Get the free Rule 709 - kscourts

Show details

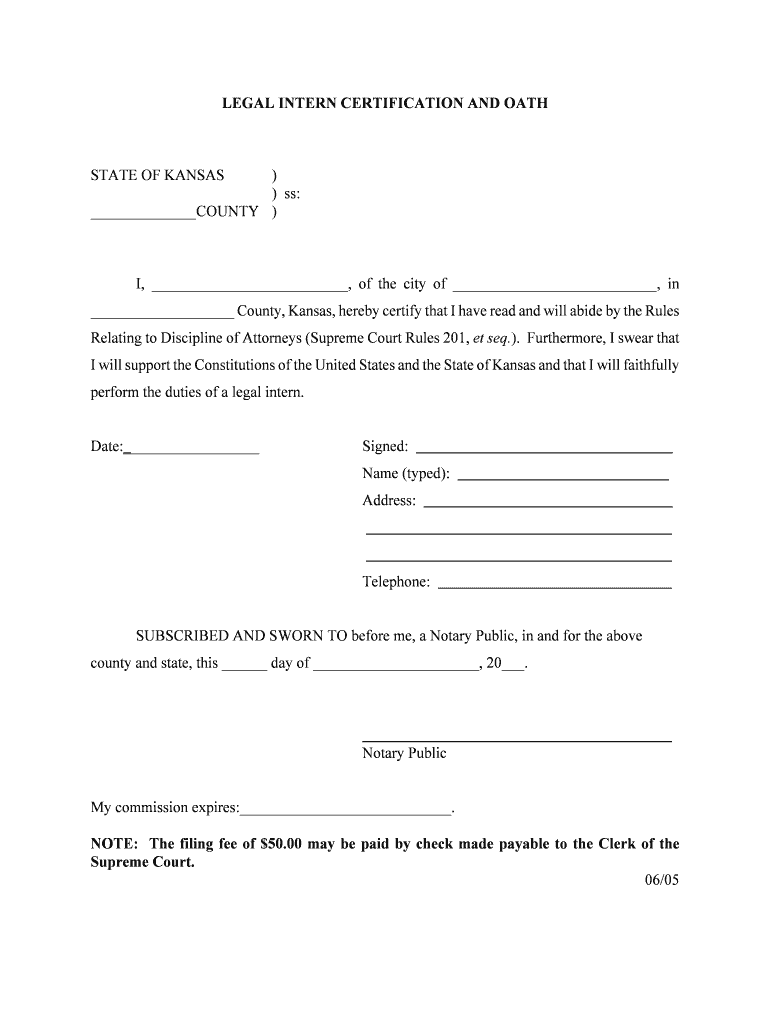

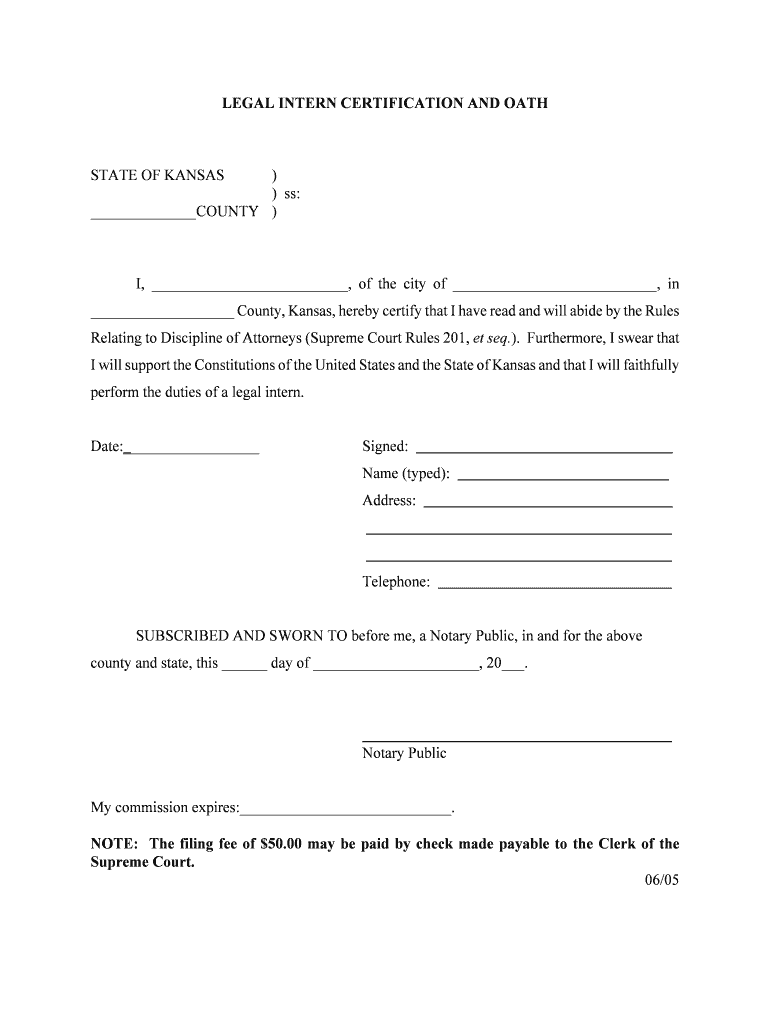

This document outlines the rules and regulations for legal interns in Kansas, including requirements for enrollment, supervision, and permissible activities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rule 709 - kscourts

Edit your rule 709 - kscourts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rule 709 - kscourts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rule 709 - kscourts online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rule 709 - kscourts. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rule 709 - kscourts

How to fill out Rule 709

01

Obtain a copy of Rule 709 from the relevant authority's website or office.

02

Read the instructions and guidelines provided with Rule 709 carefully.

03

Fill out your personal information accurately in the designated fields.

04

Provide any required documentation or supporting materials as specified.

05

Double-check all entries for accuracy and completeness before submission.

06

Submit the completed Rule 709 form through the prescribed method (online, mail, in person).

07

Keep a copy of the submitted form and any confirmation of submission for your records.

Who needs Rule 709?

01

Individuals or entities involved in specific transactions governed by Rule 709.

02

Persons seeking compliance with regulatory requirements set forth by Rule 709.

03

Organizations that are impacted by the legal or financial implications of Rule 709.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following entities are required to file form 709?

Explanation. An individual is required to file Form 709, United States Gift Tax Return.

What is the IRS Rule 709?

Each individual is responsible to file a Form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in Part III Spouse's Consent on Gifts to Third Parties, later. If a gift is of community property, it is considered made one-half by each spouse.

Is IRS form 709 complicated?

The government requires this to keep track of your lifetime gift and estate tax exemption. It's only when you use up the large lifetime exemption that you would owe an out-of-pocket tax. Still, filling out Form 709 can get complicated.

Who needs to file form 709?

Individuals Who Exceed the Annual Exclusion Limit: If you give more than $17,000 to a single individual in 2024 or 2025, you must file Form 709 to report the excess. For married couples, if you jointly gift more than $34,000 to one recipient, you must file the return and elect to "split the gift."

What is the IRS rule for gifting money to family members?

The total value of gifts the individual gave to at least one person (other than his or her spouse) is more than the annual exclusion amount for the year. The annual exclusion amount for 2025 is $19,000 and for 2024 is $18,000.

What triggers a gift tax audit?

What Can Trigger a Gift or Estate Tax Audit? Here are some of the common factors that can lead to gift or estate tax audits: Total estate and gift value: Generally speaking, gift and estate tax returns are more likely to be audited when there are taxes owed and the size of the transaction or estate is relatively large.

Which of the following situations would require the filing of form 709?

You must file Form 709 if any of the following situations apply to you: You made gifts to individuals exceeding the annual exclusion amount (currently $15,000 per recipient in 2023). You and your spouse are "splitting gifts" (gifts made by one spouse are treated as made equally by both).

What is an example of a notice of consent for form 709?

"I consent to have the gifts (and generation-skipping transfers) made by me and by my spouse to third parties during the calendar year considered as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent." Sign and date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rule 709?

Rule 709 refers to a regulation under the Securities Exchange Act that outlines requirements for the registration and reporting of securities. It is primarily concerned with the registration of certain securities offerings and the disclosure of relevant financial information.

Who is required to file Rule 709?

Entities that are planning to offer securities that fall under the provisions of Rule 709 are required to file the necessary documentation, which typically includes companies and issuers of securities, as well as certain investment funds.

How to fill out Rule 709?

To fill out Rule 709, filers must complete the designated forms provided by the Securities and Exchange Commission (SEC) and include all required financial statements, disclosures, and relevant information about the securities being offered.

What is the purpose of Rule 709?

The purpose of Rule 709 is to enhance transparency in the securities markets by requiring issuers to disclose pertinent information to potential investors, thus protecting investors and promoting informed decision-making.

What information must be reported on Rule 709?

Information that must be reported on Rule 709 includes the details of the securities being offered, financial statements of the issuer, management discussions, risk factors, use of proceeds, and any legal proceedings that may affect the securities.

Fill out your rule 709 - kscourts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rule 709 - Kscourts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.