Get the free Autorizacin para Deduccin de Nmina

Show details

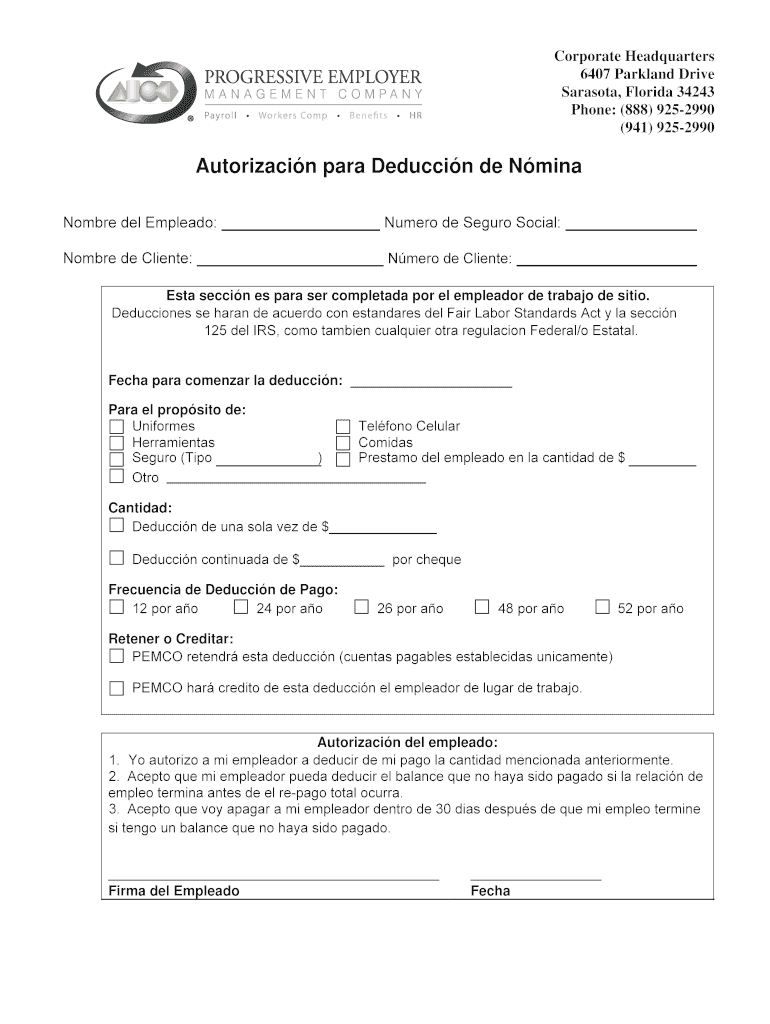

Corporate Headquarters 6407 Parkland Drive Sarasota, Florida 34243 Phone: (888) 9252990 (941) 9252990 Authorization para Deduction de Nmina Hombre Del Plead: Number de Seguro Social: Hombre de Cliente:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign autorizacin para deduccin de

Edit your autorizacin para deduccin de form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your autorizacin para deduccin de form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing autorizacin para deduccin de online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit autorizacin para deduccin de. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out autorizacin para deduccin de

How to Fill Out Autorización para Deducción de:

01

Obtain the form: The first step is to obtain the autorización para deducción de form. This form is typically provided by the organization or entity requesting authorization for certain deductions from your income.

02

Fill in personal information: Start by filling in your personal information on the form. This may include your full name, address, contact information, and identification number.

03

Specify the deductions: Indicate the specific deductions you are authorizing on the form. This could involve deductions related to taxes, insurance, retirement plans, or any other deductions allowed by the organization or entity.

04

Provide supporting documents: Depending on the deductions requested, you may need to provide supporting documents. These documents can include tax forms, insurance policies, or any other relevant documentation to support your authorization.

05

Review and sign: Before submitting the form, carefully review all the information you have provided. Ensure that everything is accurate and complete. Once you are satisfied, sign the form to indicate your consent and authorization.

Who Needs Autorización para Deducción de:

01

Employees: Employees who want to authorize specific deductions from their income may need to fill out autorización para deducción de forms. These deductions can include taxes, insurance premiums, retirement contributions, or any other deductions allowed by the employer.

02

Insurance policyholders: Individuals who have insurance policies and wish to authorize deduction of premiums from their income may be required to fill out autorización para deducción de forms. This form ensures that the insurance company can deduct the premiums directly from the policyholder's income.

03

Retirement plan participants: Individuals participating in retirement plans, such as employer-sponsored 401(k) plans, may need to fill out autorización para deducción de forms. This enables the automatic deduction of retirement contributions from their income, ensuring consistent savings for their future.

Note: The specific requirements for autorización para deducción de may vary depending on the country, organization, or entity requesting the authorization. It is important to carefully read and follow the instructions provided on the form and consult with the relevant authorities if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify autorizacin para deduccin de without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your autorizacin para deduccin de into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send autorizacin para deduccin de for eSignature?

Once you are ready to share your autorizacin para deduccin de, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the autorizacin para deduccin de in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your autorizacin para deduccin de in minutes.

What is autorizacin para deduccin de?

Autorizacion para deduccion de is a document that authorizes deductions from a person's income.

Who is required to file autorizacin para deduccin de?

Individuals or entities who want to authorize deductions from their income are required to file autorizacin para deduccin de.

How to fill out autorizacin para deduccin de?

Autorizacin para deduccin de can be filled out by providing personal information, details of the deductions to be authorized, and signing the document.

What is the purpose of autorizacin para deduccin de?

The purpose of autorizacin para deduccin de is to formally authorize deductions from one's income.

What information must be reported on autorizacin para deduccin de?

Information such as personal details, details of the deductions to be authorized, and signature must be reported on autorizacin para deduccin de.

Fill out your autorizacin para deduccin de online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Autorizacin Para Deduccin De is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.