Get the free Indiana Reinstatement Directions

Show details

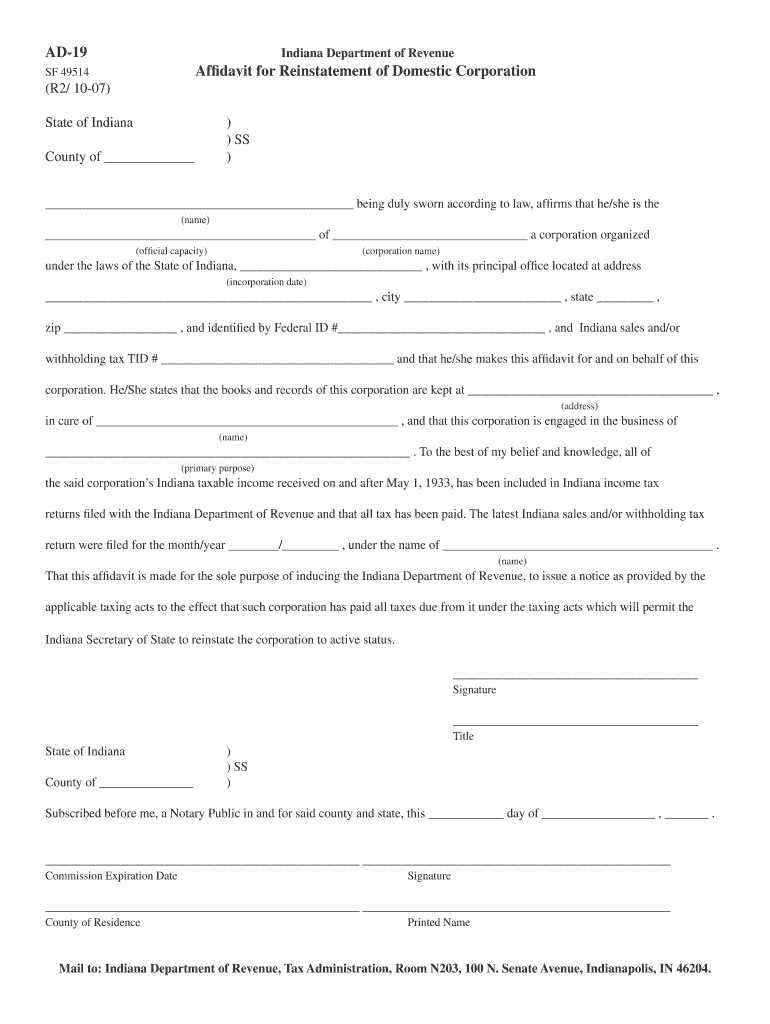

This document outlines the steps required to reinstate a corporation or limited liability company that has been administratively dissolved in Indiana. It includes obtaining a Certificate of Clearance,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiana reinstatement directions

Edit your indiana reinstatement directions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana reinstatement directions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana reinstatement directions online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit indiana reinstatement directions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indiana reinstatement directions

How to fill out Indiana Reinstatement Directions

01

Visit the Indiana Bureau of Motor Vehicles (BMV) website.

02

Locate the section for reinstatement of driving privileges.

03

Gather necessary documents, including your current identification and any court documents.

04

Complete the required reinstatement form available on the BMV website or at a BMV branch.

05

Pay any outstanding fees or fines associated with your license suspension.

06

Submit the completed form and any required documentation either online, by mail, or in person at a BMV branch.

07

Confirm the status of your reinstatement by checking your account on the BMV website or contacting BMV customer service.

Who needs Indiana Reinstatement Directions?

01

Individuals who have had their driving privileges suspended or revoked in Indiana.

02

Those who wish to regain their driving rights after completing any mandated requirements or waiting periods.

03

Drivers who have received a notice from the BMV indicating their need to reinstate their license.

Fill

form

: Try Risk Free

People Also Ask about

How to reinstate business in Indiana?

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. Process an Application for Reinstatement through INBiz.

What happens when an LLC is administratively dissolved in Indiana?

If your business has been administratively dissolved or revoked, you cannot conduct business in Indiana. Don't panic. If you intend to continue doing business, you can reinstate the business if it has not been administratively dissolved or revoked for more than five (5) years.

How do I reinstate my LLC in Indiana?

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. Process an Application for Reinstatement through INBiz.

Do you have to renew LLC every year in Indiana?

Your Indiana LLC Business Entity Report is due every 2 years, before the last day of your LLC's anniversary month. Your LLC's anniversary month is the month it was approved by the state.

How much does it cost to reinstate an LLC in Indiana?

Filing fees – The filing fees consists of all fees owed for Business Entity Reports plus the reinstatement fee of $30.00. For help determining the correct fees, call the information line at (317) 232-6576.

How much does it cost to have your license reinstated in Indiana?

Along with any outstanding tickets, you may also see reinstatement fees on your driving record. These are administrative fees that are required by the BMV before you can obtain a new license or renew your license. Depending on your driving record, these can be in the $1000s.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Indiana Reinstatement Directions?

Indiana Reinstatement Directions are guidelines provided by the state of Indiana for businesses that have been dissolved or have had their business registration revoked. These directions outline the necessary steps and documentation required to reinstate a business in the state.

Who is required to file Indiana Reinstatement Directions?

Entities that had their business registration revoked or dissolved in Indiana are required to file Indiana Reinstatement Directions to restore their legal status. This typically applies to corporations, limited liability companies, and partnerships.

How to fill out Indiana Reinstatement Directions?

To fill out Indiana Reinstatement Directions, one must provide required information such as the business name, the reason for dissolution or revocation, and any outstanding fees or taxes. Following the provided form and instructions is crucial to ensure a successful reinstatement.

What is the purpose of Indiana Reinstatement Directions?

The purpose of Indiana Reinstatement Directions is to provide a clear and structured process for businesses to regain their legal standing within the state after facing dissolution or revocation. This ensures that they can continue operations legally and fulfill any statutory obligations.

What information must be reported on Indiana Reinstatement Directions?

Information required on the Indiana Reinstatement Directions includes the business name, date of dissolution or revocation, reasons for reinstatement, any filings or taxes due, and contact information for the individual completing the form.

Fill out your indiana reinstatement directions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Reinstatement Directions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.