Get the free Basics of Private Equity Regulations and ReportingTax

Show details

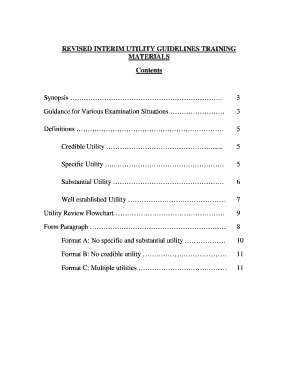

Basics of Private Equity Regulations and Reporting Tax Matters Presented at Airs 9th Annual Private Equity Tax & Compliance Practices 2010 By: Steven D. Brick June 23, 2010, Hyatt Harbor side Boston,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basics of private equity

Edit your basics of private equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basics of private equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing basics of private equity online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit basics of private equity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basics of private equity

How to Fill Out Basics of Private Equity:

01

Start by understanding the concept of private equity: Learn about the key elements and characteristics of private equity investments. This includes understanding the different stages of private equity investing, such as venture capital and buyouts.

02

Study the industry: Familiarize yourself with the various sectors within private equity, such as technology, healthcare, real estate, and energy. Understand the trends and dynamics affecting these sectors, as well as the key players and their strategies.

03

Learn about the due diligence process: Develop an understanding of the thorough analysis and research involved in evaluating potential investments in private equity. This includes analyzing financial statements, assessing management teams, and evaluating market opportunities.

04

Explore different investment strategies: Understand the different approaches and strategies employed by private equity firms, such as leveraged buyouts, growth equity, and distressed investing. Gain insights into the risk-return profiles associated with each strategy.

05

Familiarize yourself with financial modeling and valuation techniques: Private equity involves complex financial analysis and valuation of companies. Learn how to create financial models, perform valuation analysis, and assess investment returns.

06

Study the legal and regulatory environment: Understand the legal and regulatory framework surrounding private equity investments. This includes knowledge of securities laws, fund structures, and compliance requirements.

07

Gain practical experience: Seek opportunities to work or intern in private equity firms or related industries to gain hands-on experience and exposure to actual deal-making processes. This can provide valuable insights into the day-to-day operations and decision-making processes within private equity.

Who Needs Basics of Private Equity:

01

Aspiring investors: Individuals who are interested in pursuing a career in finance, specifically within private equity, need a solid understanding of the basics to navigate the industry successfully.

02

Entrepreneurs and business owners: Understanding private equity basics is crucial for entrepreneurs looking to raise capital or sell a stake in their companies. Knowing how private equity works can help them make informed decisions and negotiate better deals.

03

Finance professionals: Professionals working in investment banking, corporate finance, or other related fields can benefit from understanding private equity basics. It enhances their knowledge of the broader financial markets and provides insights into deal structuring and valuation techniques.

04

Business students: Students pursuing degrees in finance, business administration, or related fields can benefit from learning the basics of private equity. It provides them with a comprehensive understanding of investment strategies and the opportunity to explore potential career paths.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my basics of private equity directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your basics of private equity and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send basics of private equity for eSignature?

Once your basics of private equity is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit basics of private equity on an Android device?

You can edit, sign, and distribute basics of private equity on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is basics of private equity?

Private equity refers to investments made in private companies or assets with the goal of generating returns for investors. This involves buying a stake in a company, helping it grow, and eventually selling the stake for a profit.

Who is required to file basics of private equity?

Investors or firms that have invested in private equity funds or companies are required to file basics of private equity.

How to fill out basics of private equity?

Basics of private equity can be filled out by providing details about the investment, such as the amount invested, the type of investment, the fund or company invested in, and any returns expected.

What is the purpose of basics of private equity?

The purpose of basics of private equity is to track and report investments in private companies or assets, and to provide transparency to investors and regulators.

What information must be reported on basics of private equity?

Information such as the amount invested, the name of the fund or company invested in, the type of investment (equity, debt, etc.), and any expected returns must be reported on basics of private equity.

Fill out your basics of private equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basics Of Private Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.