Get the free Tax Increment Finance (TIF) Registry - window state tx

Show details

This document is a form used to register a new Tax Increment Reinvestment Zone with the Texas Comptroller of Public Accounts, requiring detailed information about the zone, including contact information,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax increment finance tif

Edit your tax increment finance tif form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment finance tif form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax increment finance tif online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment finance tif. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment finance tif

How to fill out Tax Increment Finance (TIF) Registry

01

Gather necessary documents such as property identification information, zoning details, and project descriptions.

02

Access the official TIF Registry website or platform designated for submissions.

03

Fill out the required application forms with accurate and complete information.

04

Provide detailed descriptions of the proposed project, including its economic impact.

05

Include financial projections and funding sources related to the project.

06

Attach any supporting documentation required by the TIF Registry.

07

Review the completed application for accuracy and completeness.

08

Submit the application through the designated submission method (online or via mail).

09

Monitor your application status for any updates or requests for additional information.

Who needs Tax Increment Finance (TIF) Registry?

01

Municipalities seeking to stimulate economic development.

02

Developers and property owners proposing projects that require TIF support.

03

Businesses aiming to benefit from tax incentives for improvements or expansions.

04

Local governments looking to track and manage TIF financing and investments.

Fill

form

: Try Risk Free

People Also Ask about

What are the problems with TIF?

Disadvantages. Approval challenges — TIFs require approval from local government, which can be difficult depending on the community. Funding competition — There can be many parts of government and the private sector seeking funds, which can lead to challenges in fund allocation.

What are the basics of TIF?

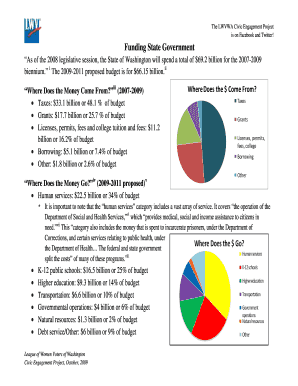

TIF is a public financing method that is used to subsidize redevelopment, infrastructure, and other community-improvement projects. The basic principle of TIF is to use the future gains in taxes to finance the current improvements that will create those gains.

Is tax increment financing capturing or creating growth?

Tax incremental financing (TIF) can be an important tool for local governments to attract economic development projects, create jobs, foster infrastructure investment, and/or redevelop blighted areas.

Is tax incremental?

In the U.S., federal income tax is incremental, also known as progressive.

What are the downsides of tax increment financing?

Con: The project could go either way More, economic conditions change, and public debate can be heated. In the end, the TIF process can be long and drawn out, and even that can a deal. It's important to keep in mind that TIFs can be incredibly complex, and in spite of your best efforts, the deal may fall through.

What is the dark side of tax increment financing?

There is a dark side to tax increment financing --- it being the devious way the TIF funds are collected from unenfranchised taxpayers outside of a city and are then used to benefit relatively few property owners within the established TIF districts in the city.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Increment Finance (TIF) Registry?

The Tax Increment Finance (TIF) Registry is a public database that tracks TIF districts and the associated financial transactions within them, promoting transparency and accountability in the use of tax increment financing.

Who is required to file Tax Increment Finance (TIF) Registry?

Municipalities and other public entities that establish TIF districts are required to file information with the TIF Registry, including details about the TIF districts and the financial activities related to them.

How to fill out Tax Increment Finance (TIF) Registry?

To fill out the Tax Increment Finance (TIF) Registry, municipalities must provide specific details about the TIF district such as its boundaries, the purpose of the TIF, projected increment revenues, and expenditures, along with supporting documentation.

What is the purpose of Tax Increment Finance (TIF) Registry?

The purpose of the TIF Registry is to ensure transparency in the use of tax increment financing, enabling stakeholders, including taxpayers and government officials, to access information about TIF districts and assess their economic impact.

What information must be reported on Tax Increment Finance (TIF) Registry?

Information that must be reported includes the legal description of the TIF district, projected tax increment revenues, expenditures, the status of projects funded by TIF, and any changes or amendments to the TIF plan.

Fill out your tax increment finance tif online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Finance Tif is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.