Get the free Cash and Internal Controls

Show details

CHAPTER 4Cash and Internal ControlsBRIEF EXERCISES

Identify terms associated

with the SarbanesOxley

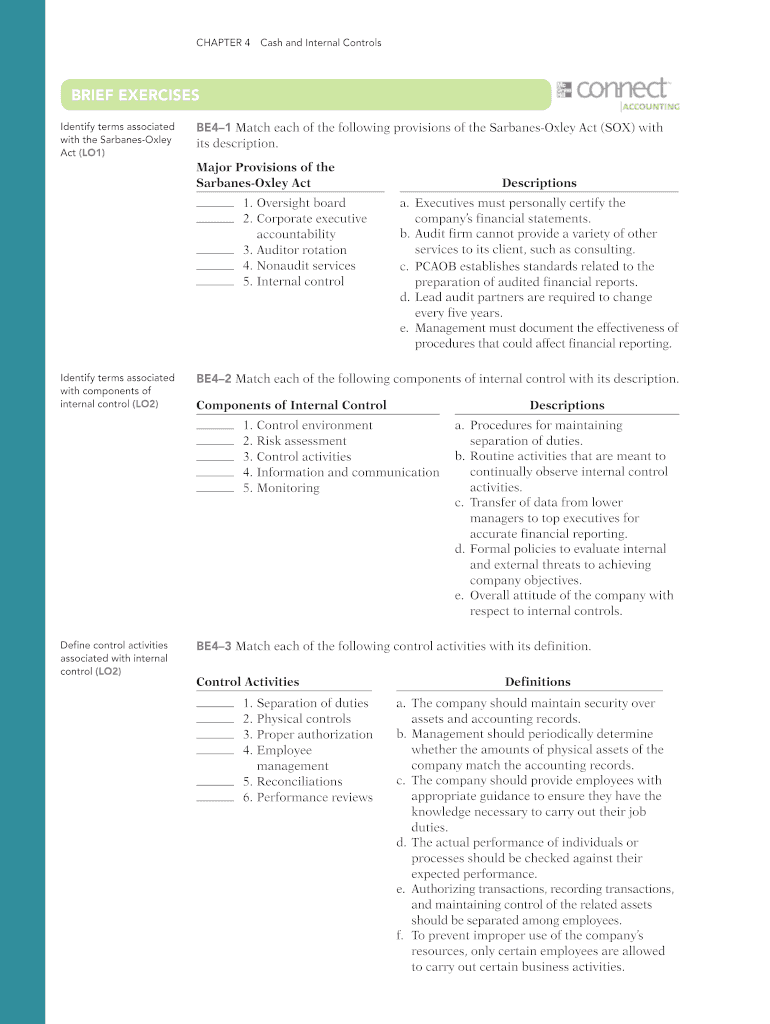

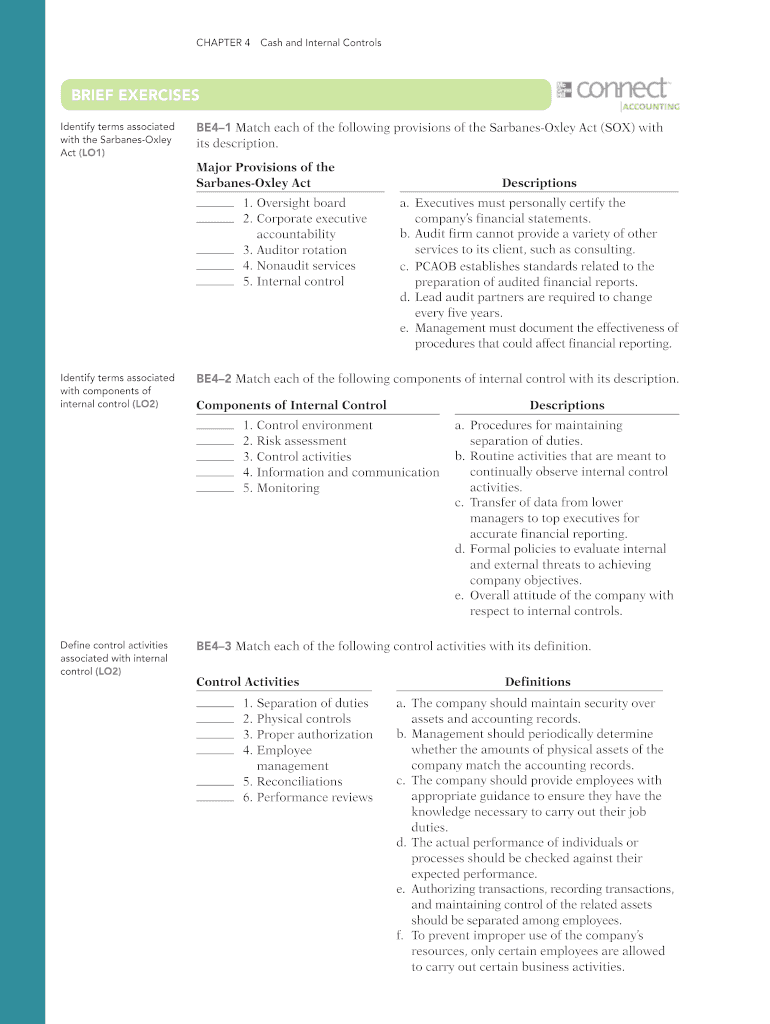

Act(LO1)BE41 Match each of the following provisions of the SarbanesOxley Act (SOX) with

its description.

Major

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and internal controls

Edit your cash and internal controls form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and internal controls form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash and internal controls online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cash and internal controls. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash and internal controls

How to fill out cash and internal controls:

01

Identify the key participants: Start by determining who will be responsible for filling out cash and internal controls. This may include members of the finance department or individuals designated by management.

02

Establish control procedures: Develop a set of control procedures to ensure the accuracy and reliability of cash transactions and internal controls. This may involve documenting the processes for cash handling, verification, and reporting.

03

Separate duties: Ensure that there is a clear separation of duties among individuals involved in cash handling and internal controls. This helps prevent potential fraud or errors by having different individuals perform different tasks.

04

Implement cash handling policies: Establish clear policies on how cash is handled, including procedures for receiving, counting, and depositing cash. This helps maintain accountability and prevent the mishandling or misappropriation of funds.

05

Create a paper trail: Maintain records of all cash transactions and internal controls. This can include keeping accurate and up-to-date financial records, receipts, and paperwork to support cash movements and control procedures.

06

Regularly review and reconcile: Conduct regular reviews and reconciliations of cash transactions and internal controls. This involves comparing financial records, bank statements, and other relevant documents to ensure that all transactions are accounted for and accurately recorded.

Who needs cash and internal controls?

01

Businesses: Cash and internal controls are essential for businesses of all sizes. They help ensure that cash transactions are accurately recorded, reduce the risk of fraud, and maintain the integrity of financial reporting.

02

Non-profit organizations: Non-profit organizations often handle significant amounts of cash through donations and fundraising activities. Implementing effective cash handling and internal control procedures helps maintain transparency and accountability in managing these funds.

03

Government agencies: Government agencies also require robust cash and internal controls to ensure the proper use and management of public funds. This helps prevent financial mismanagement and maintain public trust.

Overall, anyone involved in handling cash or responsible for the financial management of an organization can benefit from implementing cash and internal controls. These controls promote accuracy, accountability, and transparency in cash transactions, reducing the risk of errors and fraud.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cash and internal controls to be eSigned by others?

To distribute your cash and internal controls, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my cash and internal controls in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your cash and internal controls right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out cash and internal controls on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your cash and internal controls. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is cash and internal controls?

Cash and internal controls refer to the procedures and policies implemented by a business to safeguard its assets, ensure accurate financial reporting, and prevent fraud.

Who is required to file cash and internal controls?

All businesses, regardless of size or industry, are required to establish and maintain cash and internal controls.

How to fill out cash and internal controls?

To fill out cash and internal controls, businesses need to document their procedures for handling cash, reconciling bank accounts, and monitoring financial transactions.

What is the purpose of cash and internal controls?

The purpose of cash and internal controls is to minimize the risk of errors, fraud, and misappropriation of funds, and ensure the accuracy and reliability of financial information.

What information must be reported on cash and internal controls?

Businesses must report on their cash balances, cash flow activities, bank reconciliations, and any instances of non-compliance with internal controls.

Fill out your cash and internal controls online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Internal Controls is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.