Get the free Flexible Spending Account FSA Expenses amp Contributions

Show details

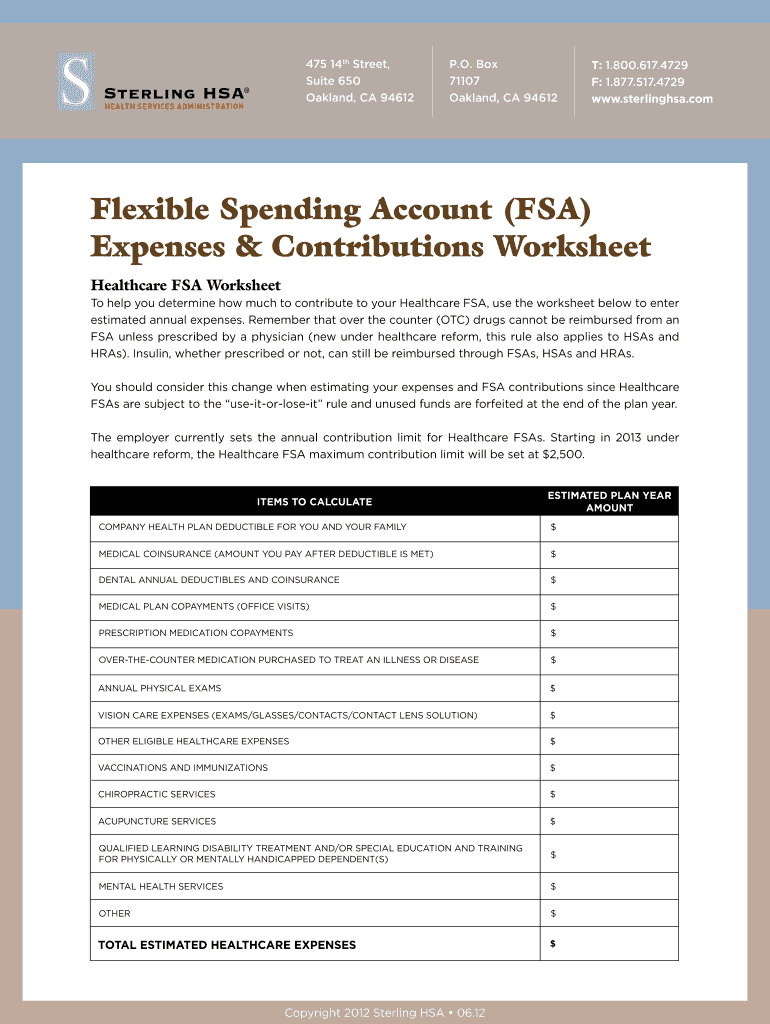

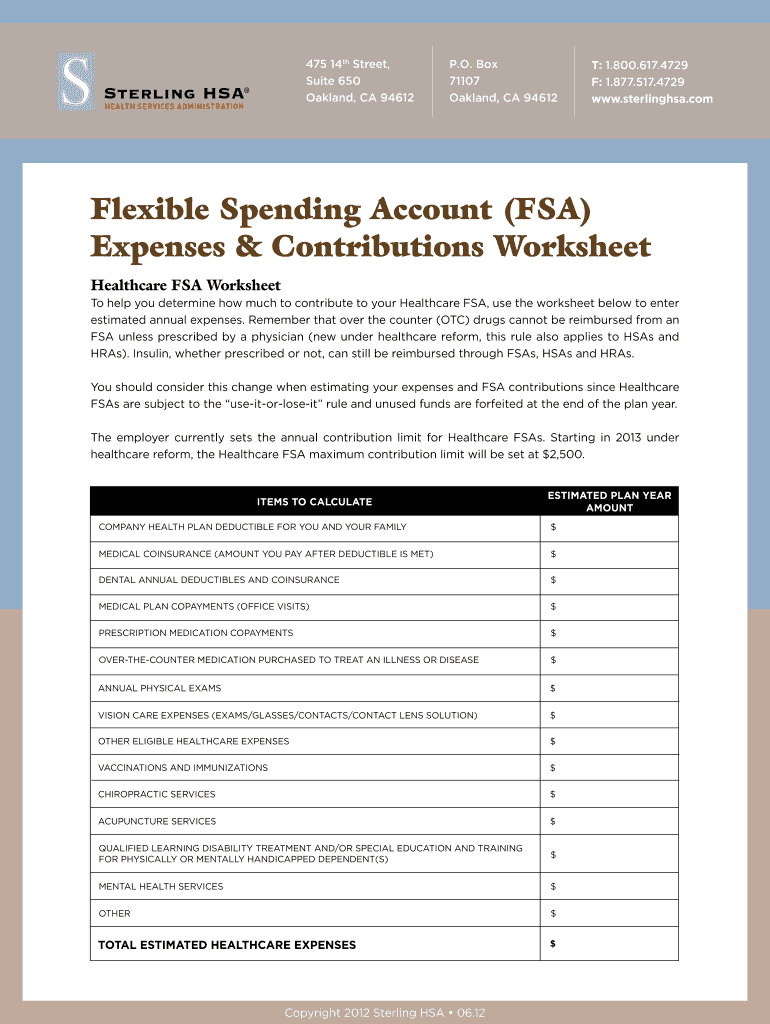

475 14th Street, Suite 650 Oakland, CA 94612 P.O. Box 71107 Oakland, CA 94612 T: 1.800.617.4729 F: 1.877.517.4729 www.sterlinghsa.com Flexible Spending Account (FSA) Expenses & Contributions Worksheet

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending account fsa

Edit your flexible spending account fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending account fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible spending account fsa online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit flexible spending account fsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending account fsa

How to fill out a Flexible Spending Account (FSA)?

01

Determine your eligibility: Before filling out an FSA, you need to check if you meet the eligibility criteria set by your employer or the FSA provider. Typically, individuals who have a full-time job and are not enrolled in a high-deductible health plan or health savings account (HSA) are eligible for an FSA.

02

Access the enrollment materials: Contact your employer's human resources department or the FSA provider to obtain the enrollment materials. These materials usually include a detailed FSA guide, enrollment forms, and contribution limits.

03

Understand the contribution limits: It is crucial to know the contribution limits set by the Internal Revenue Service (IRS) for FSA accounts. For the 2021 tax year, the maximum contribution limit is $2,750 per individual. Take note of this limit while filling out the enrollment form.

04

Complete the enrollment form: Provide accurate personal information, such as your name, address, social security number, and employee identification number, if applicable. Indicate the amount you want to contribute to your FSA account for the year.

05

Choose your contribution type: Decide whether you want to make pre-tax or post-tax contributions. Pre-tax contributions reduce your taxable income, while post-tax contributions occur after taxes are deducted. Consult with a tax professional to determine the best option for your financial situation.

06

Select your eligible expenses: Review the list of eligible expenses that qualify for reimbursement through your FSA. These expenses may include medical, dental, vision, and dependent care-related costs. Familiarize yourself with the documentation requirements for each expense category.

Who needs a Flexible Spending Account (FSA)?

01

Employees with anticipated out-of-pocket medical expenses: An FSA is an excellent resource for individuals who expect to have significant medical expenses throughout the year. If you have ongoing medical treatments, prescription medications, or regular doctor visits, an FSA can help you save money on these expenses.

02

Parents with dependent care expenses: Childcare, summer camps, and other dependent care expenses can be costly. Utilizing an FSA can help parents offset some of these expenses by using pre-tax dollars, reducing their taxable income, and maximizing their potential savings.

03

Individuals with predictable or planned medical expenses: If you know you will need to undergo a medical procedure, dental work, vision correction, or purchase prescription eyewear, an FSA can be a beneficial tool. It allows you to set aside pre-tax funds, minimizing the financial burden of these expected healthcare costs.

In summary, when filling out a Flexible Spending Account (FSA), determine your eligibility, obtain the enrollment materials, understand the contribution limits, complete the enrollment form accurately, choose your contribution type, and select eligible expenses for reimbursement. Meanwhile, FSAs are beneficial for employees with anticipated medical expenses, parents with dependent care costs, and individuals expecting predictable or planned medical expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flexible spending account fsa directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your flexible spending account fsa and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send flexible spending account fsa to be eSigned by others?

When your flexible spending account fsa is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the flexible spending account fsa form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign flexible spending account fsa and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is flexible spending account fsa?

A flexible spending account (FSA) is a tax-advantaged financial account that allows employees to set aside a portion of their earnings to pay for qualified expenses such as medical costs, dependent care expenses, and other eligible expenses.

Who is required to file flexible spending account fsa?

Employees who have access to a flexible spending account (FSA) through their employer are typically required to file for the account if they wish to take advantage of the tax benefits it offers.

How to fill out flexible spending account fsa?

To fill out a flexible spending account (FSA), employees need to work with their employer to determine the contribution amount, eligible expenses, and submission process for reimbursement.

What is the purpose of flexible spending account fsa?

The purpose of a flexible spending account (FSA) is to help employees save money on out-of-pocket expenses by using pre-tax dollars to pay for eligible costs like medical care and dependent care.

What information must be reported on flexible spending account fsa?

Employees need to report information such as the amount contributed to the FSA, expenses incurred, and any reimbursements received on their flexible spending account (FSA) documentation.

Fill out your flexible spending account fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Account Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.