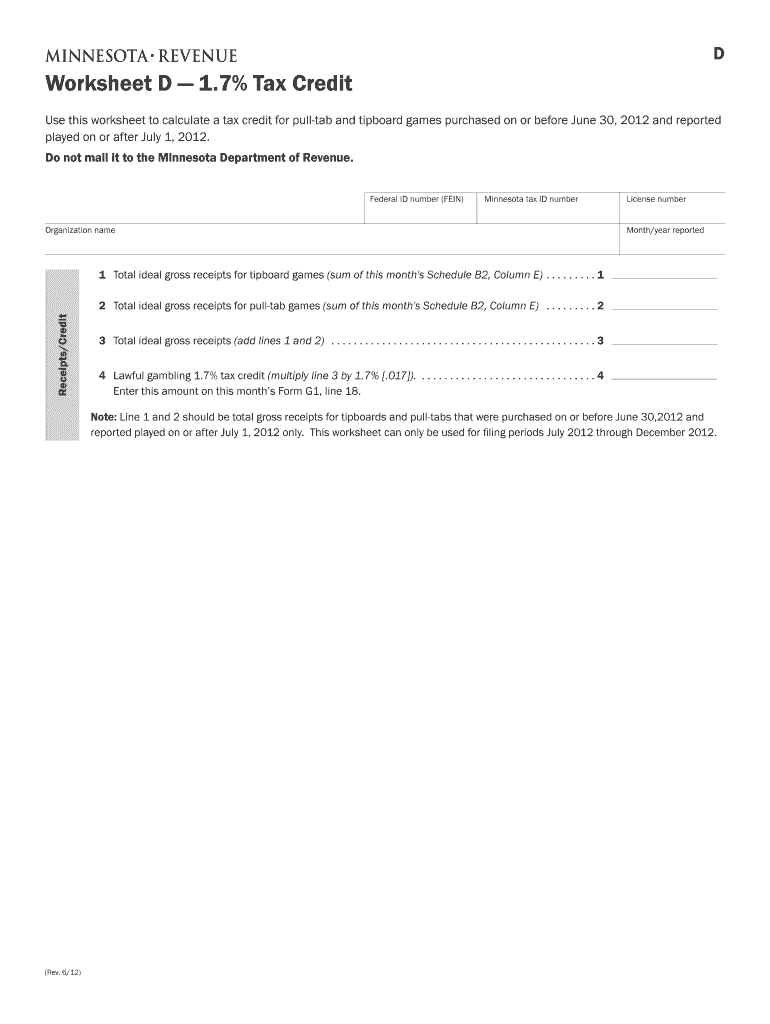

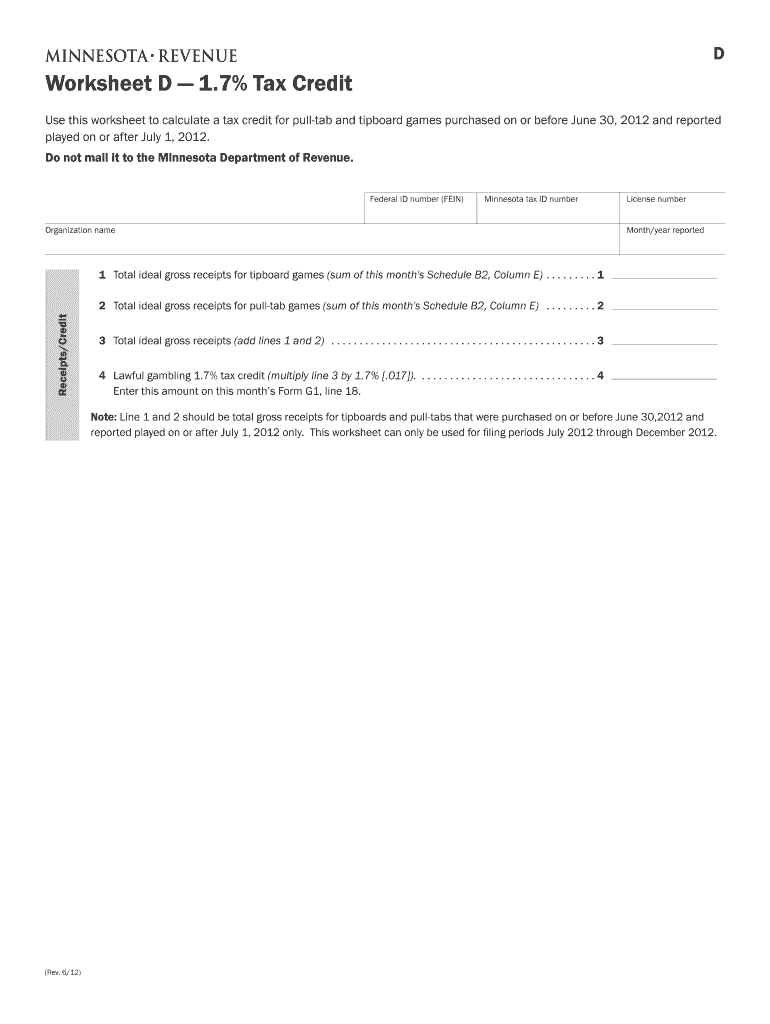

Get the free Worksheet D — 1.7% Tax Credit

Show details

Use this worksheet to calculate a tax credit for pull-tab and tipboard games purchased on or before June 30, 2012 and reported played on or after July 1, 2012.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign worksheet d 17 tax

Edit your worksheet d 17 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your worksheet d 17 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit worksheet d 17 tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit worksheet d 17 tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out worksheet d 17 tax

How to fill out Worksheet D — 1.7% Tax Credit

01

Gather your financial documents, including income statements and relevant financial records.

02

Obtain a copy of Worksheet D — 1.7% Tax Credit from the relevant tax authority or their website.

03

Begin by entering your personal information in the designated fields at the top of the worksheet.

04

Fill out the income details as required, making sure to include all eligible sources of income.

05

Calculate any deductions that apply to your income according to the instructions provided on the worksheet.

06

Insert your adjusted income figure into the appropriate section of the worksheet.

07

Follow the calculations for the 1.7% tax credit based on the instructions, ensuring to use accurate figures.

08

Double-check all entries for accuracy and completeness before submission.

09

Sign and date the worksheet as required.

10

Submit the completed worksheet to the relevant tax authority by the specified deadline.

Who needs Worksheet D — 1.7% Tax Credit?

01

Individuals or businesses that are eligible for the 1.7% tax credit based on specific financial criteria.

02

Taxpayers who have qualified expenses that can be calculated for the credit.

03

Anyone looking to reduce their tax liability through eligible credits may require this worksheet.

Fill

form

: Try Risk Free

People Also Ask about

What is the credit rating ICR?

A Best's issuer Credit Rating (ICR) is an independent opinion of an entity's ability to meet its ongoing financial obligations and can be issued on either a long-or short-term basis.

How do I check my tuition tax credit in Canada?

Using your CRA My Account: Log in to your CRA My Account. Click Tax Returns. Scroll to Carryover amounts and click View carryover amounts. Find the Federal Tuition, Education and Textbook Amounts and Provincial Tuition, Education and Textbook Amounts tables.

What is the schedule D tax worksheet?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

What does a B2 credit rating mean?

B2. A rating within speculative grade Moody's Long-term Corporate Obligation Rating. Obligations rated B2 are considered speculative and are subject to high credit risk.

What is the meaning of tax credit rate?

The term “tax credit” refers to an amount of money that taxpayers can subtract directly from the taxes they owe. This is different from tax deductions, which lower the amount of an individual's taxable income. The value of a tax credit depends on the nature of the credit.

What is the A1 a+ credit rating?

A+/A1 are credit ratings produced by ratings agencies S&P and Moody's. Both A+ and A1 fall in the middle of the investment-grade category, indicating some but low credit risk.

What is the tax credit rating?

The tax credit rating is implemented by the State Administration of Taxation and the evaluation process refers to historical information and current internal and external information, all of which comprehensively evaluates the credit status of the enterprise.

How is Canadian foreign tax credit calculated?

The amount for the Foreign Tax Credit would be the lesser of: (Foreign Non-Business Income/Adjusted Division B Income) x Tax Otherwise Payable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Worksheet D — 1.7% Tax Credit?

Worksheet D — 1.7% Tax Credit is a form used by taxpayers to calculate and claim a tax credit of 1.7% on eligible qualified expenses.

Who is required to file Worksheet D — 1.7% Tax Credit?

Taxpayers who have incurred eligible expenses that qualify for the 1.7% tax credit are required to file Worksheet D.

How to fill out Worksheet D — 1.7% Tax Credit?

To fill out Worksheet D, taxpayers must input their total eligible expenses, calculate the 1.7% credit, and complete any required sections as specified in the worksheet instructions.

What is the purpose of Worksheet D — 1.7% Tax Credit?

The purpose of Worksheet D is to provide a structured format for taxpayers to report their eligible expenses and calculate the corresponding tax credit.

What information must be reported on Worksheet D — 1.7% Tax Credit?

Taxpayers must report their total eligible qualified expenses, any adjustments or disallowed expenses, and the resulting tax credit on Worksheet D.

Fill out your worksheet d 17 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Worksheet D 17 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.