Get the free APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE

Show details

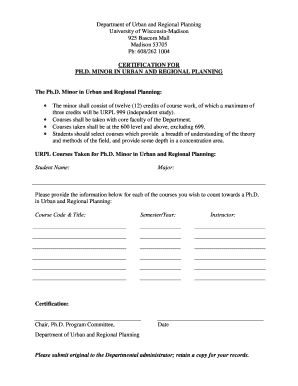

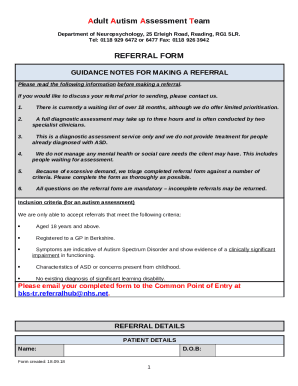

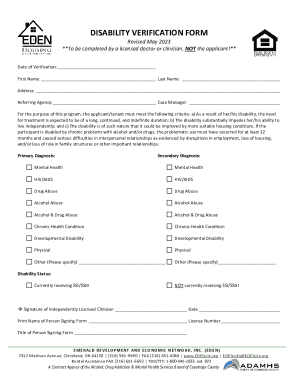

This document is an application for a sales/use tax exemption for incorporated nonprofit national scouting organizations. It requires information about the organization and includes certifications

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for saleuse tax

Edit your application for saleuse tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for saleuse tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for saleuse tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for saleuse tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for saleuse tax

How to fill out APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE

01

Obtain the APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE form from your local tax authority or their website.

02

Fill in your legal name or the name of your organization in the designated section.

03

Provide your address and contact information as requested on the form.

04

Indicate the reason for the exemption, such as nonprofit status or specific purchases that qualify for exemption.

05

List the items or types of services for which you are requesting the exemption.

06

Include any applicable identification numbers, such as your federal tax ID or state tax ID, if required.

07

Review the completed form for accuracy and ensure all necessary sections are filled out.

08

Sign and date the application, confirming that the information provided is true and correct.

Who needs APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

01

Nonprofit organizations that make qualifying purchases for their exempt purposes.

02

Educational institutions seeking to purchase materials or services without sales tax.

03

Government entities that are exempt from sales tax for certain purchases.

04

Businesses purchasing items for resale or for manufacturing that qualify for exemption.

Fill

form

: Try Risk Free

People Also Ask about

How to create an exemption certificate?

Step-by-Step: How to Get a Tax Exemption Certificate from FBR Using IRIS. To how to get tax exemption certificate from fbr, log into your IRIS account, navigate to the “Exemptions” section, choose your exemption type (e.g., exemption under Section 159), attach the required documents, and submit the application.

What is an exemption certificate?

Exemption Certificate Definition An exemption certificate is a document that grants an individual or organization relief from certain taxes or fees. These certificates are usually issued by a state agency and are meant to provide a financial break for those who meet certain criteria.

How do you get an exemption certificate?

You can apply for a medical exemption certificate (MedEx) if you have one of the medical conditions listed here. To apply, your doctor should provide you with an application form. If you're not sure about the name of your condition, speak to your doctor.

What is an example of an exemption?

Children are exemptions, or deductions, on tax forms; the more children you have the less taxes you pay. Some non-profits are tax-exempt; their exemption means they pay no taxes at all. Exemptions also spare people from fighting in wars and doing some jobs. An exemption gets you off the hook.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

The APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE is a document used by organizations or individuals to claim exemption from sales or use tax on specific purchases, based on eligibility criteria set by tax authorities.

Who is required to file APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

Typically, nonprofit organizations, government agencies, and certain educational institutions are required to file this application to obtain tax-exempt status for relevant purchases.

How to fill out APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

To fill out the application, provide the organization's name, address, tax identification number, and details of the purchase for which tax exemption is requested, along with a signature and date.

What is the purpose of APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

The purpose of the application is to facilitate the legal exemption from sales or use tax for qualifying purchases, thereby supporting organizations that serve the public interest.

What information must be reported on APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE?

The information that must be reported includes the purchaser's name and address, the type of exemption being claimed, reason for the exemption, purchase details, and any identification or tax number assigned by the tax authority.

Fill out your application for saleuse tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Saleuse Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.