Get the free Mortgage - FNF Canada

Show details

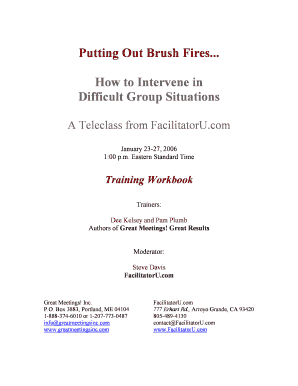

MHC 1002 8/94 Nova Scotia Mortgage Click here to Check for Common Errors before you Print Mortgage This Indenture made (in duplicate) the Reference: day of Two Thousand and IN PURSUANCE OF THE ACT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage - fnf canada

Edit your mortgage - fnf canada form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage - fnf canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage - fnf canada online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage - fnf canada. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage - fnf canada

How to fill out mortgage - FNF Canada:

01

Gather necessary documents: Before starting the mortgage application process with FNF Canada, gather all the required documents such as proof of income, employment details, identification documents, bank statements, and any other required financial information.

02

Research mortgage options: Familiarize yourself with the different types of mortgage options offered by FNF Canada. Understand the terms, interest rates, repayment plans, and eligibility criteria for each type of mortgage. This will help you make an informed decision and choose the most suitable mortgage for your needs.

03

Complete the application form: FNF Canada provides an online application form that can be filled out conveniently from your computer or smartphone. Provide accurate information regarding your personal details, employment history, income, and financial situation. Make sure to double-check all the information before submitting the form.

04

Submit supporting documents: Along with the application form, you will need to submit the required supporting documents. These may include tax returns, pay stubs, bank statements, employment letters, and any other documents requested by FNF Canada. Ensure that all the documents are complete and organized to avoid delays in the processing of your mortgage application.

05

Review and sign the mortgage agreement: Once your application is reviewed and approved by FNF Canada, you will receive a mortgage agreement to sign. Read the agreement carefully, understand the terms and conditions, and seek legal advice if necessary. After thoroughly reviewing the agreement, sign it and submit it back to FNF Canada.

06

Complete the closing process: After the mortgage agreement is signed, you will need to complete the closing process, which involves various financial and legal steps. This may include a final review of your financial documents, property appraisal, title search, and obtaining insurance. FNF Canada will guide you through this process to ensure a smooth and timely closing.

07

Make mortgage payments: Once the mortgage is approved and closed, it's important to make regular mortgage payments as per the agreed terms. FNF Canada will provide you with the necessary information and instructions on how to make your mortgage payments. Stay organized and ensure timely payments to maintain a good financial standing.

Who needs mortgage - FNF Canada:

01

Homebuyers: Individuals or families who are looking to purchase a property in Canada may need a mortgage from FNF Canada. Buying a home is a significant financial investment, and a mortgage can help spread out the cost of homeownership over time.

02

Real estate investors: Investors who are interested in purchasing income-generating properties, such as rental properties or commercial buildings, may require a mortgage to finance their real estate investments. FNF Canada offers mortgage solutions for both residential and commercial properties.

03

Mortgage refinancers: Homeowners who want to refinance their existing mortgage to take advantage of lower interest rates, change their loan term, or access equity in their property may turn to FNF Canada for refinancing options.

Overall, anyone who intends to purchase a property or explore mortgage financing options in Canada can benefit from the services provided by FNF Canada.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage - fnf canada?

Mortgage - fnf canada is a financial service company that provides mortgage solutions in Canada.

Who is required to file mortgage - fnf canada?

Individuals or entities seeking to obtain a mortgage from fnf canada are required to file.

How to fill out mortgage - fnf canada?

To fill out a mortgage application with fnf canada, you must provide personal and financial information as requested.

What is the purpose of mortgage - fnf canada?

The purpose of a mortgage from fnf canada is to secure financing for the purchase of a home or property.

What information must be reported on mortgage - fnf canada?

Information such as income, assets, debts, and credit history must be reported on a mortgage application with fnf canada.

How do I edit mortgage - fnf canada online?

With pdfFiller, the editing process is straightforward. Open your mortgage - fnf canada in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the mortgage - fnf canada in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your mortgage - fnf canada and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete mortgage - fnf canada on an Android device?

On Android, use the pdfFiller mobile app to finish your mortgage - fnf canada. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your mortgage - fnf canada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage - Fnf Canada is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.