Get the free Trusts and Estates under Attack - Malcolm Kemp-Peter Hodson - 23 September 2015docx ...

Show details

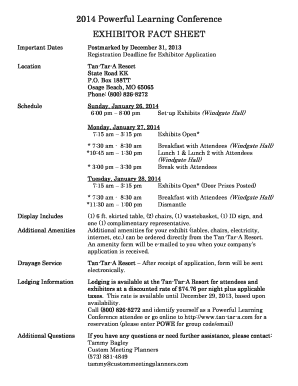

STEP HONG KONG LTD PO Box 8486 GPO Hong Kong Tel: 2559 7144 Email address: queries step.org.HK Website address: www.step.org/hongkong A SEMINAR ON TRUSTS AND ESTATES UNDER ATTACK : RECENT LITIGATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trusts and estates under

Edit your trusts and estates under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trusts and estates under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trusts and estates under online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit trusts and estates under. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trusts and estates under

How to fill out trusts and estates under:

01

Gather necessary documents: Start by collecting all relevant documents such as wills, trust agreements, property deeds, insurance policies, and financial statements. These documents will provide essential information for completing the trusts and estates under.

02

Identify assets and liabilities: Make a comprehensive list of all the assets, such as real estate, bank accounts, investments, and personal property, that are included in the trusts and estates under. Similarly, note any outstanding debts or liabilities that should be addressed.

03

Determine beneficiaries: Clearly identify and list the beneficiaries who will receive assets or benefits from the trusts and estates under. This could include family members, friends, charities, or any other designated individuals or organizations.

04

Choose fiduciaries and trustees: Select trustworthy individuals or institutions who will act as fiduciaries or trustees to manage and distribute the assets according to the terms of the trusts and estates under. It is important to consider their competence, reliability, and willingness to fulfill the designated roles.

05

Follow legal requirements: Ensure compliance with all legal requirements and regulations related to trusts and estates. This may involve consulting an attorney or professional familiar with estate planning. Understand the specific laws and regulations in your jurisdiction to avoid mistakes or complications in the future.

06

Review and update regularly: Periodically review and update the trusts and estates under as circumstances change, such as births, deaths, marriages, divorces, or changes in financial situations. Regularly reviewing the trusts and estates under helps ensure that it remains relevant and aligned with your intentions.

Who needs trusts and estates under:

01

Individuals with significant assets: Trusts and estates under are particularly beneficial for individuals with substantial wealth or complex financial situations. They provide a structured plan for managing and distributing assets according to the person's wishes, minimizing tax liabilities, and protecting the assets for future generations.

02

Parents with young children: Trusts and estates under are essential for parents who want to ensure the well-being and financial security of their children in case of unexpected events. They can designate guardians, set up funds for education or living expenses, and establish specific conditions for asset distribution.

03

Business owners: Business owners often utilize trusts and estates under to plan for the succession of their business. They can establish mechanisms for transferring ownership and control, ensure a smooth transition, and minimize potential conflicts among family members or business partners.

04

Individuals with specific charitable intentions: Trusts and estates under provide an opportunity to support charitable organizations and causes that are important to the individual. By establishing charitable trusts, individuals can contribute to philanthropic efforts while also potentially enjoying tax benefits.

Overall, trusts and estates under are valuable tools for individuals who want to protect their assets, manage their wealth, and ensure their wishes are fulfilled after their passing. Consulting with legal and financial professionals can help navigate the complexities and tailor the trusts and estates under to individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is trusts and estates under?

Trusts and estates are typically filed under income tax regulations.

Who is required to file trusts and estates under?

Any individual or entity that has income from a trust or estate is required to file trusts and estates under.

How to fill out trusts and estates under?

Trusts and estates can be filled out by completing the appropriate tax forms and reporting all income and expenses related to the trust or estate.

What is the purpose of trusts and estates under?

The purpose of trusts and estates filing is to report and pay taxes on income generated by trusts and estates.

What information must be reported on trusts and estates under?

Information such as income, deductions, and credits related to the trust or estate must be reported on trusts and estates filing.

How can I get trusts and estates under?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the trusts and estates under in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute trusts and estates under online?

Completing and signing trusts and estates under online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the trusts and estates under electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your trusts and estates under.

Fill out your trusts and estates under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trusts And Estates Under is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.