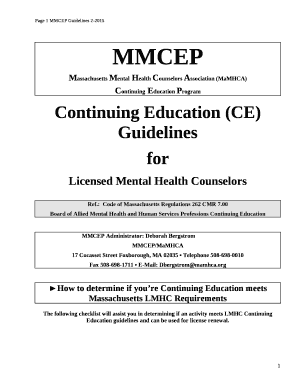

Get the free STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES

Show details

This document serves as a disclosure statement for executive employees to report sources of income, liabilities, gifts, and other relevant financial information for the reporting year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of sources of

Edit your statement of sources of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of sources of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing statement of sources of online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit statement of sources of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of sources of

How to fill out STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES

01

Start with the title: 'STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES'.

02

Provide your full name and contact information at the top of the document.

03

List your current job title and the name of your employer.

04

Declare your salary: include your base salary, bonuses, and any other regular compensation.

05

Add any additional sources of income: such as investments, rental income, or freelance work.

06

Provide detailed breakdowns for each source of income with appropriate documentation, if required.

07

Sign and date the statement at the bottom to verify accuracy.

08

Review the completed form for any mistakes or missing information before submission.

Who needs STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

01

Executives applying for a loan or mortgage.

02

Financial institutions requiring proof of income for credit assessment.

03

Tax authorities seeking verification of income sources.

04

Employers conducting background checks or verifying other income disclosures.

Fill

form

: Try Risk Free

People Also Ask about

What is the income statement in English?

An income statement is a financial statement that shows you the company's income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

What are the 5 major accounts in financial statements?

These can include asset, expense, income, liability and equity accounts. You may use each account for a different purpose and maintain them on your financial ledger or balance sheet continuously.

How do you format an income statement?

Because of the guidelines in generally accepted accounting principles (GAAP), which publicly traded companies must follow, traditional income statements typically use the following format: Sales/revenue. Cost of goods sold (COGS) Gross profit. Selling, general, and administrative expenses (SG&A) Operating profit/income.

How do I prepare an income statement?

7 Steps to prepare an income statement Calculate the total revenue for the chosen period. Calculate the expenses and the Cost of Goods Sold (COGS) Calculate gross profits. Include operating expenses. Determine earnings before taxes. Include income taxes. Calculate net income.

How to prepare an income statement step by step?

Steps to Prepare an Income Statement Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine the Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income. Include Income Taxes.

What are the 5 basic financial statements with examples?

The 5 types of financial statements you need to know Income statement. Arguably the most important. Cash flow statement. Balance sheet. Note to Financial Statements. Statement of change in equity.

How do you write a source of income letter?

How to write a Proof of Income Letter Add employer and employee names. As the employer, start by providing your name. Provide the employee's work details. Next, include the employee's work details. Add recipient details. Continue by specifying who is receiving the Proof of Income Letter. Provide employer details.

How do you do income statements?

There are several steps to completing an Income Statement. These include choosing an accounting period, generating a Trial Balance, determining revenues, calculating COGS, calculating Gross Margin, reporting operating expenses, determining operating income, adjusting income taxes, and calculating Net Income.

What are the 5 financial statements with examples?

Typically, a set of accounts consists of five elements: Statement of financial position (balance sheet); Statement of income and expense (profit and loss account); Statement of cash flows (cash flow statement); Statement of changes in equity; and. Notes to the accounts.

How do I calculate an income statement?

It's calculated as follows: Gross profit = Revenue – Cost of goods sold (or cost of sales/cost of services) Operating income = Gross profit – Operating expenses. EBT = Revenue – (Interest and amortization + Non-operating items) Net income = EBT – Income taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

The Statement of Sources of Income for Executive Employees is a document that outlines the various sources of income earned by executives within a company, including salaries, bonuses, stock options, and other forms of compensation.

Who is required to file STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

Executive employees, such as CEOs, CFOs, and other high-level management personnel, are typically required to file this statement to ensure transparency and compliance with financial regulations.

How to fill out STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

To fill out the statement, executives should gather all relevant financial information about their income sources, categorize them accordingly, and accurately report each source along with the corresponding amounts in the provided sections of the form.

What is the purpose of STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

The purpose of this statement is to provide a clear and detailed account of an executive's income sources, facilitating transparency for stakeholders, regulatory compliance, and assessment of potential conflicts of interest.

What information must be reported on STATEMENT OF SOURCES OF INCOME FOR EXECUTIVE EMPLOYEES?

The information that must be reported includes various income sources such as base salary, bonuses, benefits, stock options, and any other financial compensation received, as well as any external income from other employment or investments.

Fill out your statement of sources of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Sources Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.