Get the free 29 Sept 2009 Corporate Tax Compliance Copydoc

Show details

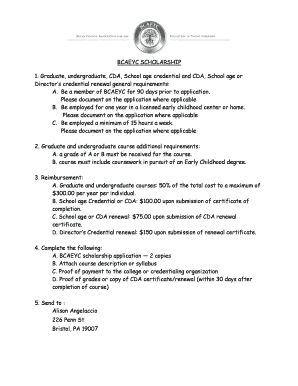

Compliance of Corporate Tax Workshop Date: 19th and 20th May 2010 Wednesday and Thursday 9.30 am to 5.30 pm SAI CSA TRAINING Center COURSE OBJECTIVE(S) This workshop is designed to equip participants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 29 sept 2009 corporate

Edit your 29 sept 2009 corporate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 29 sept 2009 corporate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 29 sept 2009 corporate online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 29 sept 2009 corporate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 29 sept 2009 corporate

How to fill out 29 sept 2009 corporate:

01

Begin by gathering all the necessary information and documentation required to complete the form. This may include details about the corporation, such as its name, address, and tax identification number.

02

Ensure you have the correct version of the 29 sept 2009 corporate form. It is essential to use the most up-to-date form to avoid any inaccuracies or errors in the filing process.

03

Review the instructions provided with the form thoroughly. These instructions will guide you on how to fill out each section correctly and provide any additional information or supporting documents that may be required.

04

Start by entering the basic information about the corporation, such as its legal name, address, and contact details.

05

Fill in the details about the corporation's board of directors or managing members. Include their names, addresses, and any other required information.

06

Provide information regarding the purpose of the corporation and its intended activities. This may include a description of the business or industry in which the corporation operates.

07

If applicable, provide details about any shareholders or stockholders, including their ownership percentages and voting rights.

08

Complete any additional sections or attachments as required by the form. These may include financial information, tax-related details, or other relevant data specific to the corporation.

Who needs 29 sept 2009 corporate?

01

Individuals or entities planning to establish a corporation on or after September 29, 2009, may need to fill out the 29 sept 2009 corporate form. This form is necessary for legally forming a corporation and filing it with the appropriate regulatory authorities.

02

Existing corporations that were established before September 29, 2009, may not be required to fill out the 29 sept 2009 corporate form. However, it is essential to consult with legal professionals or regulatory bodies to ensure compliance with any updates or changes in regulations.

03

Professionals, such as lawyers or accountants, who provide advisory or consulting services related to corporate formation and compliance, may also need to be familiar with the 29 sept 2009 corporate form. This knowledge enables them to assist their clients in correctly completing and submitting the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 29 sept 2009 corporate without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 29 sept 2009 corporate, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the 29 sept 2009 corporate electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 29 sept 2009 corporate in seconds.

Can I create an eSignature for the 29 sept 2009 corporate in Gmail?

Create your eSignature using pdfFiller and then eSign your 29 sept 2009 corporate immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is 29 sept corporate tax?

The 29 sept corporate tax is a tax imposed on corporations based on their income earned during the tax year.

Who is required to file 29 sept corporate tax?

All corporations that generate income are required to file 29 sept corporate tax.

How to fill out 29 sept corporate tax?

To fill out 29 sept corporate tax, corporations must report their income, expenses, deductions, and tax credits on the appropriate forms.

What is the purpose of 29 sept corporate tax?

The purpose of 29 sept corporate tax is to generate revenue for the government to fund public services and infrastructures.

What information must be reported on 29 sept corporate tax?

Corporations must report their total income, expenses, deductions, and tax credits on 29 sept corporate tax.

Fill out your 29 sept 2009 corporate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

29 Sept 2009 Corporate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.