Get the free DIVIDENDS - BMF

Show details

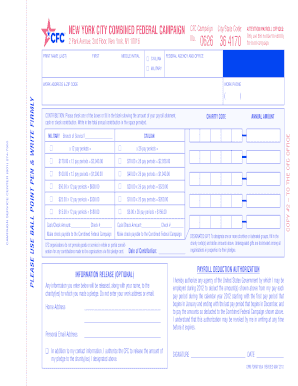

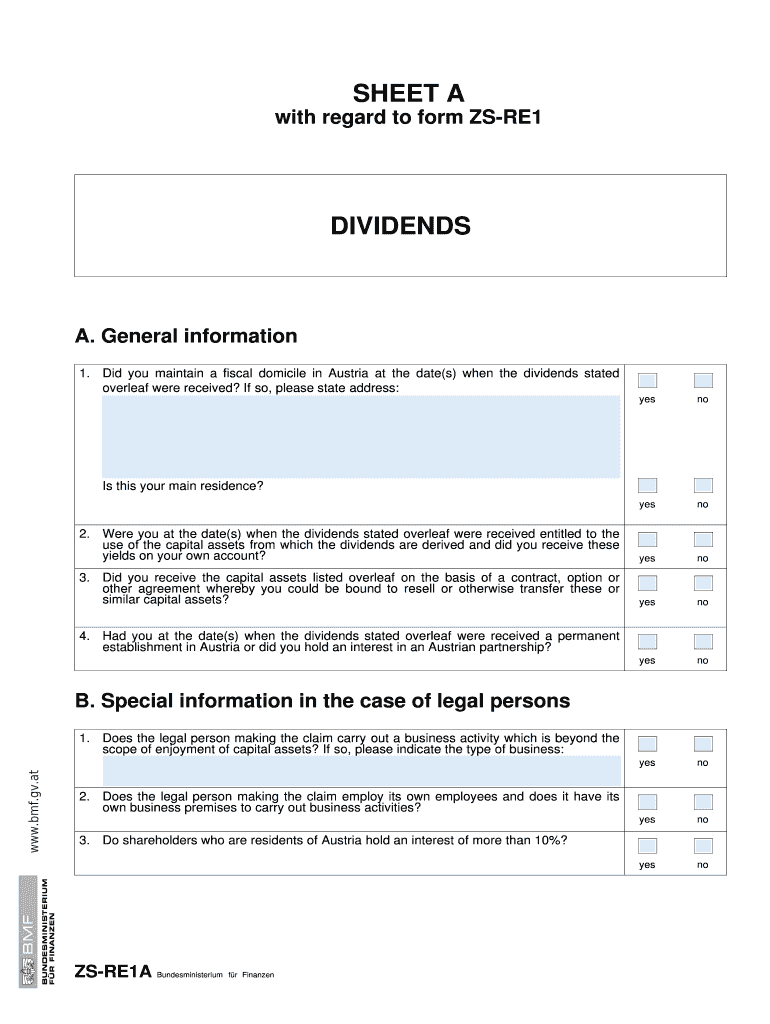

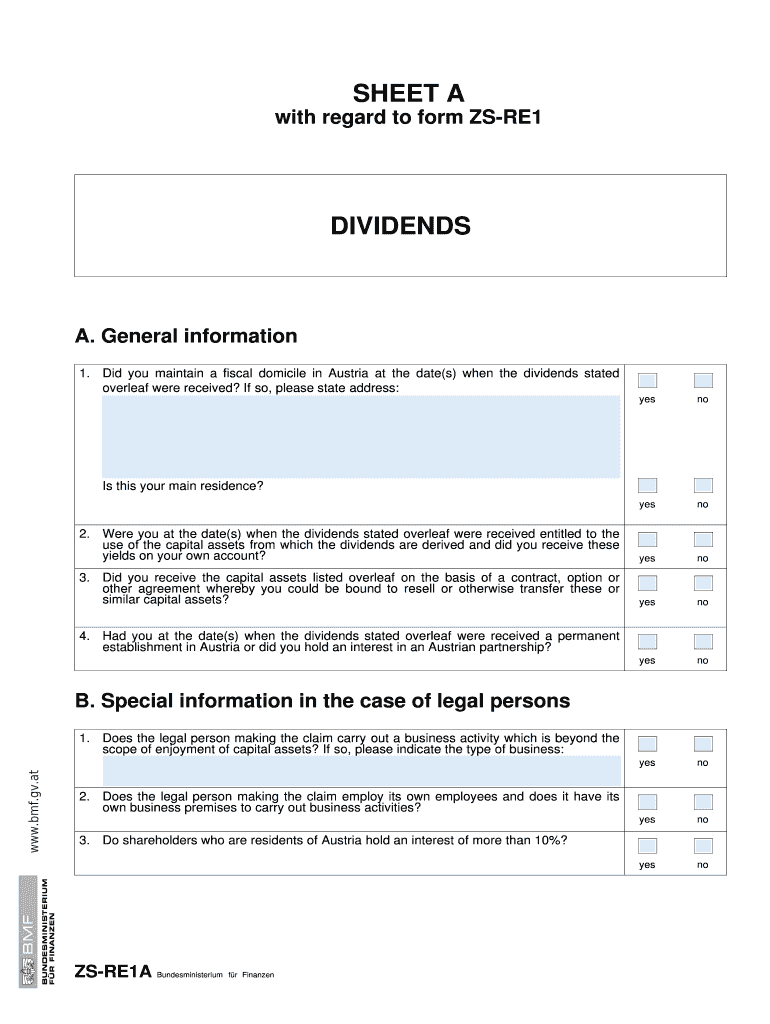

PDFs V 4 InterSteuern ZSRE1A 9999 Drunken Erlang natrlicher Personen for Zeke her DBAQuellensteuerentlastung / SHEET A Declaration by individuals for the purpose of tax treaty with relief at source

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dividends - bmf

Edit your dividends - bmf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividends - bmf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dividends - bmf online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dividends - bmf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dividends - bmf

How to fill out dividends - BMF:

01

Obtain the necessary form: To fill out dividends - BMF, you will need to obtain the specific form from the Bundesministerium für Finanzen (BMF) or German Ministry of Finance. This form can usually be found on their official website or obtained from their local offices.

02

Fill in personal information: Start by filling in your personal information accurately. This might include your name, address, social security number, and other relevant details required by the form.

03

Provide dividend details: Next, you will need to provide information about the dividends you received. This could include the company name, stock symbol, dividend payment date, dividend amount, and any other relevant details.

04

Declare income: Indicate the dividends as income in the appropriate section of the form. This is important for the purpose of tax assessment and calculation.

05

Fill out any additional sections: Depending on the specific form, there might be additional sections that require information related to your financial situation, investments, and any other relevant factors. Make sure to carefully read and complete these sections as required.

Who needs dividends - BMF:

01

Individuals receiving dividend payments: Any individual who receives dividend payments as a result of owning stocks, mutual funds, or other dividend-paying securities may need to report this income on their tax return. It is important to consult the guidelines provided by BMF or seek professional advice to determine if you need to declare dividends.

02

Investors subject to German tax laws: Individuals subject to German tax laws, such as residents or non-residents earning income within Germany, may be required to report their dividend income to the BMF. This ensures compliance with the tax regulations and facilitates proper tax assessment.

03

Those exceeding threshold limits: Depending on the specific tax regulations in Germany, there may be threshold limits for declaring dividend income. If your dividend income exceeds these limits, you may be required to report it to the BMF.

Note: The precise requirements for filling out dividends - BMF and who needs to report may vary based on individual circumstances, jurisdiction, and the applicable tax laws. It is always advisable to consult professionals or the official guidance provided by BMF for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dividends - bmf in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your dividends - bmf, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the dividends - bmf in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your dividends - bmf in seconds.

How do I edit dividends - bmf on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share dividends - bmf on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is dividends - bmf?

Dividends - bmf refer to the dividends that are paid to shareholders by a Brazilian publicly-traded company.

Who is required to file dividends - bmf?

Shareholders who receive dividends from a Brazilian publicly-traded company are required to file dividends - bmf.

How to fill out dividends - bmf?

Dividends - bmf can be filled out by providing the necessary information, such as the amount of dividends received and the company paying the dividends.

What is the purpose of dividends - bmf?

The purpose of dividends - bmf is to report the dividends received by shareholders from Brazilian publicly-traded companies to the tax authorities.

What information must be reported on dividends - bmf?

Information such as the amount of dividends received, the company paying the dividends, and the shareholder's details must be reported on dividends - bmf.

Fill out your dividends - bmf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dividends - Bmf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.