Get the free FALSE SELF-EMPLOYMENT & HOW IT AFFECTS YOU

Show details

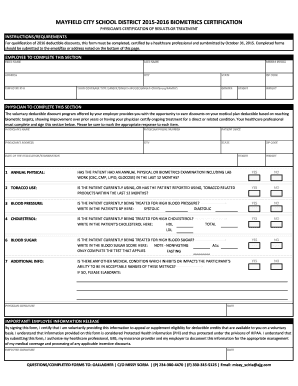

FALSE REEMPLOYMENT & HOW IT AFFECTS YOU In April 2014, there was an important amendment to the regulations that decide the tax status of any individuals that work with agencies to find their work.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign false self-employment amp how

Edit your false self-employment amp how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your false self-employment amp how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing false self-employment amp how online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

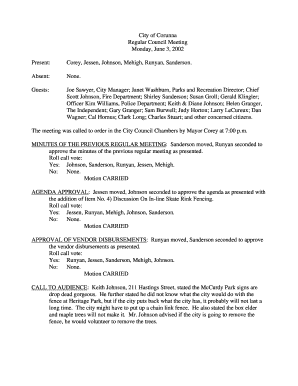

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit false self-employment amp how. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

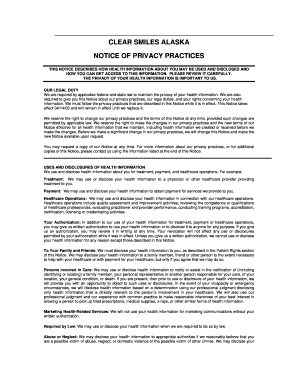

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out false self-employment amp how

How to Fill Out False Self-Employment & How:

01

Understand the concept of false self-employment: False self-employment refers to a situation where an individual is classified as a self-employed worker, but in reality, they should be considered an employee. It is crucial to be aware of the guidelines and regulations surrounding this issue.

02

Familiarize yourself with the criteria for false self-employment: Each country or jurisdiction may have its own specific criteria for determining false self-employment. In general, some key factors to consider include the level of control exercised by the employer, the level of financial risk borne by the worker, and the degree of integration of the worker into the employer's business.

03

Consult with legal or tax professionals: If you are unsure about how to determine false self-employment or how to fill out the relevant forms, it is recommended to seek advice from legal or tax professionals. They can provide guidance based on the specific laws and regulations applicable to your situation.

04

Gather necessary documentation: Before filling out any forms related to false self-employment, ensure you have all the required documentation readily available. This may include contracts, invoices, financial records, and any other evidence that supports your case.

05

Determine the appropriate form(s) to fill out: Different jurisdictions may have different forms or documents to be completed for false self-employment cases. Research or consult with professionals to identify the specific forms that need to be submitted.

06

Accurately complete the forms: Take your time to thoroughly read and understand the instructions provided with the forms. Answer all questions truthfully and with as much detail as possible. If you are unsure about any specific question or section, seek guidance to ensure you provide accurate information.

Who Needs False Self-Employment & How:

01

Workers misclassified as self-employed: False self-employment is relevant for individuals who have been incorrectly classified as self-employed when, in fact, they should be considered employees. This misclassification can have implications on various aspects such as worker rights, entitlement to benefits, and tax obligations.

02

Employers engaging in misclassification: False self-employment can also be relevant for employers who intentionally misclassify workers as self-employed to avoid certain legal obligations, such as providing benefits, paying taxes, or following labor laws. Identifying cases of false self-employment helps ensure fair treatment of workers and compliance with relevant regulations.

03

Government agencies and tax authorities: Government agencies and tax authorities play a crucial role in identifying and addressing cases of false self-employment. They need to be aware of the criteria and procedures involved in handling these cases to ensure proper enforcement and compliance with the law.

Note: The specifics of false self-employment and its regulations may vary depending on the jurisdiction. It is always advisable to consult with professionals or relevant authorities in your area to ensure accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit false self-employment amp how from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including false self-employment amp how, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete false self-employment amp how online?

With pdfFiller, you may easily complete and sign false self-employment amp how online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out false self-employment amp how using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign false self-employment amp how and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is false self-employment & how?

False self-employment is when a worker is classified as a self-employed individual when they should be considered an employee. This is often done to avoid paying taxes or providing benefits to the worker. It is illegal and can lead to severe repercussions for both the employer and the worker.

Who is required to file false self-employment & how?

Employers who misclassify their workers as self-employed when they should be classified as employees are required to file false self-employment reports. This typically involves submitting corrected tax forms to the relevant authorities.

How to fill out false self-employment & how?

To fill out false self-employment reports, employers will need to provide accurate information about the misclassified workers, their income, and any benefits they should be entitled to. This information should be submitted to the appropriate tax authorities.

What is the purpose of false self-employment & how?

The purpose of false self-employment is to correct misclassification errors made by employers and ensure that workers receive the benefits and protections they are entitled to as employees. This helps prevent tax evasion and protect workers' rights.

What information must be reported on false self-employment & how?

Employers must report detailed information about the misclassified workers, including their income, benefits, and any taxes that should have been withheld. This information is used to correct the misclassification and ensure proper taxation.

Fill out your false self-employment amp how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

False Self-Employment Amp How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.