Get the free Electronic Filing Developer - Private Information

Show details

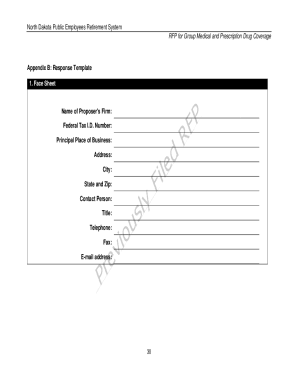

This document is intended for software developers to complete necessary information about their software product for electronic filing purposes, including identification numbers and contact information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic filing developer

Edit your electronic filing developer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic filing developer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit electronic filing developer online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit electronic filing developer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electronic filing developer

How to fill out Electronic Filing Developer - Private Information

01

Open the Electronic Filing Developer application.

02

Navigate to the Private Information section.

03

Enter your first name in the designated field.

04

Enter your last name in the designated field.

05

Provide your Social Security Number (SSN) or an equivalent tax identification number.

06

Fill in your date of birth in the required format.

07

Input your home address including street, city, state, and ZIP code.

08

Enter your email address for further communication.

09

Review all entered information for accuracy.

10

Click 'Submit' to complete the filing process.

Who needs Electronic Filing Developer - Private Information?

01

Tax professionals who prepare electronic tax filings for clients.

02

Companies that provide electronic filing services.

03

Individuals who need to file their taxes electronically.

04

Software developers working on tax-related applications.

Fill

form

: Try Risk Free

People Also Ask about

How many days to fix an e-file rejection?

If your return is rejected, you have until the later of either the filing deadline OR five days after the last rejection notice to resubmit your return and have it accepted before the IRS will assess late fees (if rejected on 4/15, this would give you until 4/20).

Why does my e-file keep getting rejected?

Key Takeaways. Make sure your name matches your Social Security number on tax forms to avoid e-file rejections. Double-check that your dependents' full names and SSNs match IRS records. If you claim a dependent already claimed on another return, or you'll need to resolve it with the IRS.

How long does it take to fix an e-file rejection?

In fact, depending on the type of error and if it is a minor problem, you may be able to resubmit in a matter of minutes. Taxpayers are provided 10 days (calendar not work week) to correct rejected returns. If you are concerned about a notice received close to or after the tax deadline, do not worry.

How long does it take to process return after e-verification?

Refund processing by the tax department starts only after the return is e-verified by the taxpayer. Usually, it takes 4-5 weeks for the refund to be credited to the account of the taxpayer.

What is the IRS electronic filing authorization form?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used.

How long does it take to become an IRS e-file provider?

It can take up to 45 days from the date of submission for the IRS to approve an application. Once an application is approved, the IRS sends an acceptance letter in the mail with the preparer's Electronic Filing Identification number.

How long does it take for an e-file to be accepted?

From e-filing to IRS acceptance Once you've taken the step to e-file your tax return, the IRS typically doesn't keep you waiting too long. Within 24 to 48 hours, you'll usually get a notice that the IRS has accepted your return. But what goes on during that time?

Who signs as the ERO on a tax return?

An ERO is an IRS-approved provider that originates the submission of electronic returns. An ERO can be the same person or entity as the preparer or they can be different. The person filing electronic returns using UltraTax CS is the ERO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Electronic Filing Developer - Private Information?

Electronic Filing Developer - Private Information refers to a system or method used to submit sensitive personal information electronically to tax authorities or other regulatory bodies, ensuring secure and efficient processing.

Who is required to file Electronic Filing Developer - Private Information?

Individuals and entities that are mandated by law to disclose private information, such as tax filers, businesses, and organizations handling personal data, are required to file Electronic Filing Developer - Private Information.

How to fill out Electronic Filing Developer - Private Information?

To fill out Electronic Filing Developer - Private Information, individuals must gather required data, access the electronic filing system, complete the necessary forms, and submit them electronically, ensuring all information is accurate and complete.

What is the purpose of Electronic Filing Developer - Private Information?

The purpose of Electronic Filing Developer - Private Information is to facilitate the secure electronic submission of personal data for compliance with regulatory requirements, improving efficiency in data processing and enhancing data security.

What information must be reported on Electronic Filing Developer - Private Information?

Information that must be reported on Electronic Filing Developer - Private Information typically includes personal identification details, income information, tax filings, and any other data requested by regulatory authorities.

Fill out your electronic filing developer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Filing Developer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.