Grow Financial Grow Checking Account Free Switch Kit 2014-2026 free printable template

Show details

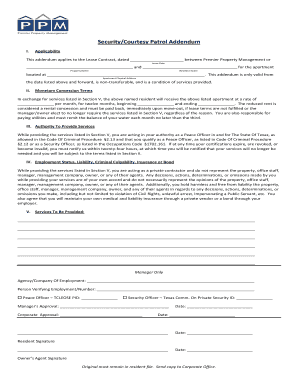

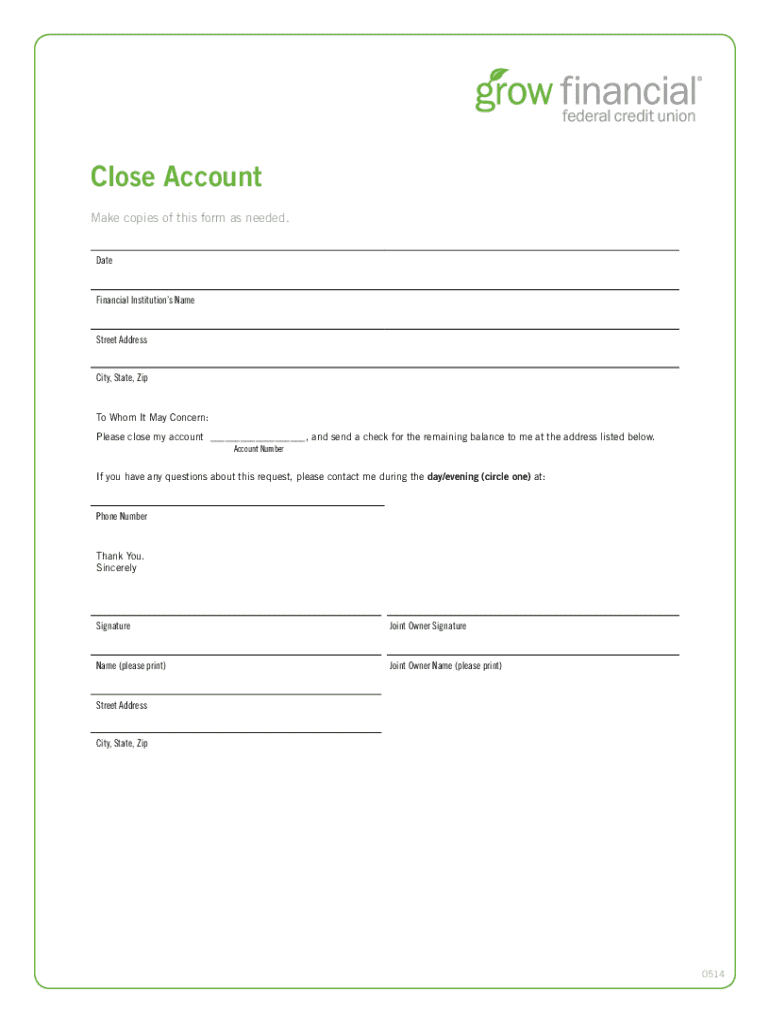

Grow Checking Account Free Switch Kit Grow Checking, the Way Checking Should Be! Includes a Growth Visa Debit Card, accepted wherever you see the Visa symbol. FREE Grow Online Banking, Mobile App

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Grow Financial Grow Checking Account Switch

Edit your Grow Financial Grow Checking Account Switch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Grow Financial Grow Checking Account Switch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Grow Financial Grow Checking Account Switch online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Grow Financial Grow Checking Account Switch. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Grow Financial Grow Checking Account Free Switch Kit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Grow Financial Grow Checking Account Switch

How to fill out grow checking account switch:

01

Visit the official website of Grow Bank and navigate to the "Checking Account" section.

02

Click on "Open an Account" or a similar option to begin the account opening process.

03

Enter your personal information, including your name, address, phone number, and email address.

04

Provide additional details such as your social security number and date of birth for identity verification purposes.

05

Select the type of checking account you want to switch to, which in this case is the "Grow Checking Account".

06

Review the account terms and conditions, including any fees associated with the account.

07

Review your account choices and make any necessary adjustments.

08

Submit your application and wait for confirmation of your new Grow Checking Account.

09

Once your account is approved, you can start enjoying the benefits of the Grow Checking Account.

Who needs grow checking account switch?

01

Individuals who are looking for a reliable and convenient checking account option may consider the Grow Checking Account switch.

02

Those who want to take advantage of features such as online and mobile banking, bill pay, and access to a nationwide network of ATMs may find the Grow Checking Account to be suitable for their needs.

03

Customers who want to benefit from competitive interest rates and low or no minimum balance requirements may find the Grow Checking Account switch appealing.

04

People who are dissatisfied with their current bank and want to switch to a trusted financial institution like Grow Bank may opt for the Grow Checking Account switch.

05

Anyone who values personalized customer service, easy-to-use account management tools, and a seamless banking experience may find the Grow Checking Account switch beneficial.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my Grow Financial bill?

You can make one-time payments or set up automatic recurring payments in Grow Online Banking. Once you log in, select “Transfer/Payments” from the menu. If you're not enrolled in Grow Online Banking yet, you can set up your account in just a few minutes.

How do I deposit a check with Grow Financial app?

Here's how to do it: Open the Grow Mobile Banking app. Select Deposit Check from the menu. Endorse your check with your signature and write “Mobile Deposit at Grow.” Take a photo of the check front and check back, following the prompts. Select Deposit Check.

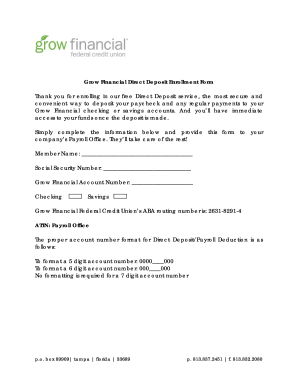

What is the account number for Grow Financial direct deposit?

Grow's routing number is 263182914. On your checks, you can find your full account number in between the routing and check number. If you don't have checks, visit your local Grow store location and pick up a Direct Deposit Letter.

How do I get a bank statement from Grow Financial?

To sign up, log in to your Grow online banking account, select Tools from the main menu and visit the eStatements & Tax Forms page. Then, select Subscribe to receive eStatements. Next, you'll have to agree to the electronic delivery disclosure notice.

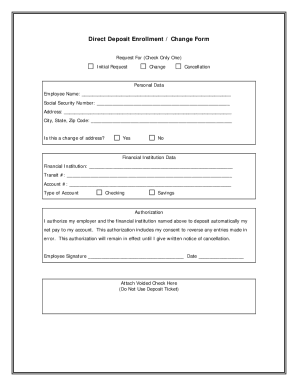

How do I get a direct deposit form from Grow Financial?

Sign in to the editor using your credentials or click Create free account to test the tool's functionality. Add the Grow financial direct deposit form for editing. Click on the New Document option above, then drag and drop the file to the upload area, import it from the cloud, or via a link. Alter your document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Grow Financial Grow Checking Account Switch?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Grow Financial Grow Checking Account Switch in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit Grow Financial Grow Checking Account Switch on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Grow Financial Grow Checking Account Switch. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete Grow Financial Grow Checking Account Switch on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Grow Financial Grow Checking Account Switch. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is grow checking account switch?

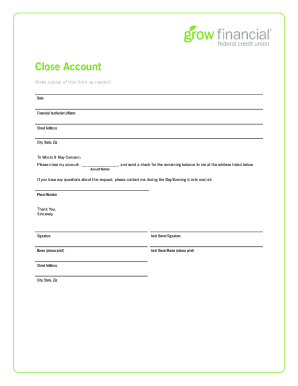

Grow checking account switch is a process where account holders can switch their checking account from one financial institution to Grow Financial Credit Union.

Who is required to file grow checking account switch?

Any individual or business entity who wishes to switch their checking account to Grow Financial Credit Union is required to file the grow checking account switch.

How to fill out grow checking account switch?

To fill out the grow checking account switch, account holders must contact Grow Financial Credit Union and follow their specific instructions and guidelines for switching accounts.

What is the purpose of grow checking account switch?

The purpose of grow checking account switch is to provide account holders with an easy and convenient way to move their checking account to Grow Financial Credit Union.

What information must be reported on grow checking account switch?

Information such as account holder details, current financial institution information, and authorization to switch the account must be reported on grow checking account switch.

Fill out your Grow Financial Grow Checking Account Switch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grow Financial Grow Checking Account Switch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.