Get the free Arizona Form 347 - ftpzillionformscom

Show details

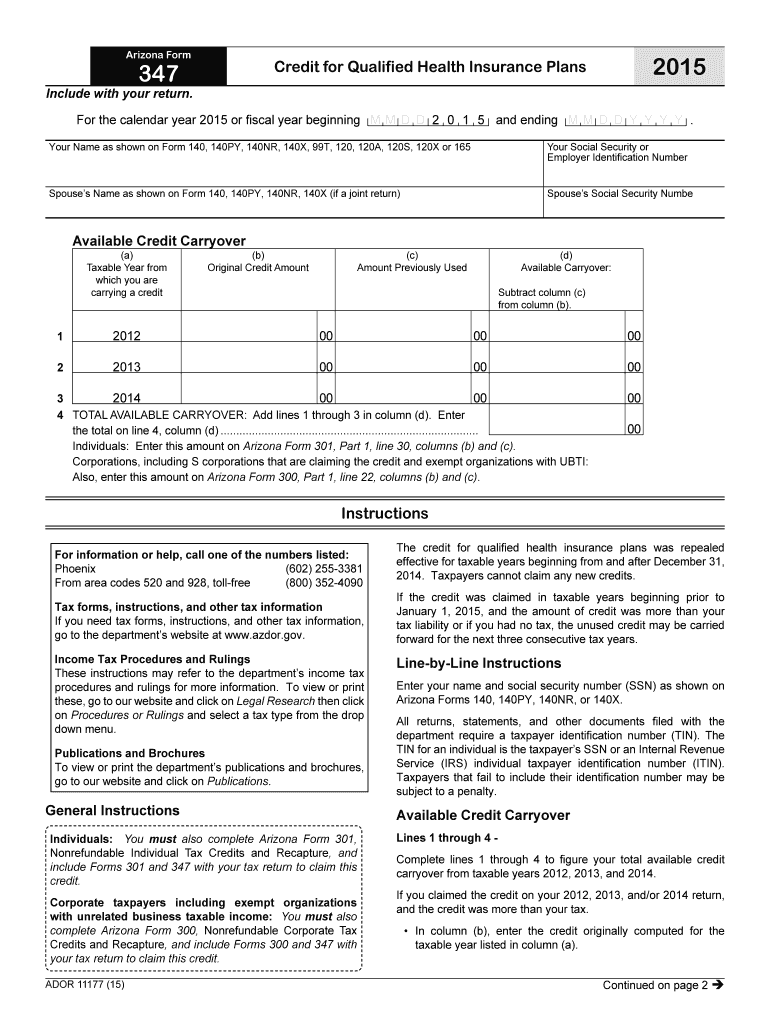

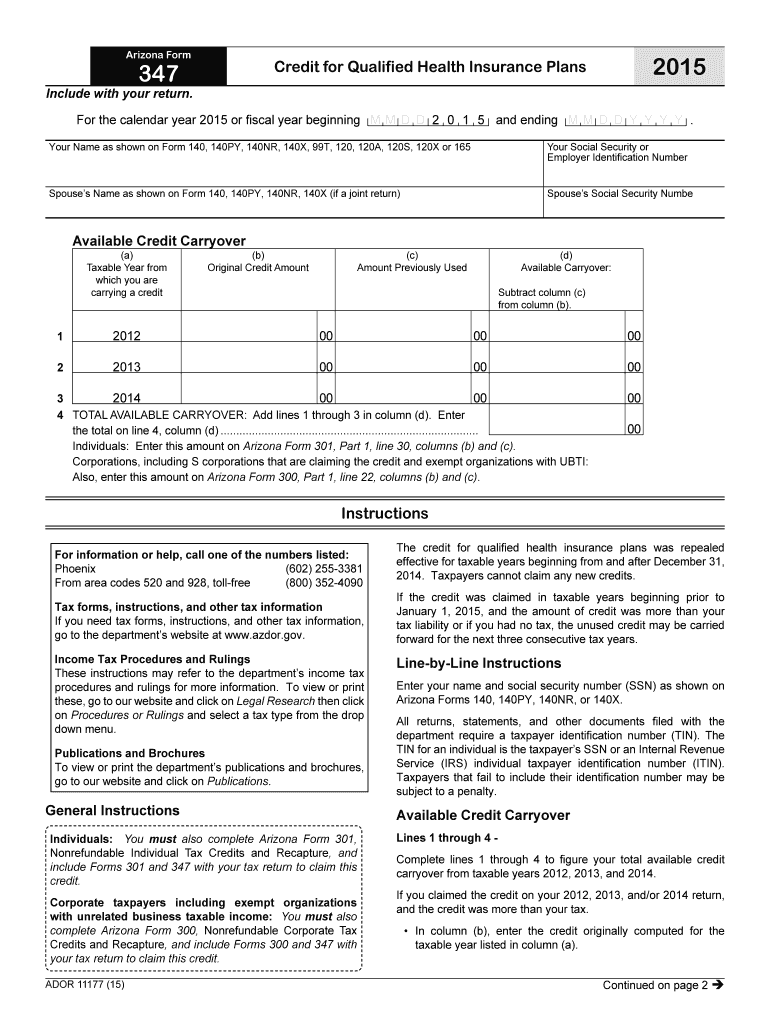

Arizona Form 2015 Credit for Qualified Health Insurance Plans 347 Include with your return. For the calendar year 2015 or fiscal year beginning M D 2 0 1 5 and ending M D D Y Y Y Y. Your Name as shown

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arizona form 347

Edit your arizona form 347 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona form 347 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona form 347 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona form 347. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arizona form 347

How to fill out Arizona Form 347:

01

Start by entering the relevant taxpayer information at the top of the form. This includes the taxpayer's name, address, and social security number or employer identification number.

02

Next, provide the tax year for which the form is being filed. This should be indicated in the appropriate section of the form.

03

Report all the wages, salaries, and tips earned by the taxpayer during the tax year on line 1 of the form. This includes any income received from any Arizona employers.

04

If any income was earned outside of Arizona, it should be reported on line 2 of the form. This includes any income earned from an out-of-state employer.

05

Calculate the total Arizona gross income by adding the amounts reported on lines 1 and 2. Enter the total on line 3 of the form.

06

If any credits are applicable, they should be reported on line 4. These may include credits for taxes paid to other states or credits related to specific industries.

07

Subtract any credits from the total Arizona gross income to determine the adjusted gross income. Enter this amount on line 5 of the form.

08

Determine the total Arizona withholding amount by reviewing any Arizona withholding statements or annual reconciliations. Enter this amount on line 6 of the form.

09

If the taxpayer has made any estimated tax payments throughout the tax year, they should be reported on line 7 of the form.

10

Subtract the total Arizona withholding amount and estimated tax payments from the adjusted gross income to determine the remaining balance or refund. Enter this amount on line 8a if it is a balance or line 8b if it is a refund.

11

Complete the taxpayer's signature and date section at the bottom of the form.

Who needs Arizona Form 347:

01

Arizona residents who have earned income from Arizona employers and/or out-of-state employers during the tax year.

02

Individuals who have received income in Arizona but are not residents of the state.

03

Taxpayers who need to report their Arizona gross income and calculate any applicable credits or deductions.

Overall, any individual who has earned income within the state of Arizona may need to fill out Arizona Form 347 to accurately report their income and fulfill their tax obligations to the state.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify arizona form 347 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including arizona form 347, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get arizona form 347?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the arizona form 347 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the arizona form 347 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign arizona form 347 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is arizona form 347?

Arizona form 347 is the Arizona Department of Revenue form used to report certain transactions related to the sale of real property.

Who is required to file arizona form 347?

Individuals or businesses who have engaged in the sale of real property in Arizona are required to file Arizona form 347.

How to fill out arizona form 347?

Arizona form 347 can be filled out by providing information about the parties involved in the real property sale, details of the transaction, and any other required information as specified on the form.

What is the purpose of arizona form 347?

The purpose of Arizona form 347 is to track and report certain real property transactions for tax purposes.

What information must be reported on arizona form 347?

Information such as the names and addresses of the parties involved, the date of the transaction, the sale price, and details of any improvements made to the property must be reported on Arizona form 347.

Fill out your arizona form 347 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Form 347 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.