Get the free Tax Technician I, BOE

Show details

This document serves as an examination bulletin for the Tax Technician I position at the Board of Equalization, outlining the qualifications, examination process, and employment opportunities available.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax technician i boe

Edit your tax technician i boe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax technician i boe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax technician i boe online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax technician i boe. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

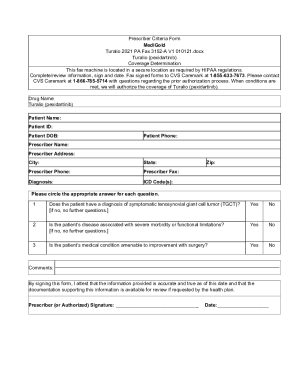

How to fill out tax technician i boe

How to fill out Tax Technician I, BOE

01

Gather all necessary documents such as income statements, prior tax returns, and W-2 forms.

02

Obtain the Tax Technician I, BOE application form from the official website or local BOE office.

03

Fill out personal information including name, address, and contact details.

04

Provide details of your previous tax experience and relevant qualifications.

05

Complete any required sections about your educational background and certifications.

06

Review the application to ensure all information is accurate and complete.

07

Submit the application along with any required supporting documents before the deadline.

Who needs Tax Technician I, BOE?

01

Individuals seeking a position in tax preparation and analysis.

02

Job seekers interested in employment with the Board of Equalization.

03

Professionals looking to advance their careers in taxation and compliance.

04

Students or graduates from accounting or finance programs aiming for entry-level positions.

Fill

form

: Try Risk Free

People Also Ask about

How much do tax technicians make in California?

How much does a Tax Technician make in California? As of Jun 25, 2025, the average annual pay for a Tax Technician in California is $40,622 a year. Just in case you need a simple salary calculator, that works out to be approximately $19.53 an hour. This is the equivalent of $781/week or $3,385/month.

How much do tax assistants make in California?

How much does a Tax Assistant make in California? As of Jun 25, 2025, the average hourly pay for a Tax Assistant in California is $24.65 an hour.

How much is $25 an hour annually in California?

Annual Salary Before Taxes A full-time work schedule consists of 40 hours per week as a standard implication: Hourly wage: $25. Weekly earnings: $25 × 40 = $1,000. Annual salary (52 weeks): $1,000 × 52 = $52,000.

How much do IRS workers make in California?

How much does IRS in California pay? The average IRS salary ranges from approximately $43,638 per year for Customer Service Representative to $142,273 per year for Senior Economist. Average IRS hourly pay ranges from approximately $31.47 per hour for Dog Walker to $31.98 per hour for Technician.

What is a good tech salary in California?

Tech Worker Salary in California Annual SalaryHourly Wage Top Earners $58,720 $28 75th Percentile $51,300 $25 Average $43,458 $21 25th Percentile $35,500 $17

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Technician I, BOE?

Tax Technician I, BOE refers to a position within the Board of Equalization that involves the administration and processing of tax-related data. This role typically includes responsibilities such as reviewing tax returns, assisting with audits, and providing support to taxpayers.

Who is required to file Tax Technician I, BOE?

Individuals or entities who engage in taxable business activities or transactions that fall under the jurisdiction of the Board of Equalization are required to file with Tax Technician I, BOE. This includes businesses that sell goods or provide services subject to sales tax.

How to fill out Tax Technician I, BOE?

To fill out the Tax Technician I, BOE form, gather necessary financial records, follow the form's instructions for reporting taxable sales, deductions, and credits, and accurately complete all required sections. Ensure that the form is signed and dated before submission.

What is the purpose of Tax Technician I, BOE?

The purpose of Tax Technician I, BOE is to facilitate the proper assessment and collection of taxes owed to the state. It serves to ensure compliance with tax laws and regulations and to provide a framework for taxpayers to report taxable activities.

What information must be reported on Tax Technician I, BOE?

The information that must be reported on Tax Technician I, BOE includes the total sales, exempt sales, tax collected, and any deductions or credits claimed. Additionally, all relevant business information, including the taxpayer's identification and contact details, must be included.

Fill out your tax technician i boe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Technician I Boe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.