Get the free D.C. Official Code Title 47 - doh dc

Show details

This document outlines the regulations and provisions related to the licensing and operation of pharmacies and pharmacists in the District of Columbia, including definitions, prohibitions, and the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dc official code title

Edit your dc official code title form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dc official code title form via URL. You can also download, print, or export forms to your preferred cloud storage service.

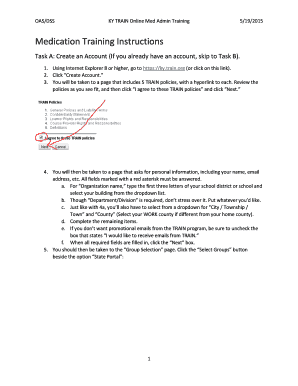

How to edit dc official code title online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dc official code title. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dc official code title

How to fill out D.C. Official Code Title 47

01

Obtain a copy of D.C. Official Code Title 47 from the official website or local government office.

02

Review the sections of the code relevant to your situation, such as tax filings or regulatory requirements.

03

Gather necessary documentation, including financial records and identification.

04

Fill out the required forms provided in D.C. Official Code Title 47, ensuring all information is accurate.

05

Submit the completed forms to the appropriate government agency as outlined in the code.

06

Keep a copy of the submission for your records and follow up if necessary.

Who needs D.C. Official Code Title 47?

01

Businesses operating in Washington D.C. that need to comply with local tax laws.

02

Individuals who are filing taxes or are subject to local regulations.

03

Government agencies requiring adherence to the municipal laws outlined in the code.

04

Legal professionals advising clients on D.C. tax law and regulatory matters.

Fill

form

: Try Risk Free

People Also Ask about

Is DC tax 10%?

According to the DC instructions: “Merchandise, services and rentals are taxed at a rate of 6%. Alcoholic beverages sold for off-the-premises consumption are taxed at a rate of 10.25%. Purchases of catered food or drinks are taxed at a rate of 10%.

What is the DC income tax rate?

The D.C. income tax consists of seven tax brackets, with rates from 4% to 10.75%.

Is Washington, D.C. a high tax state?

Top marginal state income tax rate, 2025 The top marginal tax rate in the DMV is D.C.'s 10.75%, compared to 5.75% in Maryland and Virginia. Why it matters: Your annual tax bill depends at least partly on where you live, with state income taxes varying from nonexistent to nearly 14% for some especially high earners.

What is a DC code?

Like the U.S. Code and state codes, the District of Columbia Code is a subject compilation of enacted legislation, divided into titles, chapters and sections. However, unlike most state codes, the D.C. Code also contains federal statutes which have an impact on the District of Columbia.

How much is $100,000 a year after taxes in DC?

If you make $100,000 a year living in the region of Washington DC, USA, you will be taxed $29,318. That means that your net pay will be $70,682 per year, or $5,890 per month. Your average tax rate is 29.3% and your marginal tax rate is 39.8%.

How much is income taxed in DC?

Overview of District of Columbia Taxes Washington, D.C. residents pay a progressive district income tax if they've lived there for at least 183 days out of the year. Rates are quite high compared to national averages, ranging from 4% to 10.75%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is D.C. Official Code Title 47?

D.C. Official Code Title 47 is the section of the District of Columbia Municipal Regulations that governs tax laws in Washington, D.C., including income, property, and sales tax regulations.

Who is required to file D.C. Official Code Title 47?

Individuals and businesses that have income, own property, or engage in sales in Washington, D.C. are required to file under D.C. Official Code Title 47.

How to fill out D.C. Official Code Title 47?

To fill out D.C. Official Code Title 47, taxpayers must first gather the necessary documentation, complete the required forms provided by the Office of Tax and Revenue, and ensure accurate reporting of income, deductions, and credits.

What is the purpose of D.C. Official Code Title 47?

The purpose of D.C. Official Code Title 47 is to establish the legal framework for tax collection and regulation in the District of Columbia, ensuring compliance and proper funding for government services.

What information must be reported on D.C. Official Code Title 47?

D.C. Official Code Title 47 requires reporting of personal and business income, deductions, tax credits, property values, sales transactions, and any other relevant financial data as dictated by the specific tax forms.

Fill out your dc official code title online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dc Official Code Title is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.