Get the free Branch Financial Institution Account - donate mennonitechurch

Show details

600 Shaftesbury Blvd Winnipeg MB R3P 0M4 Toll free 18668886785 T: 2048886781 F: 2048315675 E: give mennonitechurch.c W: www.mennonitechurch.ca We are pleased to offer you, our faithful donors, a preauthorized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign branch financial institution account

Edit your branch financial institution account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your branch financial institution account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit branch financial institution account online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit branch financial institution account. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out branch financial institution account

How to fill out a branch financial institution account:

01

Gather the necessary documents: Start by collecting all the required documents which may include your identification proof, proof of address, proof of income, and any other relevant documents requested by the financial institution.

02

Visit the branch: Once you have the necessary documents, visit the branch of the financial institution where you wish to open the account. Approach the customer service desk and let them know that you would like to open a branch financial institution account.

03

Fill out the application form: The customer service representative will provide you with an application form. Take your time to carefully fill out all the required fields in the form. Make sure to provide accurate and up-to-date information.

04

Submit the application form: Once you have completed filling out the application form, submit it to the customer service representative. They may review the form to ensure all information is complete and accurate.

05

Provide the necessary documents: Along with the application form, submit all the required documents as mentioned earlier. The customer service representative may make copies of these documents for their records, so be prepared to provide both the originals and copies.

06

Initial deposit: Depending on the requirements of the financial institution, you may be asked to make an initial deposit into your branch financial institution account. This amount will vary depending on the institution and the type of account you are opening.

07

Review terms and conditions: Before finalizing the account opening process, carefully review the terms and conditions provided by the financial institution. It is essential to understand the fees, charges, and any other conditions associated with your new account.

08

Collect account details: Once your application has been processed, the customer service representative will provide you with your account details, such as your account number and any relevant login information for online banking services.

Who needs a branch financial institution account:

01

Individuals: Branch financial institution accounts are essential for individuals who want a safe and secure place to manage their personal finances. These accounts offer features like savings accounts, checking accounts, and financial management tools to help individuals meet their banking needs.

02

Businesses: Small businesses, large corporations, and other entities also require branch financial institution accounts for various financial transactions. These accounts enable businesses to process payments, receive funds, and effectively manage their finances.

03

Non-profit organizations: Non-profit organizations often need branch financial institution accounts to receive donations, manage funds, and carry out their mission effectively. These accounts help them separate their funds and maintain transparency in their financial transactions.

In summary, anyone who wishes to manage their personal finances, run a business, or operate a non-profit organization can benefit from having a branch financial institution account. These accounts offer various banking services and account options to cater to the specific needs of individuals, businesses, and organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete branch financial institution account online?

pdfFiller has made it simple to fill out and eSign branch financial institution account. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the branch financial institution account electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your branch financial institution account and you'll be done in minutes.

How do I edit branch financial institution account on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as branch financial institution account. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

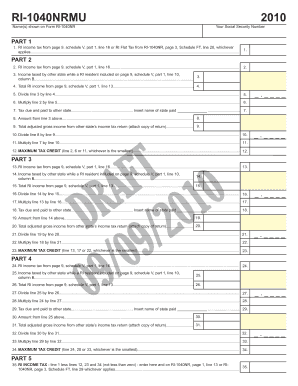

What is branch financial institution account?

A branch financial institution account is a report that details the financial activities of a branch of a financial institution.

Who is required to file branch financial institution account?

Financial institutions are required to file branch financial institution accounts.

How to fill out branch financial institution account?

Branch financial institution accounts can be filled out electronically or on paper, following the provided guidelines.

What is the purpose of branch financial institution account?

The purpose of the branch financial institution account is to provide a comprehensive overview of the financial activities of a branch of a financial institution.

What information must be reported on branch financial institution account?

Information such as income, expenses, assets, liabilities, and other financial data must be reported on the branch financial institution account.

Fill out your branch financial institution account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Branch Financial Institution Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.