Get the free Automatic Payment Plan - mySBLI

Show details

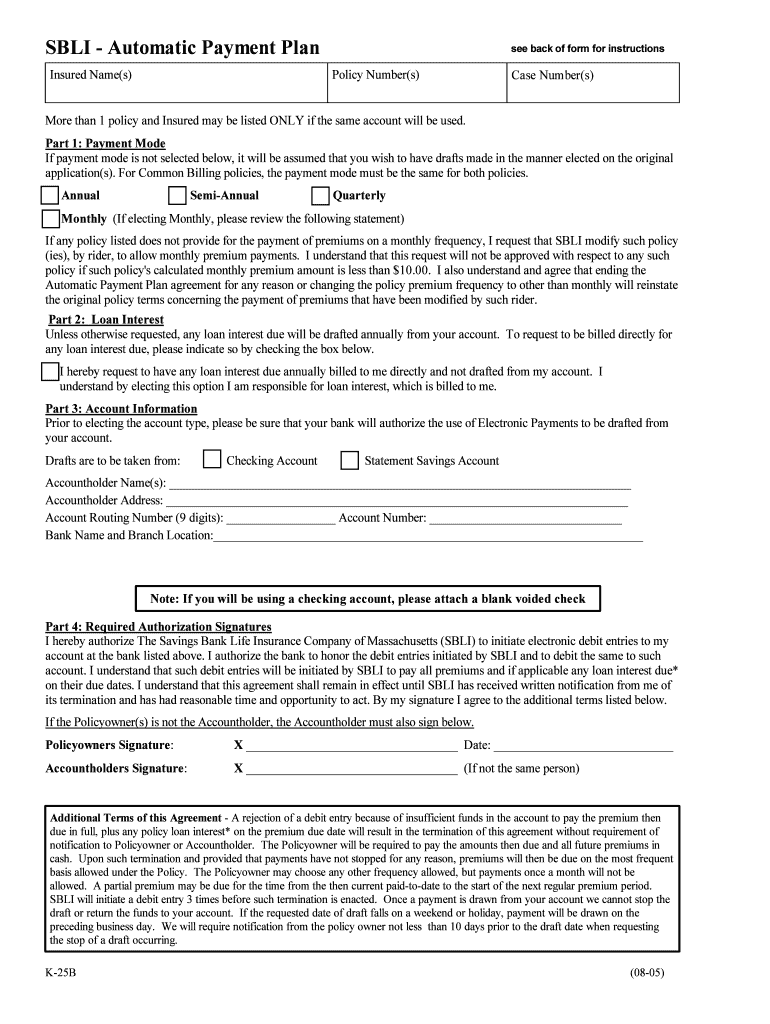

SBI Automatic Payment Plan Insured Name(s) see back of form for instructions Policy Number(s) Case Number(s) More than 1 policy and Insured may be listed ONLY if the same account will be used. Part

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic payment plan

Edit your automatic payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic payment plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit automatic payment plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic payment plan

How to Fill Out Automatic Payment Plan:

01

Begin by contacting your service provider or financial institution to inquire about setting up an automatic payment plan. They will guide you through the necessary steps.

02

Gather the required information, which typically includes your account details, payment method, and any relevant identification or authorization documents.

03

Make sure you have sufficient funds in your chosen payment account to cover the automatic payments.

04

Provide the necessary information to your service provider or financial institution, either by filling out a paper form or through an online portal.

05

Carefully review the terms and conditions of the automatic payment plan, including the frequency and amount of payments, any applicable fees, and the duration of the plan.

06

Sign any necessary agreements or authorize the automatic payments electronically.

07

Double-check all the provided information for accuracy and completeness before submitting the documentation.

08

If required by your service provider or financial institution, wait for confirmation or approval of your automatic payment plan.

09

Monitor your account statements regularly to ensure that payments are being deducted as expected and that you have sufficient funds available to cover them.

10

Update or modify your automatic payment plan as needed if there are any changes to your payment account or personal information.

Who Needs an Automatic Payment Plan:

01

Individuals who have regular monthly expenses, such as utility bills, mortgage or rent payments, insurance premiums, or subscription services, may find an automatic payment plan convenient.

02

People who frequently forget to make manual payments or have a busy lifestyle that makes it challenging to stay on top of bill payments may benefit from an automatic payment plan.

03

Individuals who want to ensure timely payments and avoid late payment fees or negative impacts on their credit score may opt for an automatic payment plan.

04

Those who prefer the convenience and ease of having payments automatically deducted from their accounts, saving them time and effort in managing various bill payments, may prefer an automatic payment plan.

05

Individuals who want to maintain good financial discipline by regularly setting aside funds for bill payments may choose to use an automatic payment plan to ensure consistent payments.

Remember, it is essential to evaluate your personal financial situation and preferences before deciding if an automatic payment plan is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit automatic payment plan in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your automatic payment plan, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit automatic payment plan on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing automatic payment plan right away.

Can I edit automatic payment plan on an Android device?

You can edit, sign, and distribute automatic payment plan on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is automatic payment plan?

An automatic payment plan is a system that allows for recurring payments to be made automatically on a scheduled basis.

Who is required to file automatic payment plan?

Anyone who wants to make regular payments without the hassle of manual transactions can benefit from using an automatic payment plan.

How to fill out automatic payment plan?

To set up an automatic payment plan, you will need to provide your payment information and select the frequency and amount of the payments.

What is the purpose of automatic payment plan?

The purpose of an automatic payment plan is to streamline the payment process and ensure that payments are made on time without the need for manual intervention.

What information must be reported on automatic payment plan?

The information required for an automatic payment plan typically includes the payment amount, frequency, start date, and bank account information.

Fill out your automatic payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.