company's financial health and compliance with accounting standards.

Note: The specific individuals or entities that require a statement of cash receipts may vary depending on the industry, company size, legal requirements, and internal reporting procedures. It is always advisable to consult with a professional or relevant authorities to determine the exact needs for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the statement of cash receipts in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit statement of cash receipts on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing statement of cash receipts right away.

How do I edit statement of cash receipts on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute statement of cash receipts from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is statement of cash receipts?

The statement of cash receipts is a financial document that records all cash inflows received by a business.

Who is required to file statement of cash receipts?

Businesses and individuals who receive cash payments are required to file a statement of cash receipts.

How to fill out statement of cash receipts?

To fill out a statement of cash receipts, you will need to record all cash inflows in the appropriate categories and total them at the end.

What is the purpose of statement of cash receipts?

The purpose of the statement of cash receipts is to accurately track and report all cash inflows received by a business or individual.

What information must be reported on statement of cash receipts?

The information that must be reported on a statement of cash receipts includes the date of receipt, amount received, source of payment, and any other relevant details.

Fill out your statement of cash receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Cash Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.