Get the free ESTATE OF ANTHONY J - ustaxcourt

Show details

T.C. Memo. 2006-183 UNITED STATES TAX COURT ESTATE OF ANTHONY J. TAMILS, DECEASED, WANDA ROGERSON, EXECUTOR AND TRUSTEE, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 20721-03.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate of anthony j

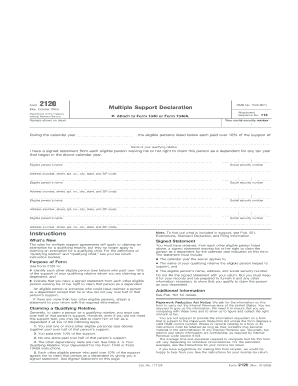

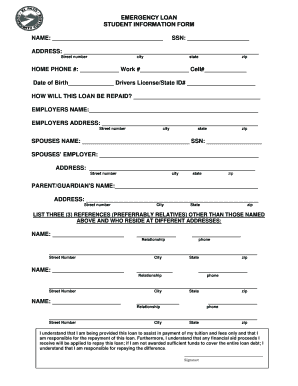

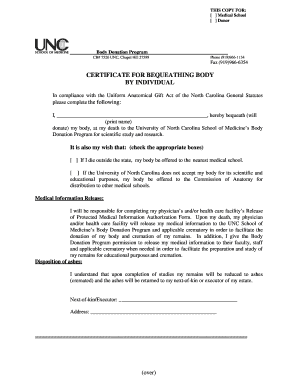

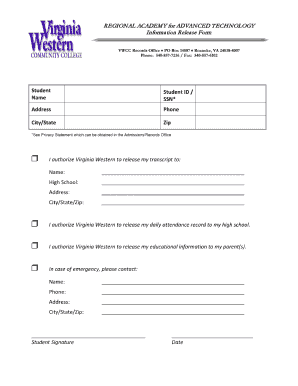

Edit your estate of anthony j form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate of anthony j form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate of anthony j online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estate of anthony j. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate of anthony j

01

Gather Important Documents: Start by collecting all the necessary documents related to Anthony J's estate, including wills, trust agreements, insurance policies, bank statements, property titles, and any other relevant paperwork.

02

Identify Beneficiaries: Determine the beneficiaries mentioned in the will or trust documents. These individuals or organizations will have a legal claim to Anthony J's assets upon his passing.

03

Determine Executor or Personal Representative: If Anthony J named an executor or personal representative in his will or estate planning documents, they should take the lead in managing the estate. If not, a representative will need to be appointed by the court.

04

Notify Relevant Parties: Make sure to inform all interested parties about Anthony J's passing, including immediate family members, beneficiaries, financial institutions, lawyers, and accountants involved in his affairs.

05

Pay Outstanding Debts: Gather information about any outstanding debts or liabilities Anthony J had and arrange for their repayment using the available estate funds. This may involve contacting creditors and following proper legal procedures.

06

Inventory and Appraise Assets: Take inventory of Anthony J's assets, including real estate, vehicles, financial accounts, investments, and personal belongings. Obtain professional appraisals if necessary to determine their value accurately.

07

Distribute Assets: Once all debts, taxes, and administrative costs have been settled, distribute the remaining assets as per Anthony J's wishes outlined in his will or trust documents.

08

File Tax Returns: Prepare and file any necessary tax returns on behalf of Anthony J's estate. This includes income tax returns, estate tax returns, and any other applicable forms required by local laws.

09

Close Accounts and Cancel Services: Close any open accounts in Anthony J's name, such as bank accounts, credit cards, utilities, subscriptions, and other services. Provide the necessary paperwork or documentation to complete this process.

10

Keep Detailed Records: Throughout the estate administration process, maintain detailed records of all actions taken, expenses incurred, communications made, and decisions implemented. These records will be required for tax purposes and may be requested by beneficiaries or other interested parties.

Who needs estate of Anthony J?

01

Anthony J's immediate family members, such as spouse, children, or parents, may be the primary beneficiaries of his estate.

02

Named beneficiaries mentioned in his will or trust documents are entitled to receive specific assets or inheritances.

03

Professionals involved in managing the estate, such as lawyers, accountants, or financial advisors, require access to Anthony J's estate information to fulfill their duties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit estate of anthony j from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including estate of anthony j, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit estate of anthony j online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your estate of anthony j to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the estate of anthony j in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your estate of anthony j right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is estate of anthony j?

Estate of Anthony J refers to the legal process of handling and distributing the assets and liabilities left behind by a person named Anthony J after their death.

Who is required to file estate of anthony j?

The executor or administrator of Anthony J's estate is responsible for filing the estate. They are typically named in Anthony J's will or appointed by the court if there is no will.

How to fill out estate of anthony j?

To fill out the estate of Anthony J, the executor or administrator needs to gather all relevant financial and personal information about Anthony J's assets, debts, and beneficiaries. They must then complete the necessary legal forms and documentation required by the probate court or governing authority.

What is the purpose of estate of anthony j?

The purpose of the estate of Anthony J is to ensure that Anthony J's assets are properly distributed to the intended beneficiaries and that any outstanding debts or obligations are settled.

What information must be reported on estate of anthony j?

The estate of Anthony J typically requires reporting of Anthony J's assets, such as real estate, bank accounts, investments, and personal property. It may also include reporting of debts, taxes, and the beneficiaries entitled to inherit from the estate.

Fill out your estate of anthony j online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Of Anthony J is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.