Get the free SD EForm - 0886 - state sd

Show details

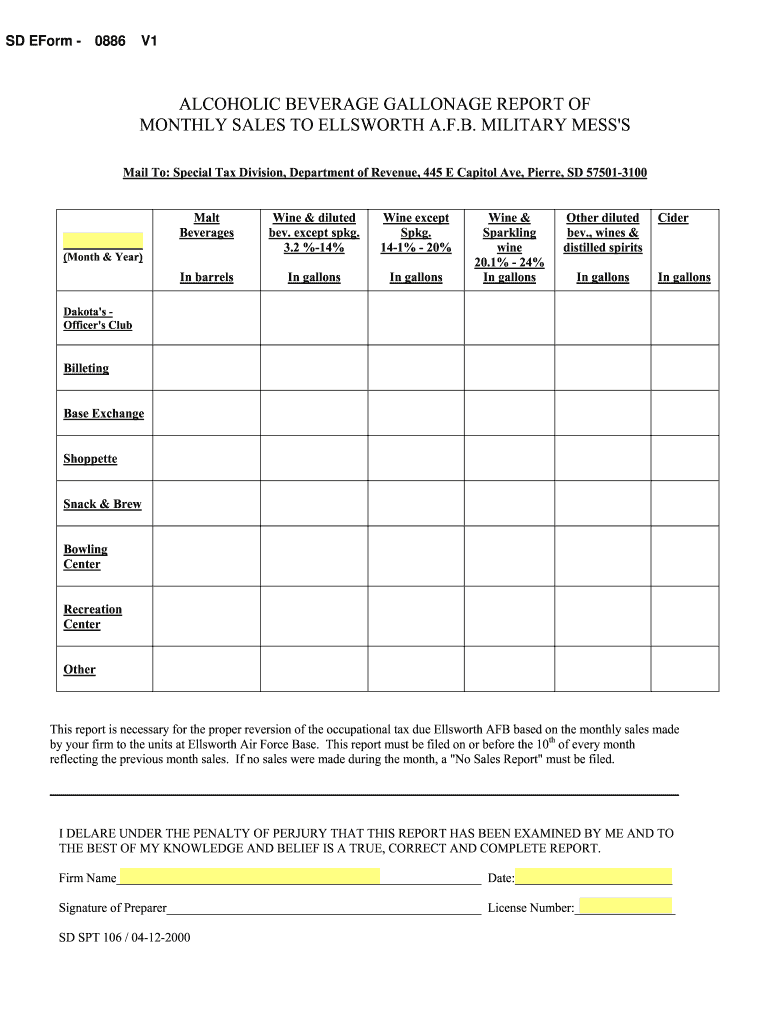

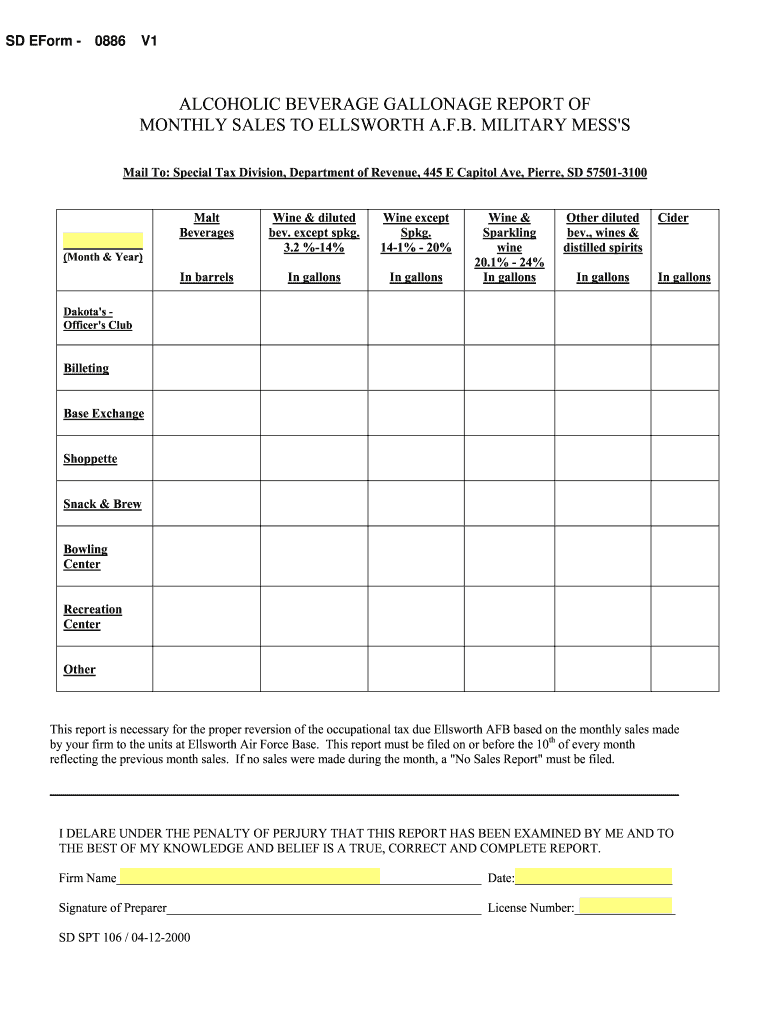

This document is a report to detail the monthly alcoholic beverage sales to various units at Ellsworth Air Force Base for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sd eform - 0886

Edit your sd eform - 0886 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sd eform - 0886 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sd eform - 0886 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sd eform - 0886. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sd eform - 0886

How to fill out SD EForm - 0886

01

Download the SD EForm - 0886 from the official website or obtain a physical copy.

02

Read the instructions carefully before filling out the form to ensure compliance with requirements.

03

Fill in personal information, including name, address, and contact details, in the designated sections.

04

Provide the necessary identification numbers, such as Social Security Number or Tax Identification Number, where applicable.

05

Indicate the type of request or information being submitted on the form.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form through the specified channels provided in the instructions (mail or online submission).

Who needs SD EForm - 0886?

01

Individuals or organizations applying for a specific service or benefit offered by the SD government.

02

Anyone required to report or disclose information as part of government compliance or regulation.

Fill

form

: Try Risk Free

People Also Ask about

Which long standing sales tax nexus requirements overturned by South Dakota v Wayfair?

In finding in South Dakota's favor, the Supreme Court overturned long-standing precedent requiring sellers to have an in-state physical presence in order for a state to require such sellers to collect and remit sales tax to the state.

What is the sales tax threshold in South Dakota?

Marketplace provider must collect and pay sales tax on all sales it facilitates into South Dakota if the marketplace provider: Is a remote seller that exceeds $100,000 in gross sales or 200 or more separate transactions into South Dakota in the previous or current calendar year; or.

What is SD sales tax?

South Dakota Tax Rates, Collections, and Burdens South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.20 percent state sales tax rate and an average combined state and local sales tax rate of 6.11 percent.

What is the nexus tax in the US?

Sales tax nexus is a term used to describe the connection between a business and state or local government that triggers the requirement to collect and remit sales tax. It is the minimum threshold of activity that a business must have in a state before it is obligated to collect and remit sales tax in that state.

How to determine tax nexus?

An out-of-state entity has an economic nexus in Texas if gross receipts from business done in Texas are $500,000 or more. This is even without a physical presence in the state. Furthermore, an entity's treatment for federal income tax purposes does not determine its responsibility for Texas franchise tax.

What is the source of tax revenue in South Dakota?

(South Dakota reports some corporate income tax revenue because it levies a special tax on financial institutions.) After federal transfers, South Dakota's largest sources of per capita revenue were general sales taxes ($2,206) and property taxes ($1,708).

How do I register for sales tax in South Dakota?

How do you register for a sales tax permit in South Dakota? You can apply online at the South Dakota Tax Application website or call 1-800-829-9188 for more information on applying in person.

What is the nexus threshold for sales tax in South Dakota?

Economic nexus Remote sellers and marketplace facilitators that have gross revenue from sales exceeding $100,000 in the previous or current calendar year must collect and remit South Dakota sales and use tax on taxable sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SD EForm - 0886?

SD EForm - 0886 is a specific electronic form used for reporting certain transactions or financial information to regulatory authorities.

Who is required to file SD EForm - 0886?

Entities or individuals who engage in qualifying transactions subject to reporting requirements are required to file SD EForm - 0886.

How to fill out SD EForm - 0886?

To fill out SD EForm - 0886, users must follow step-by-step instructions provided in the form guidelines, ensuring all relevant fields are completed accurately.

What is the purpose of SD EForm - 0886?

The purpose of SD EForm - 0886 is to collect data for regulatory compliance, ensuring transparency and accountability in financial reporting.

What information must be reported on SD EForm - 0886?

SD EForm - 0886 requires information such as transaction details, participant identification, and any pertinent financial data related to the reported transaction.

Fill out your sd eform - 0886 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sd Eform - 0886 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.