Get the free SECTION 125 CAFETERIA PLAN - dakotacarecom

Show details

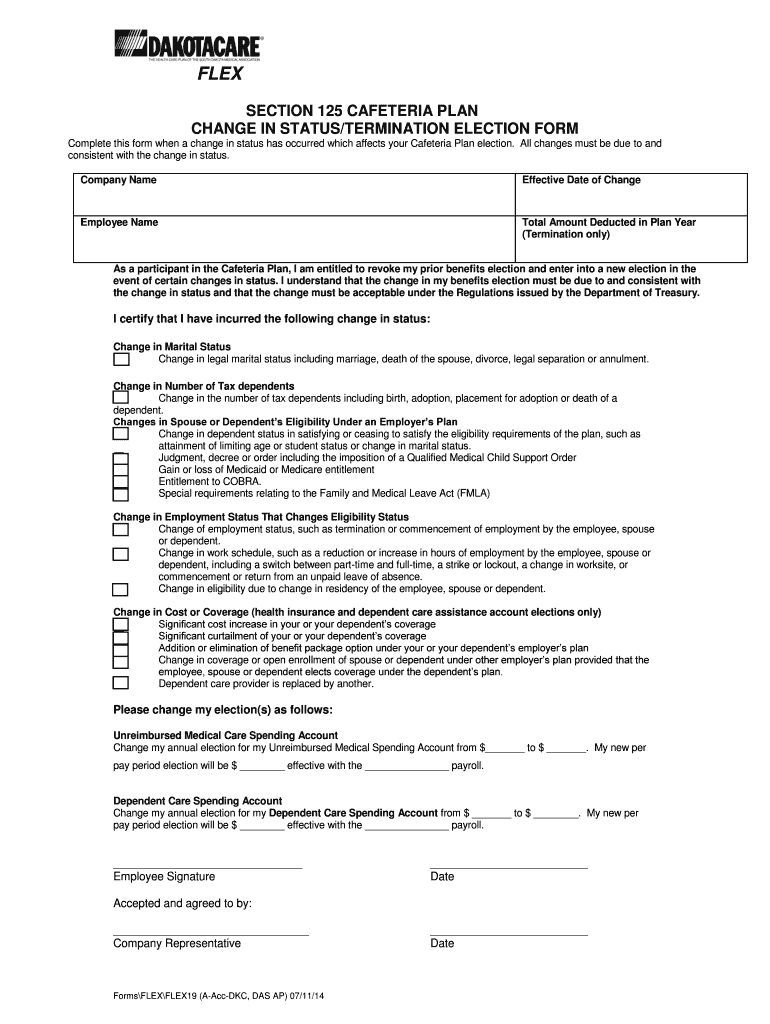

FLEX SECTION 125 CAFETERIA PLAN CHANGE IN STATUS/TERMINATION ELECTION FORM Complete this form when a change in status has occurred which affects your Cafeteria Plan election. All changes must be due

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 125 cafeteria plan

Edit your section 125 cafeteria plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 125 cafeteria plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 125 cafeteria plan online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit section 125 cafeteria plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 125 cafeteria plan

How to Fill Out Section 125 Cafeteria Plan:

01

Gather the necessary information and documents such as the plan documents, employee enrollment forms, and eligible benefit options.

02

Identify the available benefits that will be offered through the cafeteria plan, such as health insurance, flexible spending accounts, and dependent care assistance.

03

Provide employees with clear and detailed information about the cafeteria plan, including the benefits offered, enrollment period, contribution limits, and any applicable deadlines.

04

Ensure that employees understand their options and provide them with tools or resources to help them make informed decisions about participating in the plan.

05

Collect completed enrollment forms from employees and review them for accuracy and completeness.

06

Establish a system to manage employee contributions and deductions, ensuring compliance with federal regulations and the plan's rules.

07

Communicate with benefits providers and coordinate the enrollment process to ensure a smooth transition for employees who will be participating in the cafeteria plan.

08

Train HR staff or designated individuals responsible for managing the cafeteria plan on how to administer the program effectively and answer any employee questions.

09

Monitor the cafeteria plan regularly, ensuring that it remains compliant with applicable laws and regulations, and make any necessary updates or adjustments as needed.

Who Needs a Section 125 Cafeteria Plan:

01

Employers: Companies of all sizes can benefit from offering a cafeteria plan, as it provides a cost-effective way to offer employee benefits while allowing employees more flexibility in selecting the benefits that meet their specific needs.

02

Employees: Any employee who wishes to have greater control over their benefits options can benefit from a cafeteria plan. It allows them to choose the benefits that are most important to them and potentially save money through pre-tax deductions.

03

Families with Dependent Care Expenses: A cafeteria plan can be advantageous for employees with dependents who incur child or dependent care expenses. By electing a dependent care assistance benefit, they can pay for eligible expenses using pre-tax dollars, resulting in potential tax savings.

04

Individuals with Medical Expenses: Cafeteria plans often include options like flexible spending accounts (FSAs) or health savings accounts (HSAs), which allow individuals to set aside pre-tax dollars for medical expenses. This can help alleviate the financial burden of healthcare costs.

05

Those Seeking Tax Savings: Section 125 cafeteria plans offer employees an opportunity to reduce their taxable income by allocating pre-tax dollars towards eligible benefits. This can result in substantial tax savings, making it attractive to individuals looking to maximize their earnings.

Remember, it is always important to consult with a qualified benefits professional or legal advisor to understand the specific regulations and requirements related to section 125 cafeteria plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my section 125 cafeteria plan in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your section 125 cafeteria plan and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit section 125 cafeteria plan straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing section 125 cafeteria plan, you need to install and log in to the app.

Can I edit section 125 cafeteria plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share section 125 cafeteria plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is section 125 cafeteria plan?

A section 125 cafeteria plan is an employee benefits plan that allows employees to choose between taxable benefits (such as cash) and nontaxable benefits (such as health insurance or retirement contributions).

Who is required to file section 125 cafeteria plan?

Employers who offer a section 125 cafeteria plan to their employees are required to file the plan.

How to fill out section 125 cafeteria plan?

To fill out a section 125 cafeteria plan, employers must provide employees with the necessary enrollment forms and information on available benefits.

What is the purpose of section 125 cafeteria plan?

The purpose of a section 125 cafeteria plan is to provide employees with a way to pay for certain benefits with pre-tax dollars, reducing their overall tax liability.

What information must be reported on section 125 cafeteria plan?

The section 125 cafeteria plan must include information on the available benefits, employee contributions, and any employer contributions.

Fill out your section 125 cafeteria plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 125 Cafeteria Plan is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.