Get the free TRANSACTION SET 813 - window state tx

Show details

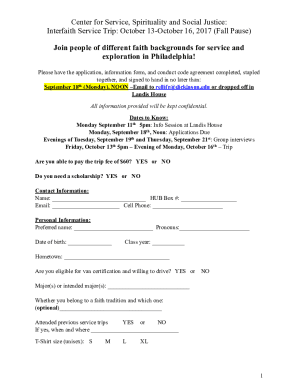

This document provides the required format of the ANSI ASC X12 813 Transaction Set for filing a Texas Diesel Fuel Distributor report and schedule, used for electronic tax filing and payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transaction set 813

Edit your transaction set 813 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transaction set 813 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transaction set 813 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transaction set 813. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transaction set 813

How to fill out TRANSACTION SET 813

01

Start with the Transaction Set Header (ST segment) - include the transaction set identifier code '813' and the corresponding control number.

02

Fill in the Beginning Segment for Pricing Information (BPR segment) - include payment method, payment amount, and other necessary payment details.

03

Add the Accounting Information (CUR segment) if applicable, specifying the currency type.

04

Include the Payee Identification (PYD segment), detailing the payee's name and identification numbers.

05

Enter the Pricing Segment (LIN segment) which outlines the item details - product/service information and associated pricing.

06

Provide Item Reference (ITD segment) if there are specific contract terms or item discounts to stipulate.

07

Include necessary adjustment data, if applicable, detailing any changes to the pricing.

08

Close with the Transaction Set Trailer (SE segment) providing the total number of segments and the same control number used in the header.

Who needs TRANSACTION SET 813?

01

Businesses or organizations that engage in electronic transactions related to pricing and payment information.

02

Companies involved in supply chain management that need to communicate pricing details to partners or suppliers.

03

Any entity seeking standardized electronic billing and payment processes to enhance efficiency in business transactions.

Fill

form

: Try Risk Free

People Also Ask about

What are 3 EDI transactions?

Most Common EDI Codes While there are hundreds of transaction sets, these are some of the most frequently used in supply chain and logistics: EDI 856 – Advance Shipping Notice (ASN) EDI 850 – Purchase Order. EDI 810 – Invoice.

What are the 4 major components of EDI?

The 4 major components of EDI are: standard document format, translation and mapping, preferred communication method and communication network to send and receive documents.

What are X12 transactions?

X12 defines and maintains transaction sets that establish the data content exchanged for specific business purposes and, in some cases, implementation guides that describe the use of one or more transaction sets related to a single business purpose or use case.

What are the three types of EDI?

Different Types of EDI The three main types of EDI are Direct EDI (Point-to-Point), EDI via Value-Added Networks (VANs), and Web EDI. Each has its benefits. Direct EDI (Point-to-Point): Direct EDI establishes a direct connection between trading partners' computer systems to exchange EDI documents.

What is a transaction set?

A transaction set is the collection of data that is exchanged in order to convey meaning between the parties engaged in electronic data interchange. A transaction set is composed of a specific group of segments that represent a common business document (for example, a purchase order or an invoice).

What are EDI transaction types?

7 Common Types of EDI Transactions (EDI Codes) EDI 856: Ship Notice/Manifest. EDI 810: Invoice. EDI 850: Purchase Order. EDI 855: Purchase Order Acknowledgment. EDI 820: Payment Order/Remittance Advice. EDI 997: Functional Acknowledgment. EDI 940: Warehouse Shipping Order. Common EDI Communication Standards.

What are some examples of EDI?

1000s of standard business transaction documents can be sent automatically using EDI. Some common examples include: purchase orders, invoices, shipping statuses, customs information, inventory documents and payment confirmations.

What is a transaction set purpose code?

Transaction set purpose codes are user-defined codes that you set up to control the actions taken by the system. The system uses the action code each time the Transaction Set Purpose field appears in a file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRANSACTION SET 813?

TRANSACTION SET 813 is an Electronic Data Interchange (EDI) format used for reporting and managing financial and accounting transactions, specifically related to the management of payments and adjustments.

Who is required to file TRANSACTION SET 813?

Entities involved in financial transactions that require reporting adjustments and payments, such as financial institutions, governments, and businesses that provide accounting services, are required to file TRANSACTION SET 813.

How to fill out TRANSACTION SET 813?

To fill out TRANSACTION SET 813, you must include required segments such as transaction headers, detail segments for each transaction, and appropriate identifiers for reporting period, amount, and related accounts. Ensure that data adheres to the EDI format standards.

What is the purpose of TRANSACTION SET 813?

The purpose of TRANSACTION SET 813 is to facilitate the electronic exchange of financial transaction data, allowing for more efficient tracking, reporting, and reconciliation of payments and adjustments between parties.

What information must be reported on TRANSACTION SET 813?

TRANSACTION SET 813 must report information such as transaction date, payment amount, adjustment details, account numbers, and any relevant identifiers that aid in identifying the nature of the transactions.

Fill out your transaction set 813 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transaction Set 813 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.