Get the free Bank Guarantee Letter

Show details

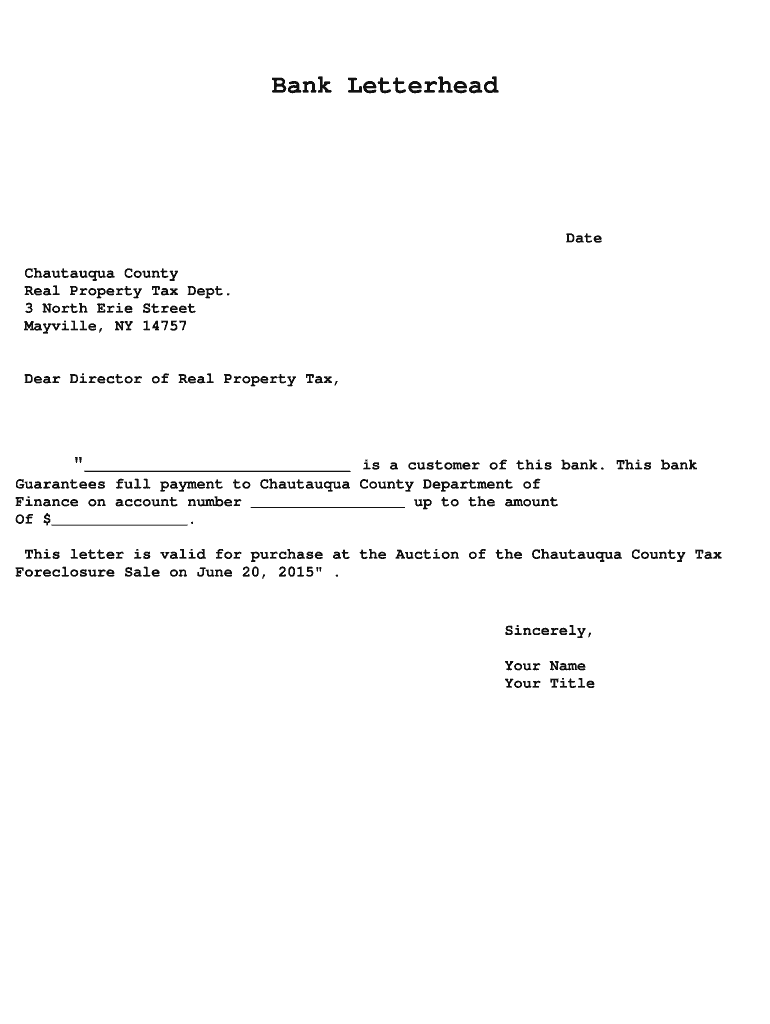

Bank Letterhead Date Chautauqua County Real Property Tax Dept. 3 North Erie Street Maryville, NY 14757 Dear Director of Real Property Tax, is a customer of this bank. This bank Guarantees full payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank guarantee letter

Edit your bank guarantee letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank guarantee letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bank guarantee letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank guarantee letter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank guarantee letter

How to fill out a bank guarantee letter:

01

Begin by addressing the letter to the appropriate party, usually the recipient or beneficiary of the guarantee. Include their full name, designation, and contact details.

02

Provide your own details as the guarantor, including your name, company name (if applicable), address, and contact information.

03

Clearly state the purpose of the bank guarantee and the amount being guaranteed. Include specific details such as the date, reference number, and any specific terms or conditions associated with the guarantee.

04

Include a detailed description of the transaction or project for which the guarantee is being issued. This should include the scope, duration, and any other relevant information.

05

Clearly outline the rights and obligations of each party involved in the guarantee. This may include details regarding the release of funds, termination conditions, and any additional requirements.

06

Sign the letter at the bottom and include your full name, title, and date. If applicable, have the letter notarized or witnessed for additional authenticity.

Who needs a bank guarantee letter?

01

Contractors or suppliers participating in bidding processes for public or private projects often require a bank guarantee letter to demonstrate their financial capability and commitment to complete the project.

02

Importers and exporters may need bank guarantee letters to guarantee payment or assure delivery of goods or services.

03

Landlords, particularly in commercial real estate, may request a bank guarantee letter from tenants as a form of security deposit or rent assurance.

04

Financial institutions may require bank guarantee letters as collateral for loans or credit facilities.

05

Individuals involved in legal matters such as lawsuits or disputes may require a bank guarantee letter to ensure the availability of funds in case of a court judgment.

Overall, anyone involved in transactions or projects that require financial security or assurance may need a bank guarantee letter. The specific need varies depending on the industry and context of the transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bank guarantee letter directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your bank guarantee letter along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send bank guarantee letter to be eSigned by others?

Once your bank guarantee letter is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my bank guarantee letter in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your bank guarantee letter directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is bank guarantee letter?

A bank guarantee letter is a promise from a bank that a particular financial obligation will be fulfilled by the borrower.

Who is required to file bank guarantee letter?

Individuals or businesses who need to provide financial assurance to a third party may be required to file a bank guarantee letter.

How to fill out bank guarantee letter?

To fill out a bank guarantee letter, one must provide details of the transaction, the amount guaranteed, the parties involved, and contact information for the issuing bank.

What is the purpose of bank guarantee letter?

The purpose of a bank guarantee letter is to ensure that a financial obligation will be fulfilled in case the borrower fails to fulfill their commitment.

What information must be reported on bank guarantee letter?

The bank guarantee letter should include details of the transaction, the amount guaranteed, the parties involved, and contact information for the issuing bank.

Fill out your bank guarantee letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Guarantee Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.