Get the free REPORT ON CLOSING TRUST ACCOUNT - kansas

Show details

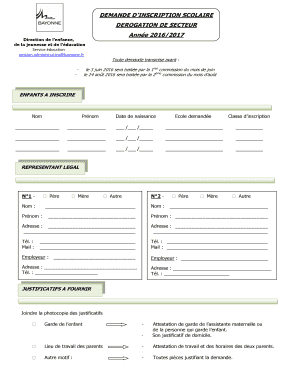

Este formulario debe ser completado por un Corredor Supervisor o Corredor de Sucursal cuando una oficina o empresa cierra y se ha mantenido una cuenta fiduciaria.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report on closing trust

Edit your report on closing trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report on closing trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report on closing trust online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit report on closing trust. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report on closing trust

How to fill out REPORT ON CLOSING TRUST ACCOUNT

01

Gather all relevant financial documents related to the trust account.

02

List all transactions that occurred in the account during its operation.

03

Calculate the final balance of the trust account.

04

Document the reason for closing the account.

05

Complete the form with accurate information about the account holder and trust details.

06

Include signatures from authorized individuals.

07

Submit the report to the appropriate regulatory body or institution as required.

Who needs REPORT ON CLOSING TRUST ACCOUNT?

01

Individuals or organizations that are closing a trust account.

02

Trustees managing the trust accounts.

03

Financial institutions that require official documentation for record-keeping.

Fill

form

: Try Risk Free

People Also Ask about

How to issue a cheque in trust?

Trust checks credit the trust bank account and debit the Client Funds in Trust liability account. Click on Clients & Matters > New transaction > Write Trust Cheques. Select or enter the trust bank account from which this cheque needs to be issued. Select or enter the correct date from the calendar.

What type of bank account is best for a trust?

A Trust checking account makes it easy for your Trustees to pay off debts and distribute inheritances without draining other assets or relying on outside funds. It also makes it easy to track the money going out and its Beneficiaries.

How do I shut down my trust account?

Instead, in most cases, an irrevocable trust can only be dissolved by court order. The details of dissolving an irrevocable trust differ widely between states and jurisdictions. However, typically you will need to get approval from the trust's beneficiaries and potentially its trustees as well.

How can we open a trust account?

General Documentation for opening Savings Account of Trust/NGO Registration Certificate of Trust / Society / Association/ Club. Trust Deed / Bye-laws / Constitutional Document (If unregistered, notarized copy to be obtained) Copy of PAN Card. Income Tax registration u/s 12A for entities as specified in RBI circular.

What is a trust account in English?

A trust account is an account that is held in trust for someone else, such as a minor or an estate. It may be illegal to take money out of a trust account and not use it for the benefit of the beneficiary.

How do I open a trust account?

Open a trust account in just 4 steps A legally established trust with your attorney. A completed trust account application, including personal information of the trustees, the type of trust, the date of the trust, and the trust's tax identification number. Supporting legal trust documents (as detailed below).

What are the three types of trust?

In this blog, we'll explore three different types of trusts: revocable living trusts, irrevocable trusts, and testamentary trusts, so that you can make an informed decision on which trust, or combination of trusts, might best suit your needs.

What is the minimum amount to open a trust?

There is no minimum The help of an attorney is usually required to set one up, and trusts come with costs and complexities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

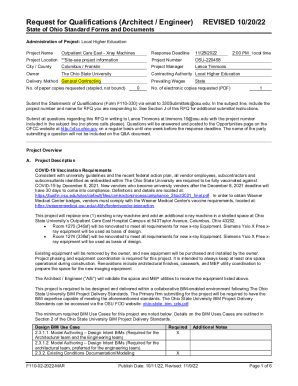

What is REPORT ON CLOSING TRUST ACCOUNT?

A REPORT ON CLOSING TRUST ACCOUNT is a legal document that details the transactions and final balance of a trust account when it is being closed.

Who is required to file REPORT ON CLOSING TRUST ACCOUNT?

Entities or individuals managing trust accounts, such as attorneys or fiduciaries, are required to file a REPORT ON CLOSING TRUST ACCOUNT upon the closure of the account.

How to fill out REPORT ON CLOSING TRUST ACCOUNT?

To fill out a REPORT ON CLOSING TRUST ACCOUNT, one must provide details such as account number, balance details, transaction history, and the reason for closing the account.

What is the purpose of REPORT ON CLOSING TRUST ACCOUNT?

The purpose of a REPORT ON CLOSING TRUST ACCOUNT is to ensure transparency and proper documentation regarding the final status of a trust account to relevant parties or authorities.

What information must be reported on REPORT ON CLOSING TRUST ACCOUNT?

The information that must be reported includes the account holder's details, the closing balance, transaction records, reasons for closure, and any remaining unsettled amounts.

Fill out your report on closing trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report On Closing Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.