Get the free Transfer of Establishment - Form IV

Show details

This form is used for transferring real estate that meets the definition of an Establishment, including when both real estate and business are transferred. It ensures compliance with environmental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of establishment

Edit your transfer of establishment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of establishment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer of establishment online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer of establishment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

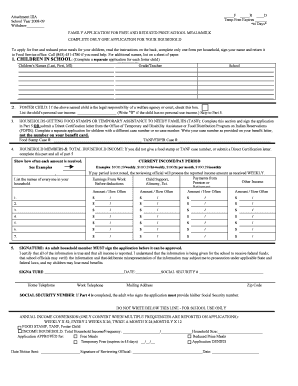

How to fill out transfer of establishment

How to fill out Transfer of Establishment - Form IV

01

Obtain Transfer of Establishment - Form IV from the relevant authority or download it from their website.

02

Fill in the 'Company Details' section with the name, address, and registration number of the current establishment.

03

Provide the new owner's information in the 'New Owner Details' section including their name, address, and contact information.

04

Specify the effective date of the transfer in the designated field.

05

List any attached documentation required, such as ownership proof and identification documents of the new owner.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form to the appropriate authority along with any required fees and supporting documents.

Who needs Transfer of Establishment - Form IV?

01

Businesses transferring ownership or management to a new entity or individual.

02

Any registered establishment that requires updating their registration details with a new owner.

Fill

form

: Try Risk Free

People Also Ask about

What is the property transfer program in CT?

The Property Transfer Program, administered by the Remediation Division of the Bureau of Water Protection and Land Reuse, requires the disclosure of environmental conditions when certain real properties and/or businesses ("establishments") are transferred.

What is the Transfer Act in CT?

Under the Transfer Act, properties that served as home to dry cleaners, auto repair shops, furniture strippers or any other entity that generated more than 100 kilograms of hazardous waste — about half of an industrial 55-gallon drum — in a month became subject to costly investigations and burdensome regulations

How to transfer a deed in CT?

Most likely, the attorney will prepare a certificate, deed or other legal document or the Probate Court will issue a document to distribute or transfer the property. The legal document prepared by the attorney or court will need to be recorded in the Town Clerk's Office along with the appropriate recording fee.

What is an establishment under the CT Transfer Act?

Establishments include specifically identified types of businesses (e.g., dry cleaners, vehicle body repair shops, furniture strippers) and sites or businesses that generated 100 kg of hazardous waste in any one month since November 1980.

How to transfer a deed in CT?

Most likely, the attorney will prepare a certificate, deed or other legal document or the Probate Court will issue a document to distribute or transfer the property. The legal document prepared by the attorney or court will need to be recorded in the Town Clerk's Office along with the appropriate recording fee.

What are the exemptions for the transfer act in CT?

Although an outright transfer of a business or real estate would always require compliance with the Transfer Act, there are numerous transfers which are exempt. Some important exemptions include mortgages, some foreclosures and deeds in lieu of foreclosure, some leases, and easements.

What are the exceptions to the CT transfer act?

Although an outright transfer of a business or real estate would always require compliance with the Transfer Act, there are numerous transfers which are exempt. Some important exemptions include mortgages, some foreclosures and deeds in lieu of foreclosure, some leases, and easements.

What is exempt from CT conveyance tax?

Exemptions from the state and municipal conveyance tax include: for foreclosure sales conducted pursuant to a foreclosure by sale conducted by a court committee. for deeds in lieu of foreclosure. for most short sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transfer of Establishment - Form IV?

Transfer of Establishment - Form IV is a formal document used to report the transfer of ownership or change in the establishment's management to relevant authorities in compliance with labor laws.

Who is required to file Transfer of Establishment - Form IV?

Business owners or employers who are transferring their establishment or changing the management structure must file Transfer of Establishment - Form IV.

How to fill out Transfer of Establishment - Form IV?

To fill out Transfer of Establishment - Form IV, provide the required details such as the name of the establishment, address, nature of business, details of the transferee, and any other relevant information as specified in the form.

What is the purpose of Transfer of Establishment - Form IV?

The purpose of Transfer of Establishment - Form IV is to formally notify authorities about a change in the ownership or management of an establishment, ensuring compliance with labor laws and regulations.

What information must be reported on Transfer of Establishment - Form IV?

The information required includes the name and address of the current owner, name and address of the new owner, details regarding the nature of business, and any relevant changes in operation or management.

Fill out your transfer of establishment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Establishment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.