Get the free Co-Insurance Plans

Show details

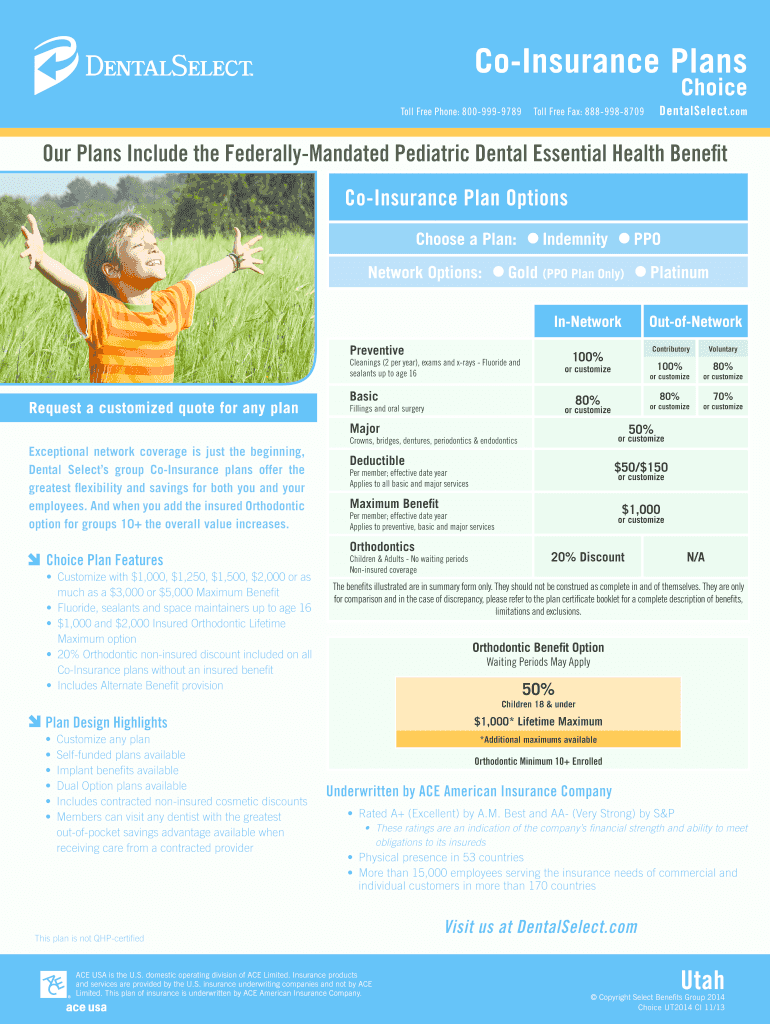

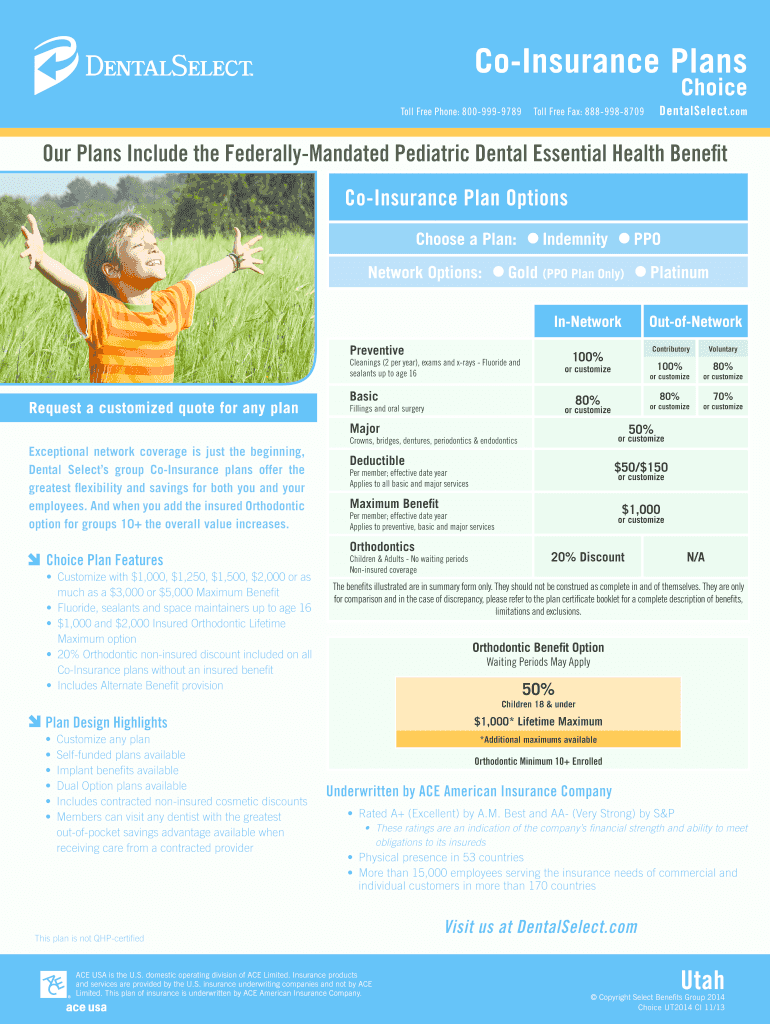

Coinsurance Plans ChoiceToll Free Phone: 8009999789DentalSelect. Common Free Fax: 8889988709Our Plans Include the FederallyMandated Pediatric Dental Essential Health Benefit Coinsurance Plan Options

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign co-insurance plans

Edit your co-insurance plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co-insurance plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit co-insurance plans online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit co-insurance plans. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co-insurance plans

How to fill out co-insurance plans:

01

Gather all necessary information: Before filling out a co-insurance plan, make sure you have all the necessary information handy. This includes your insurance policy number, the name of your primary health insurance provider, and any additional details or documents required by your co-insurance plan.

02

Understand the terms and coverage: Familiarize yourself with the key terms and coverage provided by your co-insurance plan. This includes understanding the percentage of costs you are responsible for (e.g., 20% co-insurance), any deductible amounts, and any limits or restrictions on coverage.

03

Review your medical bills: Carefully review your medical bills or invoices to understand the services or treatments you received, the costs associated with each, and any adjustments or discounts applied. This will help you accurately calculate your co-insurance responsibilities.

04

Calculate your co-insurance amount: Use the information from your medical bills and the coverage details provided by your co-insurance plan to calculate your co-insurance amount. Typically, this involves multiplying the percentage of co-insurance by the total cost of the service or treatment. For example, if your co-insurance is 20% and the total charge is $100, your co-insurance amount would be $20.

05

Submit your claims: Once you have calculated your co-insurance amount, submit your claims to your secondary insurance provider along with any necessary documentation. This may include itemized bills, receipts, or explanations of benefits from your primary insurance provider.

06

Follow up with payments: After your claims have been processed, you may receive an explanation of benefits (EOB) detailing the amount paid by your primary insurance and the remaining balance. Pay your co-insurance amount promptly to ensure timely processing of your claims and avoid any potential penalties or late fees.

Who needs co-insurance plans:

01

Individuals with primary health insurance: Co-insurance plans are typically designed for individuals who already have a primary health insurance policy. These plans help cover the remaining costs that are not paid by the primary insurance.

02

Those seeking cost-sharing options: Co-insurance plans provide a cost-sharing approach where individuals pay a percentage of the total cost of healthcare services or treatments. This can be beneficial for those looking for a more affordable way to manage medical expenses.

03

Individuals with high medical costs: Co-insurance plans can be beneficial for individuals who frequently require medical services or have ongoing healthcare needs. It helps to spread out the financial burden by sharing the costs between the insurance provider and the individual.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify co-insurance plans without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your co-insurance plans into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete co-insurance plans online?

pdfFiller has made it simple to fill out and eSign co-insurance plans. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit co-insurance plans on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share co-insurance plans from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is co-insurance plans?

Co-insurance plans are health insurance plans where the policyholder and the insurance company share the cost of covered healthcare services.

Who is required to file co-insurance plans?

Health insurance companies are required to file co-insurance plans.

How to fill out co-insurance plans?

Co-insurance plans can be filled out electronically through the designated portal provided by the insurance company.

What is the purpose of co-insurance plans?

The purpose of co-insurance plans is to ensure that both the policyholder and the insurance company have a financial stake in the cost of healthcare services.

What information must be reported on co-insurance plans?

Co-insurance plans must include details of the healthcare services provided, the cost of the services, and the percentage of the cost that will be covered by the insurance company.

Fill out your co-insurance plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co-Insurance Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.