KY W-1 REE - Louisville 2016 free printable template

Show details

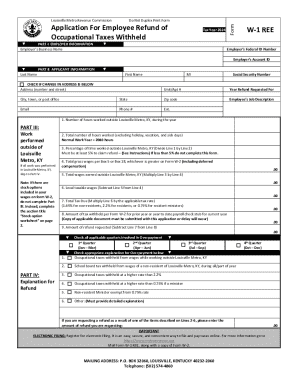

LOUISVILLE METRO REVENUE COMMISSION APPLICATION FOR EMPLOYEE REFUND OF OCCUPATIONAL TAXES WITHHELD PART I: EMPLOYER INFORMATION (Please print) Employers Name: Employers Federal ID Number: Employers

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign louisville metro revenue commission

Edit your louisville metro revenue commission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisville metro revenue commission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit louisville metro revenue commission online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit louisville metro revenue commission. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY W-1 REE - Louisville Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out louisville metro revenue commission

How to fill out Louisville Metro Revenue Commission:

01

Gather all necessary documents: Before filling out the Louisville Metro Revenue Commission form, make sure you have all the required documents handy. This may include your tax return, income statements, and other relevant financial information.

02

Obtain the correct form: Visit the official website of the Louisville Metro Revenue Commission or contact them directly to obtain the correct form needed to file your taxes or report your revenue.

03

Fill in your personal information: Start by providing your personal information accurately. This typically includes your name, address, social security number, and other relevant identification details.

04

Provide income details: If you are filing taxes, you may need to provide thorough information about your income. This includes your wages, tips, dividends, rental income, and any other sources of revenue. Ensure that you provide accurate and up-to-date information to avoid any discrepancies.

05

Deductions and exemptions: If applicable, report any deductions or exemptions that you are eligible for. This may include claiming dependents, student loan interest deductions, or other tax reliefs specific to your situation. Consult the guidelines or seek professional advice if you are unsure about any deductions or exemptions.

06

Review and double-check: Once you have completed filling out the form, carefully review all the information provided. Ensure that everything is accurate and no details have been missed. Miscalculations or incorrect information can potentially lead to issues in the future.

07

Submit the form: Once you are confident that all the information is correct, sign and date the form. Follow the instructions provided by the Louisville Metro Revenue Commission on how to submit the form. This may involve mailing it or submitting it electronically.

Who needs Louisville Metro Revenue Commission:

01

Individuals residing in Louisville Metro: Anyone living within the Louisville Metro area may be required to file their taxes or report their revenue to the Louisville Metro Revenue Commission. This includes both residents and non-residents who have income generated within the Louisville Metro boundaries.

02

Business owners: If you own a business operating within the Louisville Metro area, regardless of its size or structure, you may need to report your business revenue to the Louisville Metro Revenue Commission. This ensures compliance with local tax regulations and helps in maintaining accurate financial records.

03

Landlords and property owners: Individuals who own or rent out properties within the Louisville Metro area may be required to report their rental income to the Louisville Metro Revenue Commission. This helps in assessing proper taxes and maintaining transparency in revenue generated from real estate sources.

04

Self-employed individuals: If you are self-employed and earn income within the Louisville Metro area, you may need to report your revenue to the Louisville Metro Revenue Commission. This applies to various professionals, freelancers, contractors, and consultants who work independently.

05

Individuals with other sources of revenue: Even if you are not a business owner or self-employed, certain types of income, such as investment earnings, royalties, or rental income from properties outside of Louisville Metro but owned by a Louisville Metro resident, may still need to be reported to the Louisville Metro Revenue Commission. It is recommended to consult the specific guidelines or seek professional advice to determine your obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is Louisville occupational tax?

Form OL-3 is a tax form used by any entity with a business nexus in Louisville/Jefferson County to file and pay the Occupational Tax Rate of 2.2% (resident rate) or 1.45% (non-resident rate).

Who pays Louisville Metro taxes?

The Louisville Metro Revenue Commission collects Occupational License Fees / Taxes on all income earned within Louisville Metro, Kentucky. There is no minimum earned amount before you are liable for filing a tax return.

What is the withholding tax in Louisville Metro?

Resident employees-Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (. 0220).

Does KY have an occupational tax?

There is no minimum earned amount before you are liable for filing a tax return. The occupational tax is imposed upon the privilege of engaging in business, profession, occupation, or trade within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged.

What is Ky City occupational tax?

City Payroll For tax periods prior to January 1, 2023, the tax is 1.49% of the gross compensation paid. Beginning January 1, 2023, the tax is 1.65% of the gross compensation paid. Forms and instructions are available at the Occupational Tax Office or may be downloaded below.

What is a W 1 form Louisville Metro Revenue Commission?

Form W-1 is a tax form used by employers who are required to withhold Occupational License Fees/Taxes from gross salaries, wages, commissions, and other forms of compensation earned by employees for work performed within Louisville/Jefferson County, Kentucky.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit louisville metro revenue commission from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including louisville metro revenue commission, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send louisville metro revenue commission for eSignature?

Once your louisville metro revenue commission is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in louisville metro revenue commission without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing louisville metro revenue commission and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is louisville metro revenue commission?

The Louisville Metro Revenue Commission is a government agency responsible for collecting revenue for the city of Louisville.

Who is required to file louisville metro revenue commission?

All individuals or businesses that generate income within the Louisville Metro area are required to file with the Louisville Metro Revenue Commission.

How to fill out louisville metro revenue commission?

The Louisville Metro Revenue Commission provides forms and instructions on their website for individuals and businesses to fill out and submit their revenue information.

What is the purpose of louisville metro revenue commission?

The purpose of the Louisville Metro Revenue Commission is to ensure that all individuals and businesses pay their fair share of taxes to support city services and infrastructure.

What information must be reported on louisville metro revenue commission?

The Louisville Metro Revenue Commission requires individuals and businesses to report all sources of income, deductions, and credits as part of their tax filing.

Fill out your louisville metro revenue commission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisville Metro Revenue Commission is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.