Get the free subject to underwriting approval

Show details

Employment Practices Liability Insurance (EPL) provides protection for an employer against ... What are the facts about Employment Practices related lawsuits?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subject to underwriting approval

Edit your subject to underwriting approval form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subject to underwriting approval form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit subject to underwriting approval online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit subject to underwriting approval. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

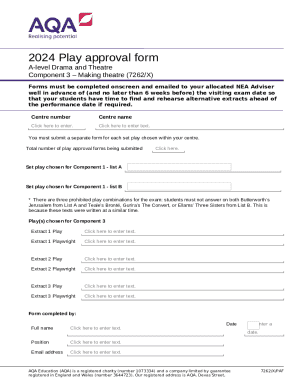

How to fill out subject to underwriting approval

How to fill out subject to underwriting approval:

01

Gather all necessary documentation: Before filling out a subject to underwriting approval, it is important to gather all the required documentation. This may include proof of income, tax returns, bank statements, credit reports, and any other relevant financial documents.

02

Complete the application: Once you have gathered all the necessary paperwork, you can begin filling out the underwriting approval application. This typically includes providing personal information, employment details, financial information, and details about the property or loan you are applying for.

03

Provide accurate and detailed information: It is crucial to provide accurate and detailed information when filling out the underwriting approval application. Any discrepancies or inaccuracies could lead to delays or even the rejection of your application. Take your time to ensure that all information provided is correct.

04

Consult with professionals if necessary: If you are unsure about any aspect of the underwriting approval process, it is advisable to consult with professionals such as mortgage brokers or loan officers. They can guide you through the process and provide valuable insights and advice.

Who needs subject to underwriting approval:

01

Homebuyers: Homebuyers who are applying for a mortgage loan usually need to go through the underwriting approval process. This ensures that the lender evaluates their financial situation, creditworthiness, and the property being purchased.

02

Borrowers seeking refinancing: Borrowers who want to refinance their existing loan may also need to undergo the underwriting approval process. This helps lenders assess the borrower's current financial standing and determine if they qualify for a new loan with more favorable terms.

03

Property investors: Real estate investors who are seeking financing for their investment properties may also require underwriting approval. This is because lenders need to assess the property's potential cash flow, the borrower's investment experience, and their ability to repay the loan.

Overall, subject to underwriting approval is necessary for individuals or entities that are seeking financing or refinancing for a property. It is an essential step in the loan application process that helps lenders determine the borrower's ability to repay the loan and assess the overall risk.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the subject to underwriting approval in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your subject to underwriting approval in seconds.

Can I edit subject to underwriting approval on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute subject to underwriting approval from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out subject to underwriting approval on an Android device?

Use the pdfFiller mobile app and complete your subject to underwriting approval and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is subject to underwriting approval?

Subject to underwriting approval refers to the process by which an insurance company evaluates an applicant's risk profile and determines whether to accept or reject the insurance application.

Who is required to file subject to underwriting approval?

Insurance agents, brokers, and underwriters are required to submit subject to underwriting approval to the insurance company.

How to fill out subject to underwriting approval?

Subject to underwriting approval is usually filled out electronically through the insurance company's online portal or via a paper application form.

What is the purpose of subject to underwriting approval?

The purpose of subject to underwriting approval is to assess the risk associated with insuring a particular individual or entity and to determine the appropriate premium to charge.

What information must be reported on subject to underwriting approval?

Subject to underwriting approval typically requires information such as the applicant's personal details, medical history, driving record, and other relevant information.

Fill out your subject to underwriting approval online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subject To Underwriting Approval is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.