Get the free TAX FORECLOSED PROPERTIES FOR POTTSBORO ISD

Show details

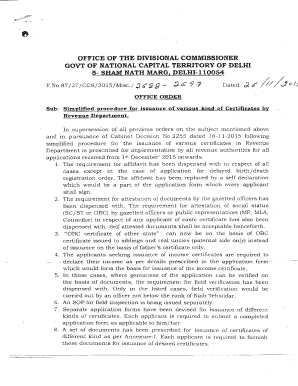

TAX FORECLOSED PROPERTIES

FOR SCOTTSBORO ISD

The following properties were obtained as a result of no bid being received at the

original Sheriffs auction. If you would like information concerning

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax foreclosed properties for

Edit your tax foreclosed properties for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax foreclosed properties for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax foreclosed properties for online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax foreclosed properties for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax foreclosed properties for

How to fill out tax foreclosed properties for:

01

Research the property: Gather all the necessary information about the tax foreclosed property you are interested in. This may include details such as the property address, previous owner, outstanding taxes, and any liens or encumbrances on the property.

02

Attend auctions or purchase from local government agencies: Tax foreclosed properties are usually sold through auctions or directly from local government agencies. Attend the auction or contact the relevant agency to inquire about the purchase process and requirements.

03

Understand the terms and conditions: Before bidding on or purchasing a tax foreclosed property, thoroughly review and understand the terms and conditions set by the auction or government agency. This may include payment deadlines, additional fees, and any restrictions on the property.

04

Conduct property inspections: If possible, visit the tax foreclosed property and conduct a thorough inspection to assess its condition and estimate any potential repair costs or renovation needs.

05

Secure funding: Determine how you will finance the purchase of the tax foreclosed property. This may involve securing a mortgage loan, utilizing personal funds, or seeking financing options specific to tax foreclosed properties.

06

Submit necessary paperwork: Complete all the required paperwork, forms, and applications to finalize the purchase of the tax foreclosed property. This typically includes submitting proof of funds, identification documents, and any additional documentation requested by the auction or government agency.

Who needs tax foreclosed properties for:

01

Real estate investors: Tax foreclosed properties can be an attractive investment opportunity for real estate investors looking for potentially discounted properties with the potential for a high return on investment.

02

Homebuyers: Individuals or families seeking affordable housing options may explore tax foreclosed properties as a way to purchase a home at a lower cost.

03

Developers: Developers may be interested in tax foreclosed properties to acquire land or existing structures for future construction projects or redevelopment initiatives.

04

Non-profit organizations: Some non-profit organizations may be interested in tax foreclosed properties to acquire spaces for community programs, housing initiatives, or other charitable purposes.

05

Local governments: In some cases, local governments may acquire tax foreclosed properties to revitalize neighborhoods, increase tax revenue, or address blight within the community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax foreclosed properties for?

Tax foreclosed properties are properties that have been seized by the government due to the owner's failure to pay property taxes.

Who is required to file tax foreclosed properties for?

Tax foreclosed properties are typically filed by government agencies or tax authorities.

How to fill out tax foreclosed properties for?

Tax foreclosed properties are filled out by providing detailed information about the property, including its location, value, and the circumstances leading to the foreclosure.

What is the purpose of tax foreclosed properties for?

The purpose of tax foreclosed properties is to recoup the unpaid property taxes and potentially auction off the property to recover the amount owed.

What information must be reported on tax foreclosed properties for?

Information such as the property's address, legal description, tax assessment value, and any outstanding taxes must be reported on tax foreclosed properties.

How do I make edits in tax foreclosed properties for without leaving Chrome?

tax foreclosed properties for can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit tax foreclosed properties for straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tax foreclosed properties for.

Can I edit tax foreclosed properties for on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tax foreclosed properties for. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your tax foreclosed properties for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Foreclosed Properties For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.