Get the free Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax

Show details

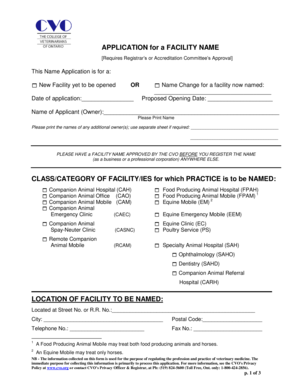

This document serves as a consent form for taxpayers to extend the statutory period for assessing petroleum taxes in Minnesota. It outlines the conditions under which the agreement is made between

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consent to extend form

Edit your consent to extend form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consent to extend form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consent to extend form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consent to extend form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consent to extend form

How to fill out Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax

01

Obtain the Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax form from the Minnesota Department of Revenue website or office.

02

Fill in the taxpayer's name, address, and identification number in the appropriate fields.

03

Provide the date on which the original assessment period is set to expire.

04

Indicate the new extended deadline for assessment or refund request.

05

Both the taxpayer and the tax authority representative must sign the form.

06

Submit the completed form to the Minnesota Department of Revenue before the expiration of the original statutory period.

Who needs Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

01

Taxpayers who are undergoing a review or audit by the Minnesota Department of Revenue.

02

Individuals or businesses who anticipate that they may require additional time for their tax assessments or refunds.

03

Tax professionals and representatives acting on behalf of a taxpayer who need to extend statutory periods related to tax matters.

Fill

form

: Try Risk Free

People Also Ask about

How far back can I file for a Minnesota property tax refund?

You may file for the Property Tax Refund on paper or electronically. The due date is August 15. You may file up to one year after the due date.

How long is the statute of limitations for most returns?

The Statute of Limitations In general, if you did file a return, the IRS has three years from the due date of the return or the date on which it was filed, whichever comes later, to determine whether you owe additional taxes.

Does Minnesota have a statute of limitations?

The limitations period typically begins when the crime is complete. 18 It ends when the time limit expires. If a person hits someone, the statute of limitations under Minnesota law begins as soon as the assault ends and runs for three years.

Is MN property tax refund taxable?

That's not taxable income and is not reported on your federal tax return. That's a state income tax credit. It is not a "refund" of taxes paid.

What is the statute of limitations on Minnesota state refunds?

3 1/2 years from the original due date or 3 1/2 years from the date you filed your return, whichever is later. We may extend this time limit in some situations.

Is there a time limit on refunds?

If you bought the item from a shop Check the shop's policy on returns. Even though they don't have to do it by law, lots of shops will say you can return items within 14 or sometimes even 30 days, as long as they're not used.

How long do I have to file my MN property tax refund?

Form M1PR should be filed by August 15, 2025. The final deadline to claim a 2024 refund is August 15, 2026. See the Minnesota Property Tax Refund Instructions for additional information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax is a formal agreement that allows taxpayers and the Minnesota Department of Revenue to extend the time frame for the assessment and refund of taxes. This extension can provide additional time for the evaluation of tax liability and related matters.

Who is required to file Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

Taxpayers who wish to extend the statutory period for assessing or refunding their taxes are required to file this consent. Both individual and business taxpayers can initiate this process when there are complexities that necessitate more time for resolution.

How to fill out Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

To fill out the Consent to Extend form, taxpayers must provide their name, address, taxpayer identification number, the specific tax type, and the agreed-upon extended period for assessment or refund. The form must be signed and dated by the taxpayer or their representative.

What is the purpose of Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

The purpose of this consent is to provide both the taxpayer and the Minnesota Department of Revenue with additional time to resolve tax issues, ensuring that all relevant information is properly reviewed and assessed before a final decision is made.

What information must be reported on Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax?

The consent form must include the taxpayer's identification details, the specific tax type involved, reasons for the extension, the proposed extension period, and signatures from both the taxpayer and the state representative if applicable.

Fill out your consent to extend form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent To Extend Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.