Get the free SURETY BOND - mepcocompk

Show details

SURETY BOND (To be executed on Nonjudicial Stamped Paper of the value of Rs. 100/) (Which must be obtained from Multan). Whereas Mr/Miss/Mrs. Son/Daughter/Wife of has been selected as or/for training,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond - mepcocompk

Edit your surety bond - mepcocompk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond - mepcocompk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

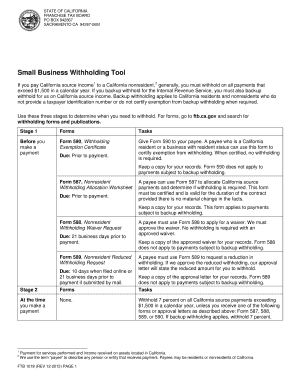

Editing surety bond - mepcocompk online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surety bond - mepcocompk. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

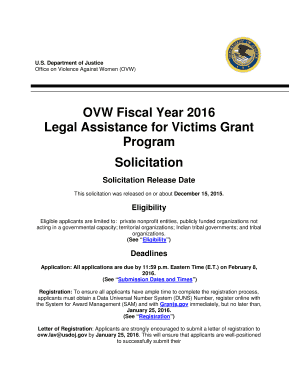

How to fill out surety bond - mepcocompk

How to fill out surety bond - mepcocompk?

01

Start by obtaining the necessary documents: Make sure you have all the required forms and applications for filling out the surety bond. These documents can usually be found on the website or office of mepcocompk.

02

Provide the required information: Fill in all the necessary details such as your personal information, business details, and any other information requested on the form. Be sure to double-check the accuracy of the information provided before submitting the form.

03

Attach any required documentation: In some cases, you may need to provide additional documentation along with your surety bond application. This can include financial statements, project plans, or any other supporting documents that may be required. Make sure you have these documents ready and attach them to your application as instructed.

04

Determine the bond amount: The next step is to determine the bond amount. This will depend on the specific requirements of mepcocompk and the nature of your business or project. It is important to accurately calculate the bond amount to ensure you meet the necessary obligations.

05

Pay the bond premium: Once you have completed the application and provided all necessary information and documentation, you will be required to pay the bond premium. The premium is typically a percentage of the bond amount and serves as a fee for the surety bond coverage.

06

Submit the application: After completing all the above steps, carefully review your application for any errors or omissions. Once you are satisfied with the accuracy of the information provided, submit the application along with the required payment. It is advisable to retain a copy of the application for your records.

Who needs surety bond - mepcocompk?

01

Contractors: Contractors involved in construction projects may need to obtain a surety bond to provide financial protection to project owners. This helps ensure that the contractor fulfills their contractual obligations and pays any subcontractors, suppliers, or laborers involved in the project.

02

Businesses requiring licenses or permits: Certain businesses, such as those in the financial services industry or auto dealerships, may be required by regulatory bodies to obtain a surety bond as a condition for obtaining licenses or permits. This helps protect consumers from potential financial losses or fraudulent activities.

03

Government contractors: Companies or individuals contracting with government agencies, whether at the federal, state, or local level, are often required to provide surety bonds. This ensures that the contractor will perform the work as specified in the contract and covers any financial losses incurred by the government in case of default.

04

Court proceedings: Surety bonds are also commonly used in legal settings. For example, individuals going through a court proceeding may be required to obtain a surety bond to secure their appearance in court or to guarantee payment of a judgment.

05

Other specific industries: Certain industries, such as transportation, healthcare, or insurance, may have specific bonding requirements. For instance, freight brokers need a surety bond to ensure payment to motor carriers, while healthcare providers may be required to obtain a bond as protection against fraudulent activities.

In conclusion, anyone who falls into the above categories or is required by mepcocompk to obtain a surety bond should consider their specific obligations and follow the outlined steps to fill out the surety bond application accurately and timely.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is surety bond - mepcocompk?

A surety bond is a legally binding contract among three parties: the principal (the person or entity purchasing the bond), the obligee (the party requesting the bond), and the surety (the company issuing the bond). It guarantees that the principal will fulfill their obligations to the obligee.

Who is required to file surety bond - mepcocompk?

Any individual or business entity that is required by law or regulation to provide a surety bond may need to file one, such as contractors, licensees, or government agencies.

How to fill out surety bond - mepcocompk?

To fill out a surety bond, the principal must contact a surety bond company or agent, complete an application, provide required documentation, and pay a premium based on the bond amount and risk.

What is the purpose of surety bond - mepcocompk?

The purpose of a surety bond is to protect the obligee (the party requesting the bond) from financial loss if the principal (the party purchasing the bond) fails to fulfill their obligations.

What information must be reported on surety bond - mepcocompk?

The information required on a surety bond may include the bond amount, term, names of the principal and obligee, details of the obligation being guaranteed, and any necessary signatures.

How can I edit surety bond - mepcocompk from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your surety bond - mepcocompk into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the surety bond - mepcocompk in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your surety bond - mepcocompk directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit surety bond - mepcocompk on an Android device?

You can make any changes to PDF files, like surety bond - mepcocompk, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your surety bond - mepcocompk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond - Mepcocompk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.