Get the free State of Tennessee 401(k) Plan - jscc

Show details

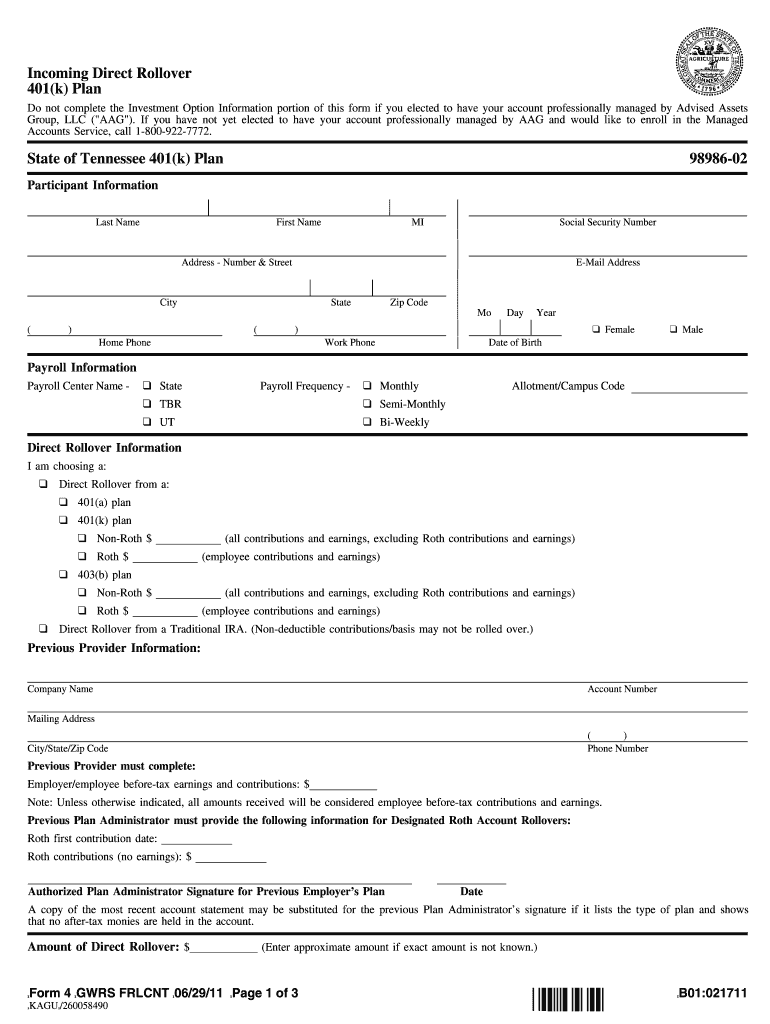

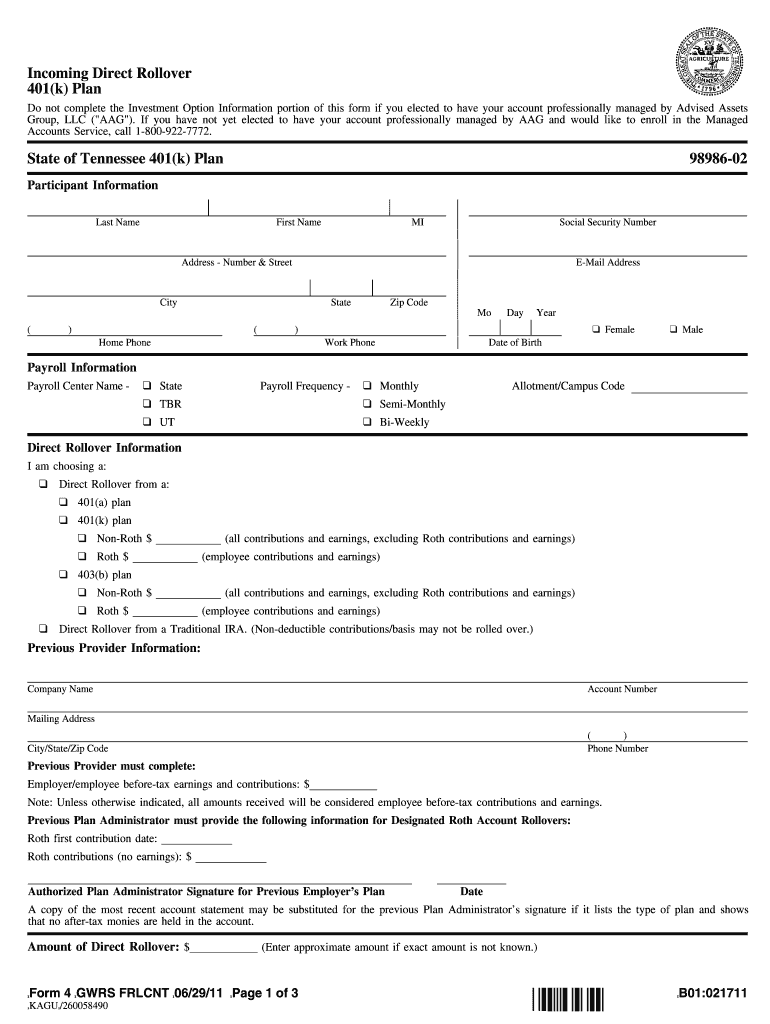

Incoming Direct Rollover 401(k) Plan State of Tennessee 401(k) Plan Participant Information 9898602 Do not complete the Investment Option Information portion of this form if you elected to have your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of tennessee 401k

Edit your state of tennessee 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of tennessee 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of tennessee 401k online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state of tennessee 401k. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state of tennessee 401k

How to fill out state of Tennessee 401k?

01

Gather necessary information: Start by collecting all the required documents and information needed to fill out the state of Tennessee 401k form. This may include your personal identification details, employment history, financial information, and any additional supporting documentation.

02

Review the instructions: Carefully read through the instructions provided with the state of Tennessee 401k form. This will help you understand the specific requirements, eligibility criteria, and the proper way to complete the form.

03

Provide personal details: Begin by filling out your personal information such as your name, address, social security number, and contact details. Ensure that all the information provided is accurate and up-to-date.

04

Employment details: Fill in the required information regarding your current and past employers. Include details such as the employer's name, address, contact information, and the dates of your employment. Be thorough and ensure all the information is complete and correct.

05

Contribution details: Indicate the contribution amount you wish to make to your state of Tennessee 401k account. This detail may vary depending on your desired contribution percentage or a fixed dollar amount. Follow the instructions provided to accurately indicate your contribution preferences.

06

Investment selection: If given the option, select the investment options that align with your financial goals and risk tolerance. Follow the instructions provided to indicate your investment choices or seek professional advice if needed.

07

Beneficiary designation: Designate the beneficiaries who will receive your state of Tennessee 401k assets in the event of your passing. Provide their names, relationship to you, and their contact details. It's important to periodically review and update your beneficiary designations as your circumstances change.

Who needs a state of Tennessee 401k?

01

Employees: Any employed individual who wishes to save for retirement and take advantage of potential tax benefits may opt for a state of Tennessee 401k plan. It is a voluntary retirement savings plan that allows employees to contribute a portion of their income towards retirement savings, often with matching contributions from their employer.

02

Self-employed individuals: Self-employed individuals may also choose to open a state of Tennessee 401k plan for their retirement savings. It offers them the opportunity to save for retirement while potentially reducing their taxable income.

03

Small business owners: Small business owners who have employees can set up a state of Tennessee 401k plan for their workforce. This not only helps attract and retain talented employees, but also provides a tax-advantaged way for both the employer and employees to save for retirement.

Note: It's advisable to consult with a financial advisor or retirement specialist to determine if a state of Tennessee 401k plan is the right retirement savings option for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit state of tennessee 401k straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing state of tennessee 401k, you need to install and log in to the app.

How do I edit state of tennessee 401k on an iOS device?

You certainly can. You can quickly edit, distribute, and sign state of tennessee 401k on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete state of tennessee 401k on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your state of tennessee 401k, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is state of tennessee 401k?

The State of Tennessee 401k is a retirement savings plan offered to employees of the state of Tennessee.

Who is required to file state of tennessee 401k?

Employees who participate in the state of Tennessee 401k plan are required to file.

How to fill out state of tennessee 401k?

To fill out the state of Tennessee 401k, employees need to provide information about their contributions, investments, and beneficiary details.

What is the purpose of state of tennessee 401k?

The purpose of the state of Tennessee 401k is to help employees save for retirement and take advantage of tax benefits.

What information must be reported on state of tennessee 401k?

Information such as contribution amounts, investments made, and beneficiary details must be reported on the state of Tennessee 401k.

Fill out your state of tennessee 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Tennessee 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.