Get the free INCOMEEXPENSE ANALYSIS APARTMENTS For Calendar Year 2015 - polkpa

Show details

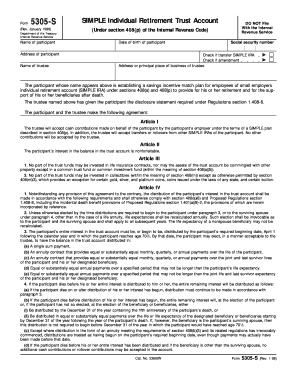

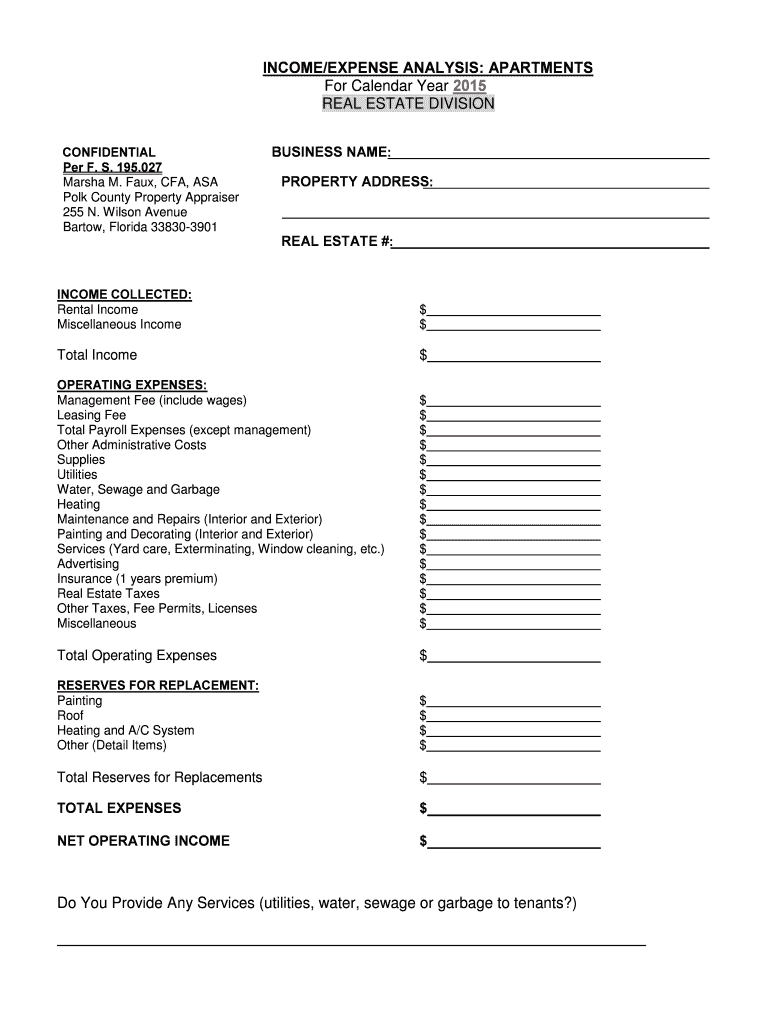

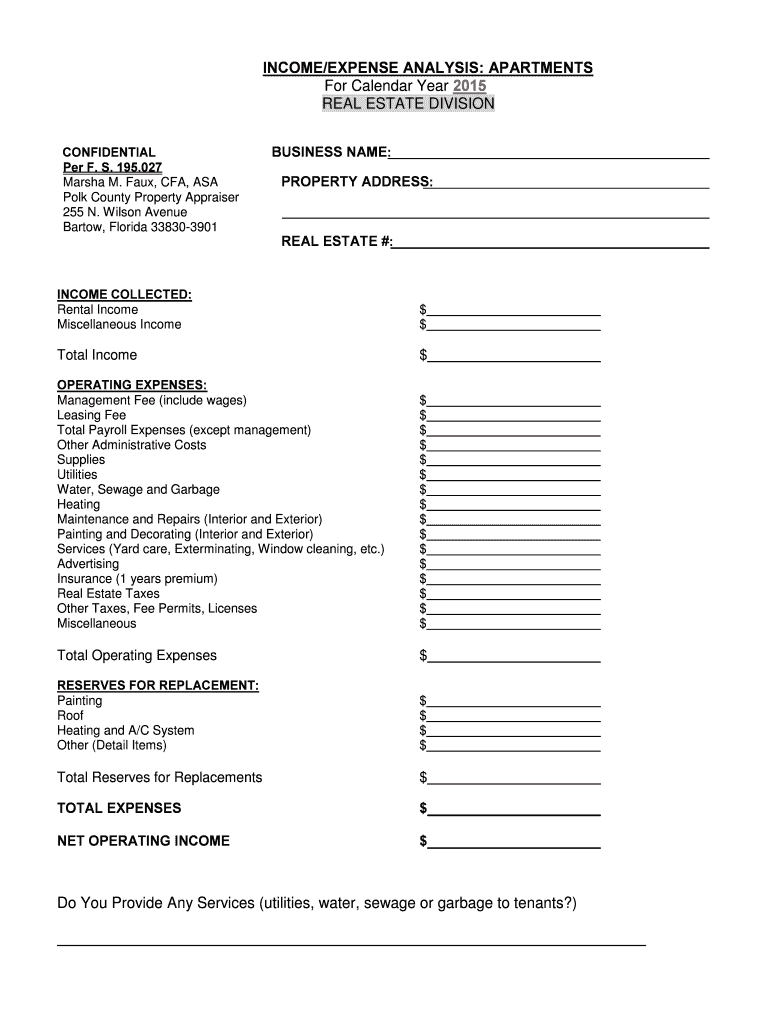

INCOME/EXPENSE ANALYSIS: APARTMENTS For Calendar Year 2015 REAL ESTATE DIVISION CONFIDENTIAL Per F. S. 195.027 Marsha M. Faux, CFA, ASA Polk County Property Appraiser 255 N. Wilson Avenue Barton,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incomeexpense analysis apartments for

Edit your incomeexpense analysis apartments for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incomeexpense analysis apartments for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit incomeexpense analysis apartments for online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit incomeexpense analysis apartments for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incomeexpense analysis apartments for

To fill out an income/expense analysis for apartments, you can follow these steps:

01

Gather necessary documents: Collect all the relevant financial documents related to the apartment, such as rent rolls, operating statements, utility bills, insurance information, and maintenance expenses.

02

Calculate rental income: Record the total amount of rental income generated from the apartment. This includes all rents collected from tenants, as well as any additional income from parking fees, laundry facilities, or other sources.

03

Determine vacancy rate: Calculate the vacancy rate by dividing the number of vacant units by the total number of units in the apartment. Multiply this rate by the average rental income per unit to determine the potential lost rental income.

04

Calculate operating expenses: Sum up all the expenses incurred in operating the apartment, including property taxes, insurance premiums, repairs and maintenance costs, utilities, advertising expenses, management fees, and any other relevant expenses. Categorize and calculate each expense separately.

05

Consider capital expenses: Capital expenses are one-time costs incurred for major improvements or upgrades to the property. These may include renovations, repairs, or big-ticket items like HVAC systems or roof replacements. Estimate and include these expenses separately.

06

Calculate net operating income: Subtract the total operating expenses and capital expenses from the gross rental income. This will give you the net operating income (NOI) for the apartment.

07

Analyze the net operating income: Evaluate the NOI to assess the profitability of the apartment. Compare it with similar properties in the area to determine if it is performing above or below average. This analysis can help identify areas for improvement or strategies for maximizing revenue.

08

Identify the target audience: The income/expense analysis for apartments is useful for various stakeholders. It can be beneficial for property owners who want to evaluate their investments, potential investors researching profitability, real estate agents preparing market analyses, or banks assessing loan applications.

09

Use the analysis for decision-making: The income/expense analysis provides valuable insights for making informed decisions. Property owners can determine rental rates, negotiate with tenants, allocate funds for property improvements, or decide whether to buy or sell the apartment. Investors can assess the potential return on investment and determine if it aligns with their financial goals.

In conclusion, the income/expense analysis of apartments helps evaluate the financial performance of the property. By following the steps outlined above, individuals or organizations can accurately fill out the analysis and make informed decisions regarding the apartment's operations, finances, and investment opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify incomeexpense analysis apartments for without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including incomeexpense analysis apartments for. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find incomeexpense analysis apartments for?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific incomeexpense analysis apartments for and other forms. Find the template you need and change it using powerful tools.

How do I complete incomeexpense analysis apartments for online?

pdfFiller has made it easy to fill out and sign incomeexpense analysis apartments for. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is incomeexpense analysis apartments for?

Incomeexpense analysis apartments is for analyzing the financial performance of apartments, including income generated and expenses incurred.

Who is required to file incomeexpense analysis apartments for?

Property owners, managers, or anyone responsible for the financial management of apartments are required to file incomeexpense analysis apartments.

How to fill out incomeexpense analysis apartments for?

Incomeexpense analysis apartments can be filled out by documenting all income sources (rent, fees, etc.) and expenses (maintenance, utilities, etc.) related to the operation of the apartments.

What is the purpose of incomeexpense analysis apartments for?

The purpose of incomeexpense analysis apartments is to track the financial performance, identify areas for improvement, and make informed decisions regarding the management of apartments.

What information must be reported on incomeexpense analysis apartments for?

Incomeexpense analysis apartments must include details of all income sources, expenses incurred, overall financial performance, and any other relevant financial information related to the apartments.

Fill out your incomeexpense analysis apartments for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incomeexpense Analysis Apartments For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.