Get the free State General Property Tax Annual Report for the Year 2013

Show details

This document is an annual report detailing the gross collections, refunds, and net adjustments for property taxes in the state for the year 2013, along with various calculations and summary checks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state general property tax

Edit your state general property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state general property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state general property tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state general property tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

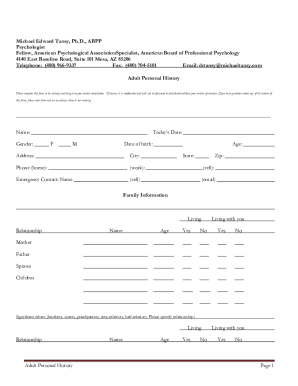

How to fill out state general property tax

How to fill out State General Property Tax Annual Report for the Year 2013

01

Gather all necessary property records, including ownership documents and property descriptions.

02

Complete the identification section, including your name, address, and any relevant identification numbers.

03

List all properties subject to the state general property tax, providing accurate details for each property.

04

Calculate the assessed value for each property and ensure it aligns with local tax assessments.

05

Include any exemptions or deductions that apply to your properties, providing necessary documentation.

06

Review the instructions for any specific forms or additional information required for the year 2013.

07

Double-check all calculations and information for accuracy before submitting the report.

08

Submit the completed State General Property Tax Annual Report by the deadline specified for the year 2013.

Who needs State General Property Tax Annual Report for the Year 2013?

01

Property owners who are subject to state general property taxes and must report their property holdings.

02

Local government authorities who need the report for tax assessment and revenue collection purposes.

03

Real estate professionals and accountants managing property portfolios on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate local property tax?

The LPT charge for these properties is calculated as the sum of: 0.1029% of the first €1.05 million of declared market value of the property. 0.25% of the portion of the declared market value between €1.05 million and €1.75 million. and. 0.3% of the portion of the declared market value above €1.75 million.

Who pays the property tax evidence from Brazil?

Highlights. The rate of property tax payment among urban households in Brazil increased from 36.1% to 56.1% between 2002 and 2018. Houses in Northern regions, large cities, or benefited of fewer urban services are less likely to pay property tax.

How do you calculate the local tax rate?

Sales Tax Formulas/Calculations: Local Tax Amount = Price x (Local Tax Percentage / 100) Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

How are local property taxes determined?

Property taxes typically are based on a property's assessed value rather than its current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

How much are property taxes in Brazil?

Some of Brazil's primary property taxes include the: Municipal Property Tax (IPTU): An annual tax — typically . 3% to 1.5% — based on the fair market value of urban properties. Municipal Property Transfer Tax (ITBI): The tax levied on real estate property transfers, typically at a rate between 2% and 6%

What state has the highest property taxes?

In calendar year 2022 (the most recent data available), New Jersey had the highest effective rate on owner-occupied property at 2.08 percent, followed by Illinois (1.95 percent) and Connecticut (1.78 percent).

How is local property tax calculated?

Local Property Tax rates depend on the valuation band your property falls into. The higher the property value, the more you'll have to pay. On top of these property tax bands, each local authority in Ireland is free to increase or decrease the LPT charge by up to 15% each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is State General Property Tax Annual Report for the Year 2013?

The State General Property Tax Annual Report for the Year 2013 is a document that summarizes the property tax assessments, collections, and distributions for the fiscal year 2013. It provides insights into the property tax revenue generated by the state and how it is allocated to various local jurisdictions.

Who is required to file State General Property Tax Annual Report for the Year 2013?

Entities that are responsible for property tax assessment and collection, including local governments and assessing authorities, are required to file the State General Property Tax Annual Report for the Year 2013.

How to fill out State General Property Tax Annual Report for the Year 2013?

To fill out the State General Property Tax Annual Report for the Year 2013, follow the guidelines provided in the reporting form. This includes entering property tax assessment data, tax collection figures, and any relevant deductions or exemptions. Ensure all figures are accurate and supported by documentation.

What is the purpose of State General Property Tax Annual Report for the Year 2013?

The purpose of the State General Property Tax Annual Report for the Year 2013 is to provide state-level authorities with information on property tax trends, enhance transparency in tax collection processes, and inform policy decisions regarding property taxation.

What information must be reported on State General Property Tax Annual Report for the Year 2013?

The information that must be reported on the State General Property Tax Annual Report for the Year 2013 includes total property values assessed, total taxes levied, amounts collected, outstanding debts, exemptions granted, and any changes in tax regulations affecting the reporting period.

Fill out your state general property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State General Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.