Get the free Small Business Quickfinder Handbook - mhavennet

Show details

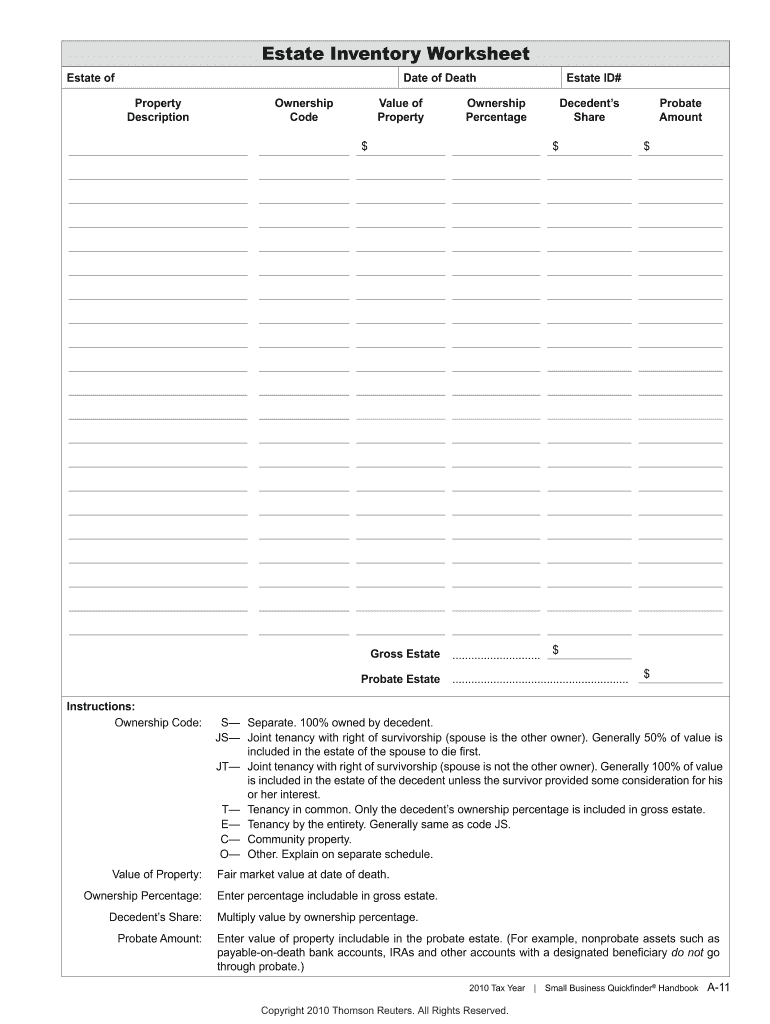

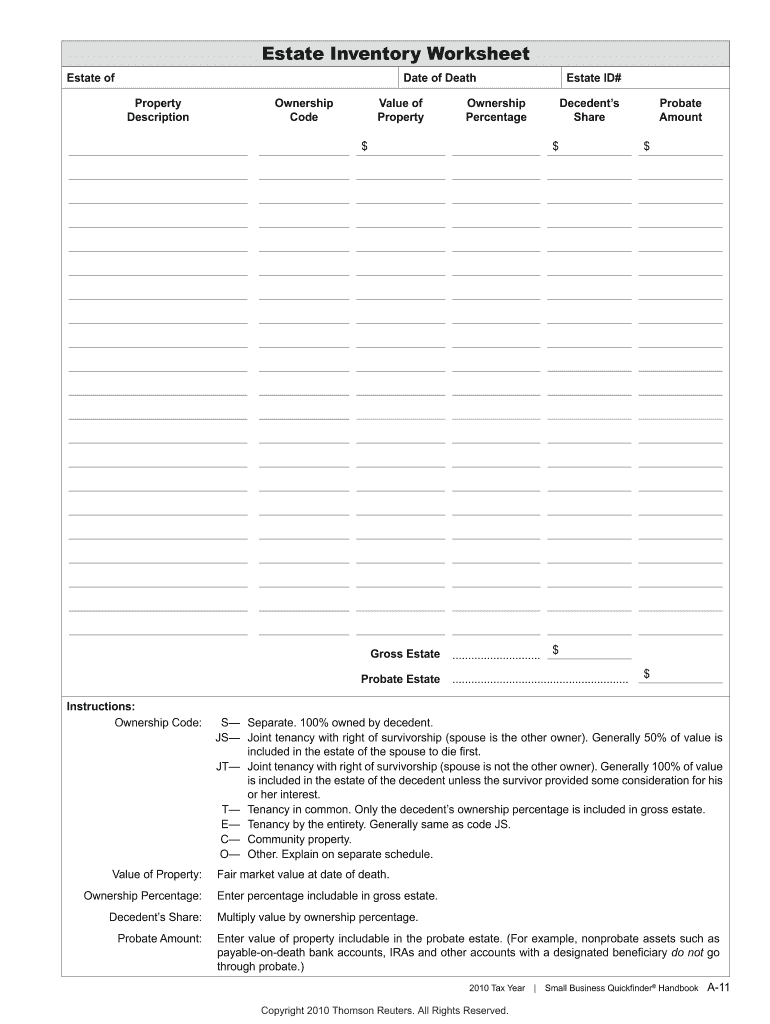

(DWH, QYHQWRU:RUNVKHHW (VWDWHRI 'DWH RI 'HAWK 3URSHUW 'HVFULSWLRQ2ZQHUVKLS &RGH9DOXHRI 3URSHUW2ZQHUVKLS 3HUFHQWDJH$45(*& ! “#$5 (, & 7 (2 #& 5 ((& 'HFHGHQWV 6KDUH 3UREDWH $PRXQW *URV(DWH, QVWUXFWLRQV

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business quickfinder handbook

Edit your small business quickfinder handbook form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business quickfinder handbook form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business quickfinder handbook online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small business quickfinder handbook. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business quickfinder handbook

How to fill out small business quickfinder handbook:

01

Obtain a copy of the small business quickfinder handbook, either by purchasing it online or at a local bookstore.

02

Set aside dedicated time to thoroughly read and understand the contents of the handbook. Familiarize yourself with the different sections and topics covered.

03

Keep any necessary documents and references handy while going through the handbook. This may include tax forms, financial statements, or relevant legal documents.

04

Begin by reading the introduction and table of contents to get an overview of the handbook's structure and content.

05

Take note of any specific instructions or guidelines provided in the handbook for filling out certain sections or forms.

06

Follow the step-by-step instructions provided in the relevant chapters for different aspects of small business management, tax preparation, and financial planning.

07

Refer to any examples or case studies provided in the handbook for practical application and better understanding.

08

Make use of any worksheets or checklists included in the handbook to organize your small business information and ensure all necessary details are included.

09

As you fill out the handbook, take the time to review and double-check your work for accuracy and completeness.

10

It may be helpful to consult with a small business advisor, tax professional, or accountant if you encounter any complex or unfamiliar concepts.

11

Once you have completed filling out the small business quickfinder handbook, keep it in a secure and easily accessible place for future reference.

Who needs a small business quickfinder handbook:

01

Small business owners who want to enhance their knowledge of various aspects of running a business, including tax planning, compliance, and financial management.

02

Individuals starting a new small business venture and seeking guidance on legal requirements, tax obligations, and best practices.

03

Tax professionals, accountants, or advisors who work closely with small businesses and want to stay updated on current regulations, strategies, and deductions.

04

Students or individuals studying business administration, accounting, or finance, who wish to gain practical insights and a comprehensive understanding of small business management.

Note: The small business quickfinder handbook serves as a valuable resource for anyone seeking practical guidance, insights, and strategies for successfully managing and navigating the complexities of running a small business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is small business quickfinder handbook?

Small business quickfinder handbook is a comprehensive guide that provides information on tax laws, regulations, deductions, credits, and other relevant information for small businesses.

Who is required to file small business quickfinder handbook?

Small business owners, self-employed individuals, and small business tax preparers are required to file small business quickfinder handbook.

How to fill out small business quickfinder handbook?

To fill out the small business quickfinder handbook, you need to gather all relevant financial information, complete the required forms accurately, and submit them to the appropriate tax authority.

What is the purpose of small business quickfinder handbook?

The purpose of the small business quickfinder handbook is to help small businesses comply with tax laws, maximize deductions, and minimize tax liabilities.

What information must be reported on small business quickfinder handbook?

Information such as income, expenses, deductions, credits, assets, liabilities, and other financial data must be reported on the small business quickfinder handbook.

How can I send small business quickfinder handbook for eSignature?

small business quickfinder handbook is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find small business quickfinder handbook?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the small business quickfinder handbook in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my small business quickfinder handbook in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your small business quickfinder handbook and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your small business quickfinder handbook online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Quickfinder Handbook is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.