Get the free Delinquent Tax and Tax Forfeiture

Show details

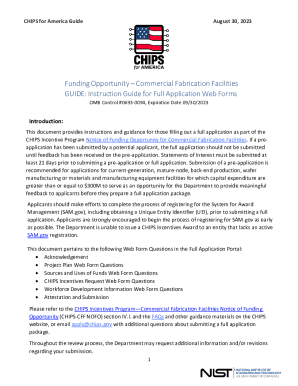

This chapter provides an overview of delinquent taxes and tax forfeiture for real and personal property in Minnesota, detailing collection processes, penalties, and differences between real and personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent tax and tax

Edit your delinquent tax and tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent tax and tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit delinquent tax and tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit delinquent tax and tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delinquent tax and tax

How to fill out Delinquent Tax and Tax Forfeiture

01

Gather all necessary financial documents related to your property taxes.

02

Obtain the Delinquent Tax and Tax Forfeiture forms from your local tax office or their website.

03

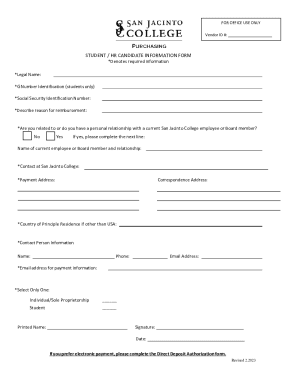

Fill out the personal information section with your name, address, and property details.

04

Detail any tax amounts that are overdue, including the original amount owed and any penalties or interest.

05

Attach any required documentation that supports your claim or provides evidence of payment attempts.

06

Review the completed form for accuracy and completeness.

07

Submit the form according to the instructions provided, which may include mailing it to a specific department or submitting it in person.

Who needs Delinquent Tax and Tax Forfeiture?

01

Homeowners who have fallen behind on property tax payments.

02

Individuals seeking to understand their tax obligations relating to delinquent taxes.

03

Taxpayers in areas where tax forfeiture laws apply.

04

Anyone interested in purchasing property that may be subject to tax forfeiture.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax forfeiture process in Minnesota?

The process by which the state takes ownership of real property due to unpaid property taxes. In Minnesota, the process generally takes four years from the time the taxes were due (taxes due in 2022 are subject to forfeiture in 2026). It also includes several stages including a period of redemption.

Can you make payments on delinquent property taxes in California?

Yes, but not until the delinquent or "defaulted" taxes have been transferred to the Redemption roll, which occurs approximately mid-July following the fiscal year in which the taxes were due. An Redemption Installment Plan allows a taxpayer the ability to pay Redemption taxes in multiple installments.

What is the penalty for paying property taxes late in California?

Annual property tax bills are mailed in early October of each year. The bill is payable in two installments. The 1st installment is due on November 1 and is delinquent if the payment is not received by 5:00 p.m. or postmarked by December 10. A 10% penalty is assessed for delinquent payments.

What is the property tax loophole in California?

19 would narrow California's property tax inheritance loophole, which offers Californians who inherit certain properties a significant tax break by allowing them to pay property taxes based on the property's value when it was originally purchased rather than its value upon inheritance.

What happens when property taxes are delinquent in California?

If unpaid property taxes are left unaddressed, it could accumulate additional fees and penalties, and the County could ultimately auction the property to recover taxes owed. This process takes some time, but if you act quickly, you have a better chance of saving your home.

How long can property taxes go unpaid in California?

During this time, the delinquent taxes, interest, and penalties are accumulating until they are all redeemed. At the end of the 5-years for residential properties and 3-years for non-residential commercial properties, if the tax is not redeemed, the TTC has the power to sell the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Delinquent Tax and Tax Forfeiture?

Delinquent Tax refers to taxes that have not been paid by the due date, leading to penalties and interest. Tax Forfeiture occurs when a property is seized due to unpaid taxes, and ownership is transferred to the government after a specified period.

Who is required to file Delinquent Tax and Tax Forfeiture?

Property owners who have failed to pay their taxes on time are required to file for Delinquent Tax. Tax authorities or local government entities typically initiate Tax Forfeiture for properties that remain unpaid over a certain duration.

How to fill out Delinquent Tax and Tax Forfeiture?

To fill out Delinquent Tax and Tax Forfeiture forms, individuals must provide personal information, details about the property, the amount of unpaid taxes, and any necessary documentation supporting the claim of non-payment.

What is the purpose of Delinquent Tax and Tax Forfeiture?

The purpose of Delinquent Tax and Tax Forfeiture is to enforce tax compliance, recover owed taxes, and ensure that local governments can fund public services by reclaiming properties that are tax-delinquent.

What information must be reported on Delinquent Tax and Tax Forfeiture?

Information that must be reported includes the taxpayer's name and address, property identification details, tax payment history, total amount owed, and any previous notices sent regarding the delinquency.

Fill out your delinquent tax and tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent Tax And Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.