Get the free JOBS AND INVESTMENT TAX CREDIT WORKSHEET

Show details

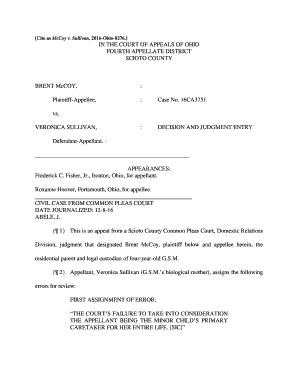

This worksheet is used to calculate the Jobs and Investment Tax Credit for eligible investments made in Maine for the tax year 2009, detailing the investment qualifications and credit computation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign jobs and investment tax

Edit your jobs and investment tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your jobs and investment tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing jobs and investment tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit jobs and investment tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out jobs and investment tax

How to fill out JOBS AND INVESTMENT TAX CREDIT WORKSHEET

01

Step 1: Gather all necessary financial documents related to job creation and investment.

02

Step 2: Review the eligibility requirements to ensure your business qualifies for the tax credit.

03

Step 3: Complete the identification section of the worksheet with your business information.

04

Step 4: Fill out the job creation section, detailing the number of jobs created and the wages offered.

05

Step 5: Provide information about the investments made, including dates and amounts.

06

Step 6: Calculate the total credit amount based on your inputs using the provided formulas.

07

Step 7: Double-check all entries for accuracy and completeness.

08

Step 8: Sign and date the worksheet before submission.

Who needs JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

01

Businesses that have created new jobs and made qualified investments seeking to claim tax credits.

02

Employers looking to reduce their tax liability through incentives offered by the government.

03

Companies expanding their operations and needing to document job creation and investment for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the investment tax credits?

When to Use Investment Tax Credits. Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

How to calculate Gilti foreign tax credit?

GILTI tax formula GILTI = Net CFC Tested Income – (10% x QBAI – Interest Expense) Tested income: The gross income (or loss) of a CFC as if the CFC were a U.S. person, minus: QBAI: Qualified business asset investment. Interest expense: Certain business expenses associated with those assets used to calculate QBAI.

Where can I find the T1 worksheet?

The T1 General Tax Form is a comprehensive summary of your financial activities and obligations for a specific tax year in Canada. To obtain your copy of the T1 Tax Form, visit the CRA website or log in to your TurboTax account if you filed through our platform.

What is my foreign tax credit?

The foreign tax credit is a U.S. tax credit for income tax paid to other countries. The general objective is to help taxpayers avoid double taxation on foreign income. Taxpayers can deduct the foreign income tax they paid or claim those taxes as a foreign tax credit.

What is the formula for foreign tax credit?

Your foreign tax credit cannot be more than your total U.S. tax liability multiplied by a fraction. The numerator of the fraction is your taxable income from sources outside the United States. The denominator is your total taxable income from U.S. and foreign sources.

What is a T2038?

T2038. General information Use this form if: you want to earn an investment tax credit (ITC) for the current tax year. you are claiming a carryforward of an ITC from a previous year. you have a recapture of an ITC on a scientific research and experimental development (SR&ED) expenditure.

How is foreign withholding tax calculated?

The U.S. withholding tax rate charged to foreign investors on U.S. dividends is 30%, but this amount is generally reduced to 15% for taxable Canadian investors by a tax treaty between the U.S. and Canada. 1. Source: MSCI, BlackRock, as of August 31, 2024.

How to calculate your foreign tax credit?

The Foreign Tax Credit limit The credit's limit is calculated by multiplying the total U.S. tax liability by a fraction where the numerator of the fraction is your client's taxable income only from foreign sources and the denominator is their total taxable income from both the U.S. and foreign sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

The JOBS AND INVESTMENT TAX CREDIT WORKSHEET is a form used by businesses to calculate and claim tax credits related to job creation and investments in certain activities or areas.

Who is required to file JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

Businesses that meet specific criteria related to job creation or capital investment in eligible locations or sectors are required to file the JOBS AND INVESTMENT TAX CREDIT WORKSHEET.

How to fill out JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

To fill out the JOBS AND INVESTMENT TAX CREDIT WORKSHEET, businesses should gather relevant financial and employment data, follow the instructions provided on the form, and ensure all calculations for tax credits are correctly completed.

What is the purpose of JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

The purpose of the JOBS AND INVESTMENT TAX CREDIT WORKSHEET is to provide a systematic way for businesses to report eligible investments and job creation, thereby qualifying for tax relief that incentivizes economic growth.

What information must be reported on JOBS AND INVESTMENT TAX CREDIT WORKSHEET?

Information that must be reported includes the number of new jobs created, the amount of investment made, the types of eligible activities, and any other data necessary to calculate the tax credit accurately.

Fill out your jobs and investment tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Jobs And Investment Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.