Get the free STOCK OPTION AGREEMENT - sec

Show details

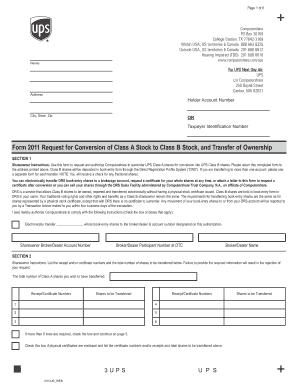

This document outlines the terms and conditions under which 8x8, Inc. grants stock options to an individual as part of its employee equity incentive plan, including details on vesting, exercise methods,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stock option agreement

Edit your stock option agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock option agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit stock option agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit stock option agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stock option agreement

How to fill out STOCK OPTION AGREEMENT

01

Title the document as 'Stock Option Agreement'.

02

Clearly define the parties involved (the company and the optionee).

03

Specify the number of shares subject to the option.

04

State the exercise price per share.

05

Indicate the vesting schedule for the options.

06

Outline the term of the option (how long it remains valid).

07

Include any conditions for exercising the options.

08

Add necessary boilerplate provisions (e.g., governing law, severability).

09

Provide space for signatures of both parties.

Who needs STOCK OPTION AGREEMENT?

01

Employees receiving stock options as part of their compensation.

02

Advisors or consultants offered equity compensation.

03

Founders of a startup looking to incentivize their team.

04

Investors who want to secure future ownership stakes.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a stock option?

Understanding stock options For example, a call option to buy 100 shares of XYZ Corp. at a "strike" or exercise price of $50 is said to be “in the money” if the stock is currently trading at $55. The option will be worth at least $500 (100 X $5) because that's how much you would earn if you exercised it right now.

What is the purpose of a stock option?

In short, a stock option gives you the right to buy company shares at a pre-set price that's hopefully lower than the current share price.

What is the $100,000 rule for stock options?

The 100K Rule[1] states that employees cannot receive more than $100K worth of exercisable incentive stock options (ISOs) in a calendar year.

What is an option contract in stocks?

An option contract is an agreement used to facilitate a possible transaction between two parties. It governs the right to buy or sell an underlying asset or security, such as a stock, at a specific price. This is called the strike price, and it's fixed until the contract's expiration date.

What is a stock options agreement?

About Stock Option Agreements Such an option, once granted to the employee, gives the employee the opportunity to benefit from increases in the company's share value by granting the right to buy shares at a future point in time at a price equal to the fair market value of such shares at the time of the grant.

What is a stock option agreement?

A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

What is a stock option in English?

a contract for the right to buy and sell shares at a later date or within a certain period at a particular price: It's like persuading people to buy stock options back immediately after the 1987 stock market crash.

How do stock options contracts work?

An option contract is simply an agreement between two people to either buy or sell 100 shares of a specific stock at a set price (strike price) within a given time frame. A call is the right to buy shares and a put is the right to sell shares.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STOCK OPTION AGREEMENT?

A Stock Option Agreement is a contract between a company and an employee that grants the employee the right to purchase company stock at a predetermined price, known as the exercise price, within a specified time frame.

Who is required to file STOCK OPTION AGREEMENT?

Typically, a company's management or HR department is responsible for filing Stock Option Agreements, particularly if the company is publicly traded and must disclose equity compensation to shareholders.

How to fill out STOCK OPTION AGREEMENT?

To fill out a Stock Option Agreement, the issuer should include details such as the option grant date, exercise price, number of options granted, vesting schedule, and any conditions of exercise. The employee should also provide personal details and sign the agreement.

What is the purpose of STOCK OPTION AGREEMENT?

The purpose of a Stock Option Agreement is to incentivize employees by giving them the opportunity to purchase stock at a set price, thereby aligning their interests with those of the company and its shareholders.

What information must be reported on STOCK OPTION AGREEMENT?

A Stock Option Agreement must report information such as the option grant date, exercise price, total number of options granted, vesting conditions, expiration date, and any tax implications associated with the options.

Fill out your stock option agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stock Option Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.