NY SW 4.1 2013 free printable template

Show details

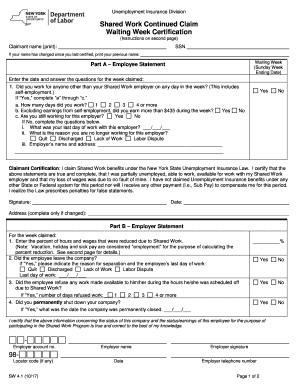

New York State Department of Labor Unemployment Insurance Division Shared Work Continued Claim: Waiting Week Certification (Instructions on second page) Claimant name (print): SSN If your name has

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY SW 41

Edit your NY SW 41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY SW 41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY SW 41 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY SW 41. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY SW 4.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY SW 41

How to fill out NY SW 4.1

01

Obtain the NY SW 4.1 form from the official New York State website or your local tax office.

02

Carefully read the instructions at the top of the form to understand the requirements.

03

Fill in your personal information, including your name, address, and Social Security number in the designated fields.

04

Complete the income section by providing details about your total income for the period required.

05

If applicable, detail any deductions or credits you are claiming.

06

Review the information for accuracy and ensure there are no missing sections.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate tax office as specified in the instructions.

Who needs NY SW 4.1?

01

Individuals filing their state taxes in New York must fill out the NY SW 4.1 form.

02

Residents claiming certain tax credits or deductions that require this specific form.

03

Taxpayers who have received a notice from the state requesting additional information related to their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the best time to call EDD disability?

Hours: 8 a.m. to 5 p.m. (Pacific time), Monday through Friday, except on state holidays. Note: Monday morning before 10 a.m. is our busiest call time, so we recommend calling at other times.

What is the phone number for short-term disability in California?

Call our toll-free telephone number 1-800-772-1213. If you are deaf or hard of hearing, you can call us at TTY 1-800-325-0778.

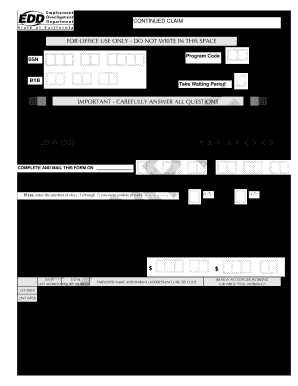

What is paper continued form DE 4581?

An insert periodically mailed with the Continued Claim Form (DE 4581) to remind claimants to report work and wages when collecting Unemployment Insurance benefits. Also, advises claimants that EDD uses the California Department of Child Support Services (DCSS) data to ensure work and wages are properly reported.

What is the best time to call disability?

Wait times to speak to a representative are typically shorter early in the day (between 8 a.m. and 10 a.m. local time) or later in the afternoon (between 4 p.m. and 7 p.m. local time).

How do I extend my temporary disability in NJ?

You can only extend or end a claim online if you received a Form P30 (Request to Claimant For Continued Claim Information) in the mail. It has a unique Form ID number you will need to enter into the online system. This form is mailed only when your benefit payments are about to stop.

Does CA EDD send text messages?

To better serve our customers, the EDD offers an SMS text notification option for people to receive updates about their unemployment insurance claim. With this service, you'll receive a text alert when: Your claim is processed in our systems. Your first benefit payment is issued on your claim.

Does disability pay more than unemployment in California?

If you're out of work and disabled, it's generally a good idea to apply for SDI benefits before applying for Unemployment Insurance. SDI can give you a larger benefit for a longer period of time than UI. You can't get UI and SDI at the same time.

What qualifies for permanent disability in California?

Permanent disability (PD) is any lasting disability from your work injury or illness that affects your ability to earn a living. If your injury or illness results in PD you are entitled to PD benefits, even if you are able to go back to work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NY SW 41 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NY SW 41 in seconds.

How do I fill out NY SW 41 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY SW 41 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete NY SW 41 on an Android device?

Use the pdfFiller app for Android to finish your NY SW 41. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY SW 41?

NY SW 41 is a tax form used in New York State for reporting withholding tax information for non-resident independent contractors.

Who is required to file NY SW 41?

Employers or businesses that pay non-resident independent contractors in New York State are required to file NY SW 41.

How to fill out NY SW 41?

To fill out NY SW 41, gather the necessary information such as the contractor's name, address, Social Security number or EIN, payment amounts, and complete the form according to the instructions provided by the New York State Department of Taxation.

What is the purpose of NY SW 41?

The purpose of NY SW 41 is to report the withholding taxes deducted from payments made to non-resident independent contractors to ensure compliance with New York tax laws.

What information must be reported on NY SW 41?

Information that must be reported on NY SW 41 includes the contractor's identification information, amount paid, amount withheld for tax, and any relevant details about the payments made.

Fill out your NY SW 41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY SW 41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.