Get the free Bazaar years

Show details

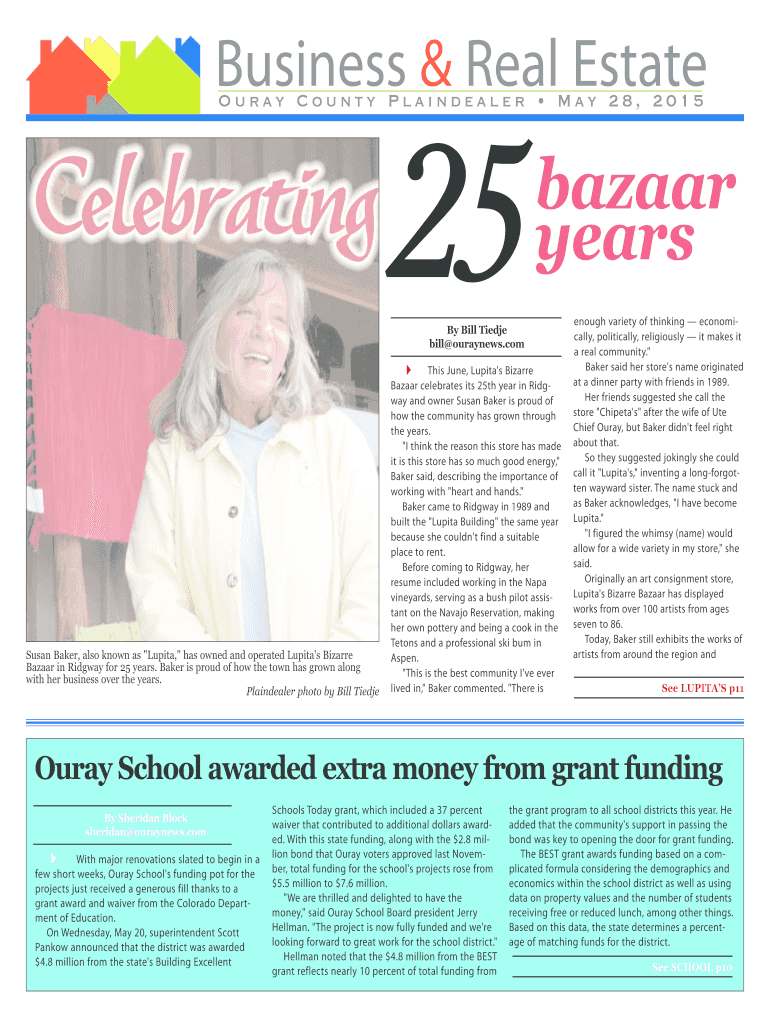

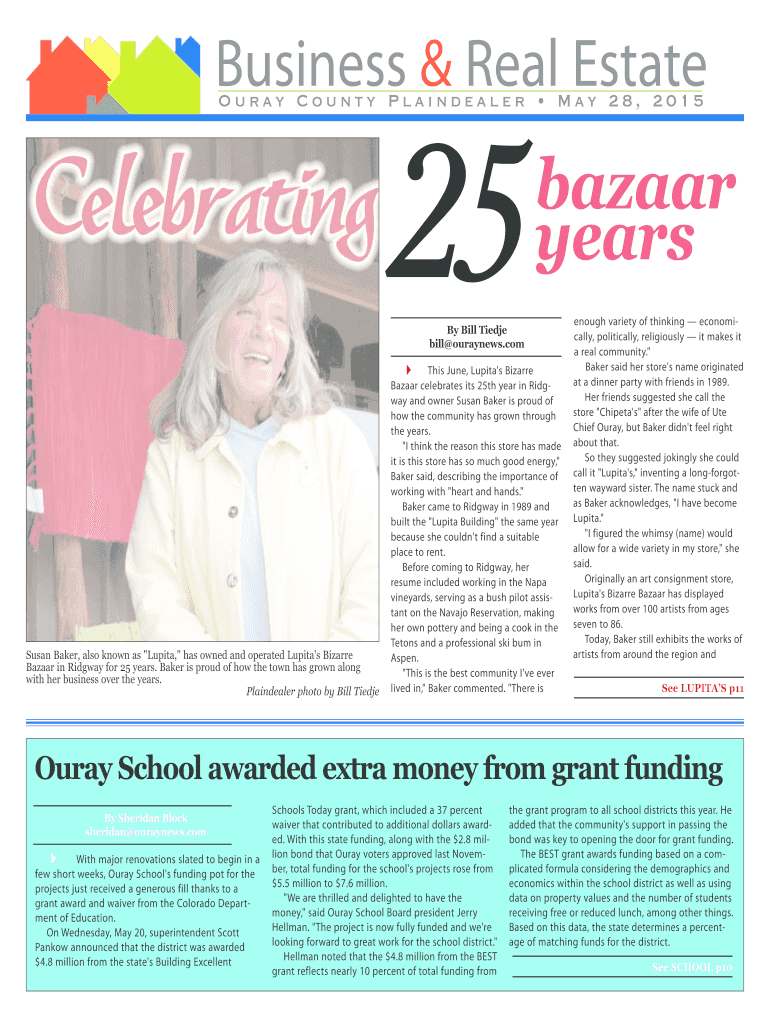

Business & Real Estate bazaar years Our County Plain dealer May 28, 2015 25 By Bill Tied bill ouraynews.com Susan Baker, also known as Lupita, has owned and operated Lupita's Bizarre Bazaar in Ridgeway

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bazaar years

Edit your bazaar years form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bazaar years form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bazaar years online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bazaar years. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bazaar years

How to fill out bazaar years:

01

First, gather all the necessary information about your business, including financial statements, invoices, and sales records.

02

Next, determine the time period that the bazaar years will cover. This could be a calendar year, a fiscal year, or any other period specified by your accounting system.

03

Use accounting software or spreadsheets to organize and categorize your financial data. Create separate accounts for revenues, expenses, assets, and liabilities.

04

Enter all the transactions that occurred during the bazaar years, ensuring that each entry is accurate and complete. Include details such as dates, invoice numbers, descriptions, and amounts.

05

Reconcile your accounts by comparing your records with bank statements and other financial documents. Make any necessary adjustments to ensure everything is in balance.

06

Calculate financial ratios and perform analysis to understand your business's performance during the bazaar years. This can help identify areas of strength and areas that require improvement.

Who needs bazaar years:

01

Business owners and entrepreneurs who want to gain a clear understanding of their financial performance over a specific period of time.

02

Investors and stakeholders who need to evaluate the financial health and stability of a company.

03

Tax authorities and regulatory agencies that require businesses to report their financial information accurately and in a standardized format.

04

Financial institutions and lenders who assess the creditworthiness and risk profile of a business before providing loans or financing.

05

Researchers and analysts who study market trends and economic indicators may also require bazaar years data to conduct their studies effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the bazaar years electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your bazaar years in seconds.

How do I edit bazaar years straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing bazaar years.

How can I fill out bazaar years on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your bazaar years, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is bazaar years?

Bazaar years refer to the financial statements and documents submitted by businesses that engage in bazaar activities.

Who is required to file bazaar years?

Businesses that participate in bazaar activities are required to file bazaar years.

How to fill out bazaar years?

Bazaar years can be filled out by providing all the necessary financial information and submitting the required documents to the relevant authorities.

What is the purpose of bazaar years?

The purpose of bazaar years is to provide a clear picture of the financial performance and activities of businesses operating in bazaars.

What information must be reported on bazaar years?

Bazaar years must include financial statements, income and expense reports, and any other relevant financial information.

Fill out your bazaar years online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bazaar Years is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.