Get the free Excess Liability Application - REVISED Jan 26 2010doc

Show details

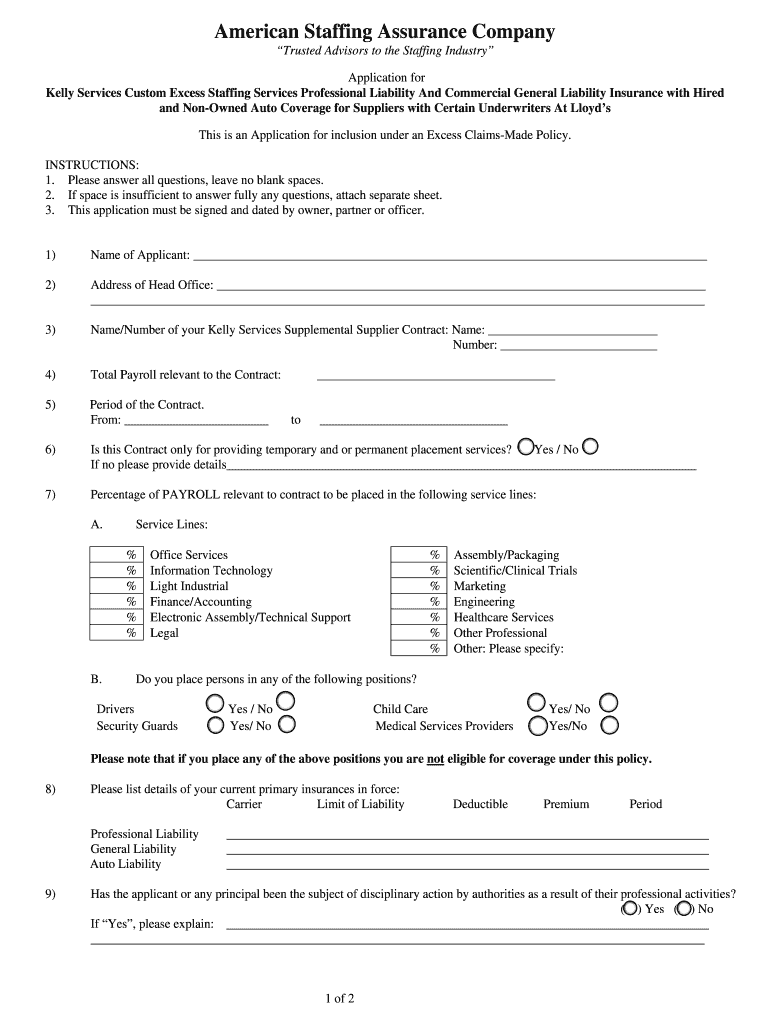

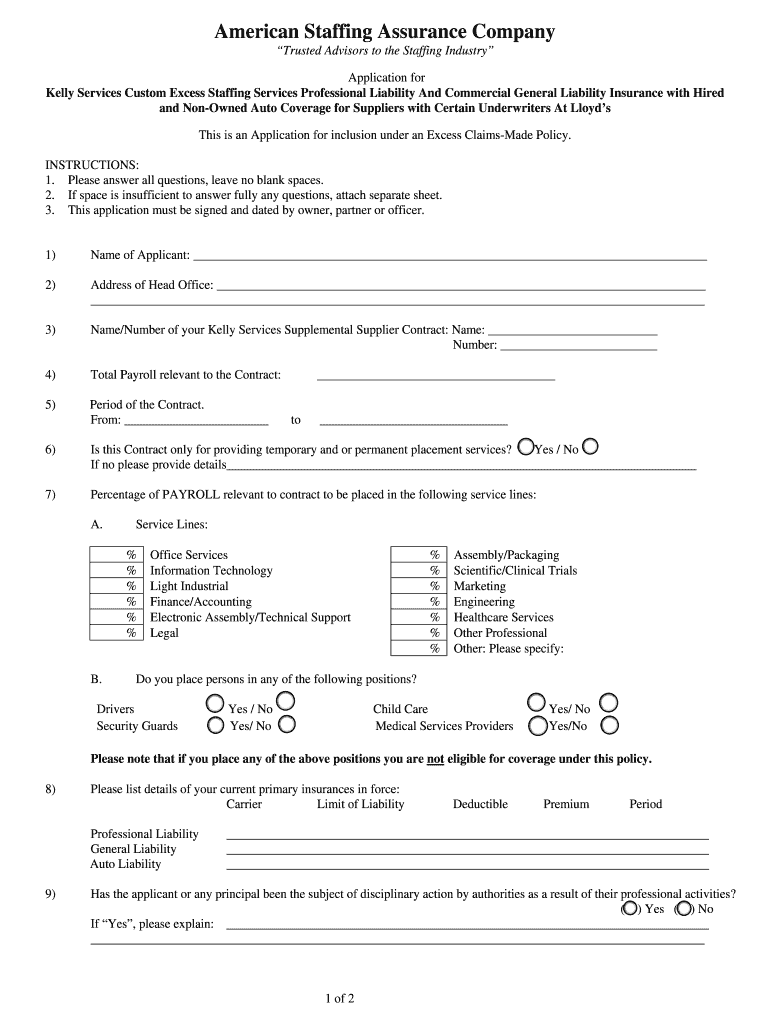

American Staffing Assurance Company Trusted Advisors to the Staffing Industry Application for Kelly Services Custom Excess Staffing Services Professional Liability And Commercial General Liability

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excess liability application

Edit your excess liability application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excess liability application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing excess liability application online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit excess liability application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excess liability application

How to Fill Out Excess Liability Application:

01

Review the application form: Start by carefully reading the excess liability application form. Pay attention to any instructions or guidelines provided by the insurance company. Gather all the necessary information and documents required for completing the application.

02

Personal details: Begin by filling out your personal information accurately, including your full name, date of birth, address, and contact details. Provide any additional information requested, such as your occupation or business details if applicable.

03

Insurance coverage details: Provide information about your existing insurance policies, including the policy number and the name of the insurance company. Specify the coverage limits and the effective dates of your current policies.

04

Assets and liabilities: In this section, list your assets and liabilities that you would like to protect with the excess liability coverage. Provide accurate details, including estimated values for assets and outstanding balances for liabilities.

05

Coverage limits: Indicate the desired coverage limits for your excess liability policy. Consider your personal circumstances and the potential risks you may face when determining the appropriate coverage limits.

06

Additional coverage options: Some excess liability applications may offer additional coverage options or endorsements. Review these options carefully and select any that are relevant to your needs. This may include coverage for specific activities or assets that require additional protection.

07

Claims history: Disclose any previous claims you have made or any incidents that may potentially lead to a claim. Provide details about the nature of the claim, the insurance company involved, and the amount paid or reserved for the claim.

Who needs excess liability application:

01

High net worth individuals: Individuals with substantial assets who are at risk of lawsuits or claims beyond the limits of their primary insurance policies may need excess liability coverage.

02

Business owners: Companies and business owners with significant assets, operations, or higher levels of risk may benefit from excess liability coverage. This can provide additional protection against catastrophic losses that may exceed traditional coverage limits.

03

Professionals: Doctors, lawyers, architects, and other professionals with potential liability exposures may require excess liability coverage to safeguard their personal assets beyond the limits of their professional liability policies.

04

Non-profit organizations: Non-profit organizations or charitable entities that engage in activities involving potential risks, such as events or volunteer programs, may consider obtaining excess liability coverage for added protection.

05

Individuals with high-risk activities: Those involved in high-risk activities, such as extreme sports or hobbies, may need excess liability coverage to protect against potential lawsuits or claims arising from accidents or injuries.

Remember to consult with an insurance professional or broker to determine whether you need excess liability application or coverage based on your specific situation and risk profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send excess liability application to be eSigned by others?

When you're ready to share your excess liability application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute excess liability application online?

pdfFiller has made it easy to fill out and sign excess liability application. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the excess liability application in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is excess liability application?

Excess liability application is a form filled out by individuals or organizations seeking additional liability coverage beyond their base policy limits.

Who is required to file excess liability application?

Anyone who wants to increase their liability coverage beyond their current policy limits is required to file an excess liability application.

How to fill out excess liability application?

Excess liability application can be filled out by providing personal information, details of existing insurance policies, desired coverage limits, and any additional information requested by the insurance provider.

What is the purpose of excess liability application?

The purpose of excess liability application is to apply for additional liability coverage to protect against potential financial losses that exceed the limits of existing insurance policies.

What information must be reported on excess liability application?

Information such as personal details, current insurance coverage details, desired coverage limits, and any additional information requested by the insurance provider must be reported on an excess liability application.

Fill out your excess liability application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excess Liability Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.