Get the free Earnings Withholding Order (Wage Garnishment) - courts ca

Show details

Esta forma se utiliza para la retención de salarios de un deudor según una orden de retención de ingresos, acorde con las modificaciones legislativas recientes sobre la cantidad máxima que se

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign earnings withholding order wage

Edit your earnings withholding order wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your earnings withholding order wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit earnings withholding order wage online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit earnings withholding order wage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out earnings withholding order wage

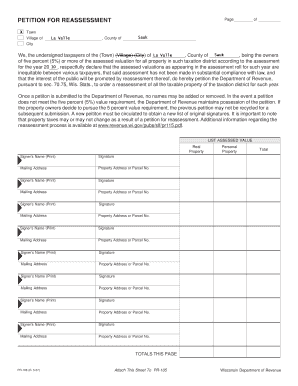

How to fill out Earnings Withholding Order (Wage Garnishment)

01

Obtain the Earnings Withholding Order form from your local court or relevant authority.

02

Fill in the case caption, including the name of the court, case number, and parties involved.

03

Enter the information about the debtor, including their name, address, and employer details.

04

Specify the amount to be withheld from the debtor's wages in the designated section.

05

Sign and date the form after reviewing all information for accuracy.

06

File the completed Earnings Withholding Order with the court and provide copies to the debtor and their employer.

07

Follow up with the employer to ensure they are processing the garnishment as ordered.

Who needs Earnings Withholding Order (Wage Garnishment)?

01

Creditors seeking to collect unpaid debts.

02

Individuals or businesses that have obtained a judgment against another party.

03

Employers who need to process wage garnishments as part of a court order.

Fill

form

: Try Risk Free

People Also Ask about

What is an earnings order?

An "attachment of earnings order" allows money to be taken from your wages to pay a debt. Your employer sends the money to the court that made the order. Then the court sends this money to the people you owe.

What is an earnings withholding order in California?

If you are an employer and you received an Earnings Withholding Order (form WG-002 or WG-030), it means you must withhold part of your employee's pay to cover money they owe in a civil lawsuit (a judgment). This is sometimes called wage garnishment.

What is a withholding order in California?

Withholding orders are legal orders we issue to collect past due income taxes or a bill owed to local or state agencies. There are different types of withholding orders we issue: Earnings withholding order for taxes (EWOT) Earnings withholding order (EWO) Order to withhold (OTW)

Can a creditor garnish my wages after 7 years in California?

Statute of Limitations on Debts Generally, it ranges from 3 to 6 years for most consumer debts. After this period, creditors can't sue you to collect the debt. However, this doesn't automatically prevent wage garnishment if a judgment was obtained before the statute expired.

What does California withholding mean?

State withholding is money that is withheld and sent to the State of California to pay California income taxes. It pays for state programs such as education, health and welfare, public safety, and the court justice system. California's elected representatives also meet every year to decide how this money will be spent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Earnings Withholding Order (Wage Garnishment)?

An Earnings Withholding Order, commonly known as wage garnishment, is a legal procedure where a portion of an employee's earnings is withheld by an employer to pay off a debt owed by the employee, typically as a result of a court order or legal obligation.

Who is required to file Earnings Withholding Order (Wage Garnishment)?

Creditors or third parties who have obtained a court judgment requiring the collection of a debt may file an Earnings Withholding Order. This typically includes individuals or entities such as lenders, child support agencies, or government agencies seeking to recover unpaid taxes.

How to fill out Earnings Withholding Order (Wage Garnishment)?

To fill out an Earnings Withholding Order, the creditor must complete the form with details including the debtor's information, the amount to be withheld, the employer's information, and any court information related to the judgment. It should also be signed and submitted to the appropriate court for processing.

What is the purpose of Earnings Withholding Order (Wage Garnishment)?

The purpose of an Earnings Withholding Order is to enforce payment of a debt by legally mandating an employer to deduct a specified amount from an employee’s wages and redirect it to the creditor until the debt is satisfied.

What information must be reported on Earnings Withholding Order (Wage Garnishment)?

The Earnings Withholding Order must include the debtor's name, Social Security number, employer's name and address, the amount to be garnished, the reason for the garnishment, and details of any court notifications or guidelines associated with the garnishment.

Fill out your earnings withholding order wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Earnings Withholding Order Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.