Get the free Single Audit or Program-Specific Audit Reporting Package Checklist

Show details

The subrecipient who qualifies to submit a complete Single Audit Reporting Package must include the following essential elements: Independent Auditor's...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single audit or program-specific

Edit your single audit or program-specific form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single audit or program-specific form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing single audit or program-specific online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit single audit or program-specific. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single audit or program-specific

How to fill out single audit or program-specific:

01

Understand the requirements: Before starting the process, it is important to have a clear understanding of the specific regulations and guidelines for the single audit or program-specific procedures. This may involve reviewing relevant laws and regulations or seeking guidance from experts or professionals in the field.

02

Gather necessary documentation: The next step is to gather all the required documentation for the audit or program-specific evaluation. This may include financial statements, budget reports, program documentation, and any other supporting documents that are necessary to demonstrate compliance or performance.

03

Review the documentation: Carefully review all the gathered documentation to ensure its accuracy and completeness. It is important to identify any discrepancies, errors, or missing information during this review process.

04

Complete the necessary forms: Fill out the designated forms or templates as required for the single audit or program-specific evaluation. These forms may vary depending on the specific regulations but typically require information related to financial data, program activities, compliance, and other relevant aspects.

05

Provide explanations and justifications: In some cases, it may be necessary to provide additional explanations or justifications for certain findings or discrepancies. This can help auditors or evaluators better understand the context or reasons behind any identified issues.

06

Collaborate with auditors or evaluators: During the audit or program-specific evaluation, it is important to collaborate and communicate effectively with the auditors or evaluators. Respond promptly to any requests for additional information or clarifications and provide any necessary assistance.

Who needs single audit or program-specific?

01

Non-profit organizations: Many non-profit organizations are required to undergo a single audit or program-specific evaluation, especially if they receive federal funding or grants. This is to ensure that the funds are being used appropriately and in accordance with the specific program regulations.

02

Government agencies: Government agencies that administer federal funds or grants may also be required to undergo single audits or program-specific evaluations. This helps ensure accountability and compliance with regulations to prevent fraud, waste, or mismanagement of public funds.

03

Universities and educational institutions: Educational institutions that receive federal funding for research or other programs may be subject to single audits or program-specific evaluations. This is to ensure that the funds are being used effectively and that the institution is in compliance with all relevant regulations.

04

State and local governments: State and local governments that receive federal funds or grants are often required to undergo single audits or program-specific evaluations. This helps ensure that the funds are being used properly and that the government entities are in compliance with federal regulations.

05

Contractors and grantees: Individuals, organizations, or businesses that enter into contracts or receive grants from federal agencies may be subject to single audits or program-specific evaluations. This ensures that the funds are being used appropriately and that the contractors or grantees are meeting the required performance standards and compliance obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send single audit or program-specific for eSignature?

Once your single audit or program-specific is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete single audit or program-specific on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your single audit or program-specific, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete single audit or program-specific on an Android device?

Complete your single audit or program-specific and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

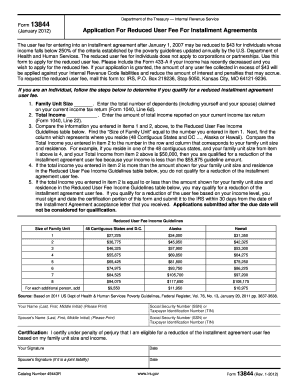

What is single audit or program-specific?

Single audit refers to the audit of a non-profit organization that expends federal awards above a certain threshold, while program-specific audit is focused on a specific federal assistance program.

Who is required to file single audit or program-specific?

Non-profit organizations that receive federal awards above a certain threshold are required to file single audit. Program-specific audit may be required for organizations expending federal awards under certain federal programs.

How to fill out single audit or program-specific?

Single audit or program-specific audit must be completed by a qualified auditor following the guidelines set forth by the Uniform Guidance.

What is the purpose of single audit or program-specific?

The purpose of single audit or program-specific audit is to provide assurance that federal funds are being used in compliance with regulations and program requirements.

What information must be reported on single audit or program-specific?

The audit report must include the organization's financial statements, schedule of federal awards, and findings related to compliance and internal control.

Fill out your single audit or program-specific online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Audit Or Program-Specific is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.